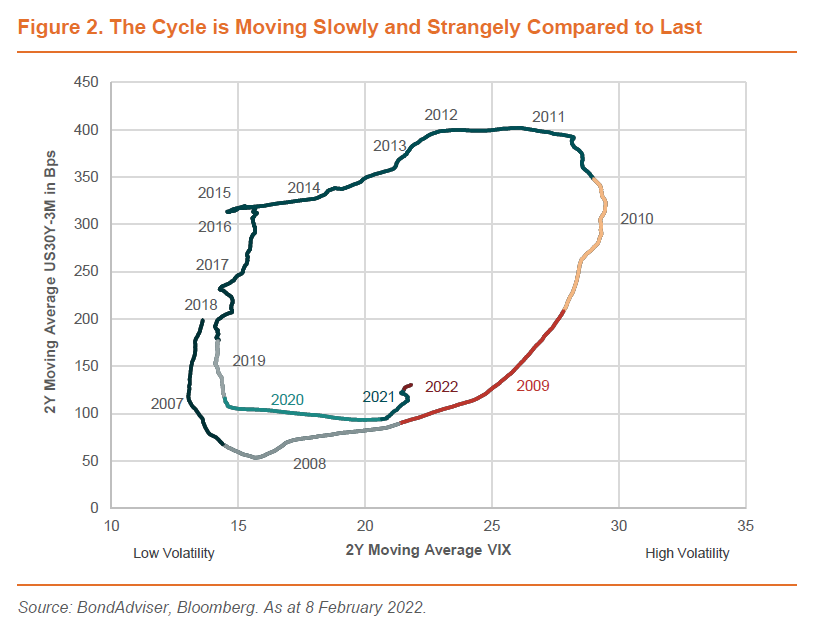

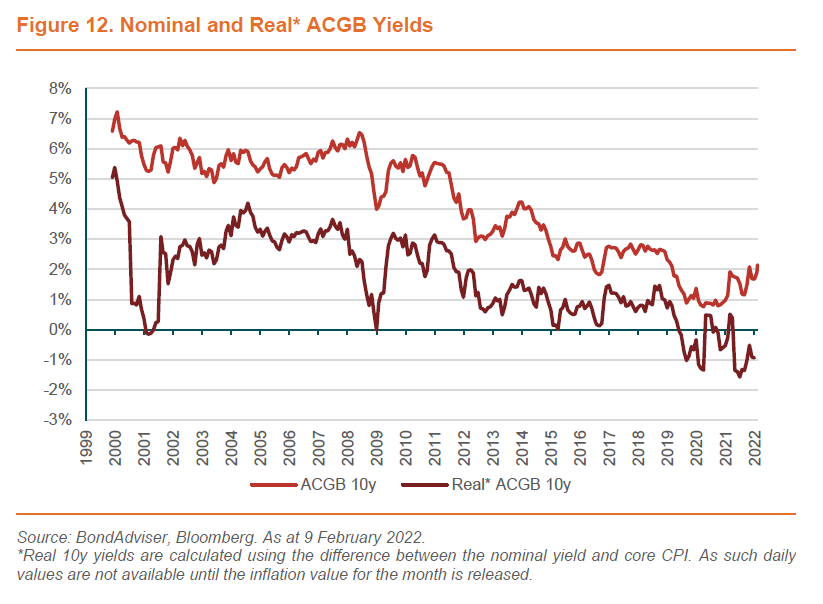

In 2022 we expect volatility to increase as a function of central bank liquidity draining from the system. In parallel, we expect inflation to remain persistent, as we have argued since May 2020. This makes asset allocation difficult as the prospects for real return in many sub-asset classes are slim. We noted the possibility of a mini-cycle in July 2021 and now a myriad of geopolitical, liquidity, growth and inflationary risks makes us question what upside catalysts are present in an already expensive market? In credit, we broadly look to improve quality and pivot right to the front-end of the curve. In rates, we see value in adding ballast to portfolios in the form of high-quality duration given the flattening yield curve environment. In alternatives, we continue to advocate seeking returns in private credit – where a rare form of real return may be sourced. Importantly, we are still sourcing alpha in relative value and idiosyncratic opportunities – a more volatile capital markets should only increase such opportunities, where deep fundamental research is well rewarded.

Expansions Don’t Die of Old Age, They’re Murdered

There is no doubt that the liquidity provided by central banks and governments globally prevented a health crisis turning into a financial crisis. Such coordinated policy support (also known as MP3 – as coined by Ray Dalio) has a positive feedback loop in terms of self-sustaining growth. High levels of spending that is outpacing supply is producing inflation. Such spending encourages more spending (albeit <1:1) and the wheel turns.

Higher levels of income, initially as a function of government handouts and tax breaks, and possibly as a future function of wage increases, especially for the lower-income groups (where the propensity for relative spending is higher), alongside an increase in credit (where counter-cyclical buffer relaxations incentivise lending) have been used to 1) decrease high cost debt, 2) fund an increase in spending and 3) slingshot financial asset prices.

The resultant spending has been funneled into business profits firstly and then increasing resources (including labour) to keep up with demand. Given unemployment is now low, in parallel with a high rate of demand, businesses increasingly need to spend more on wages to attain and retain human capital. This results in another positive feedback loop with respect to spending – given that one’s spending is another’s income. In order to avoid inflation, productivity would need to outstrip nominal spending. We view high levels of productivity growth as extremely unlikely.

Therefore, in order to control inflation, the sources of income need to be drained. Per the idiom, the expansion needs to be murdered. Automatic stabilisers would not be quick enough – especially where tax rates are actually falling.

This makes the environment for policy makers somewhat dire. Making it even grimmer is that interest rates are near zero and the pandemic possibility of a new vaccine resistant strain cannot be discounted at the policy level – despite it being discounted at the market level. Trickier still is the hesitation induced by tightening at a time where both locally and globally (in developed markets) governments are looking to reduce spending (i.e. fiscal drag).

Whilst we see tightening having a convex impact on duration-like asset prices, in real terms, household balance sheet and serviceability improvements means there is at least an initial buffer that should be quickly utilised to avoid a policy error. Failure todo so risks the possibility of having to tighten more aggressively in the future, in which case the asset market impact would be more severe.

In the last centuries of the Roman Empire inflation was rife. There are many reasons for this. One includes debasement, another includes the plague, whereby the structure of the labour market was decimated and wages increased rapidly. A health crisis, debasement of the reserve currency and labour market tightness are also contemporary issues. To continue channeling from ancient Rome, whilst indecision is the key to flexibility, it is the greatest thief of opportunity. Central banks need to take the opportunity to control inflation in an orderly manner. This crystalises our expectations of a risk-off environment.

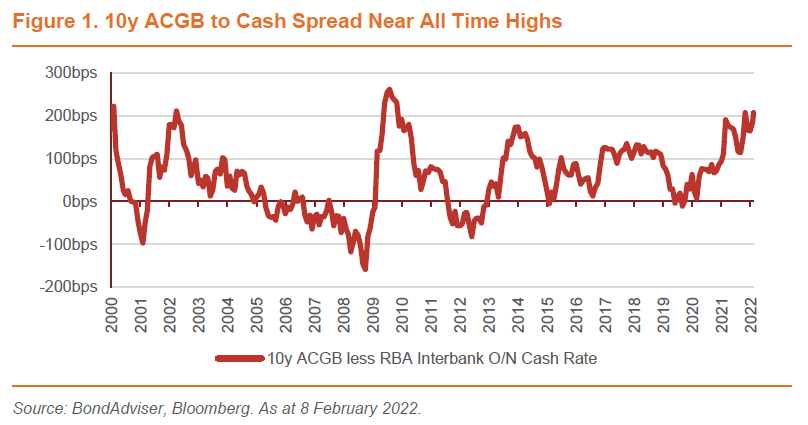

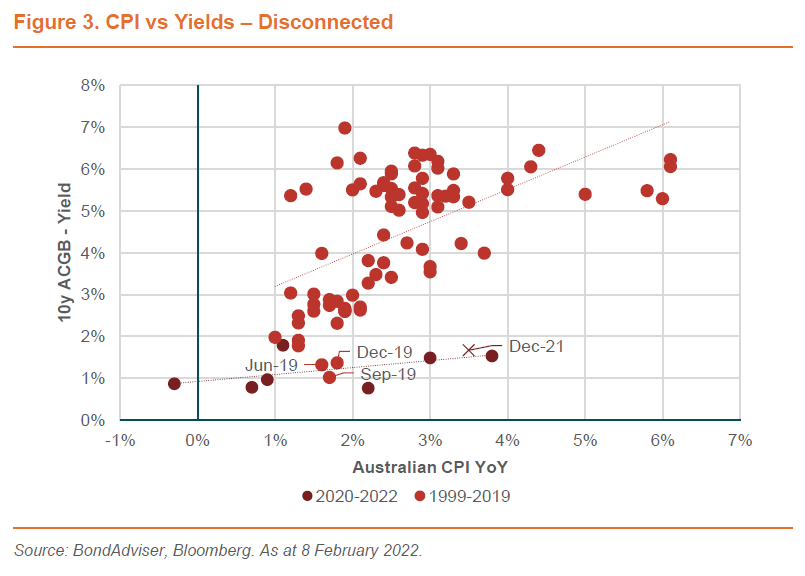

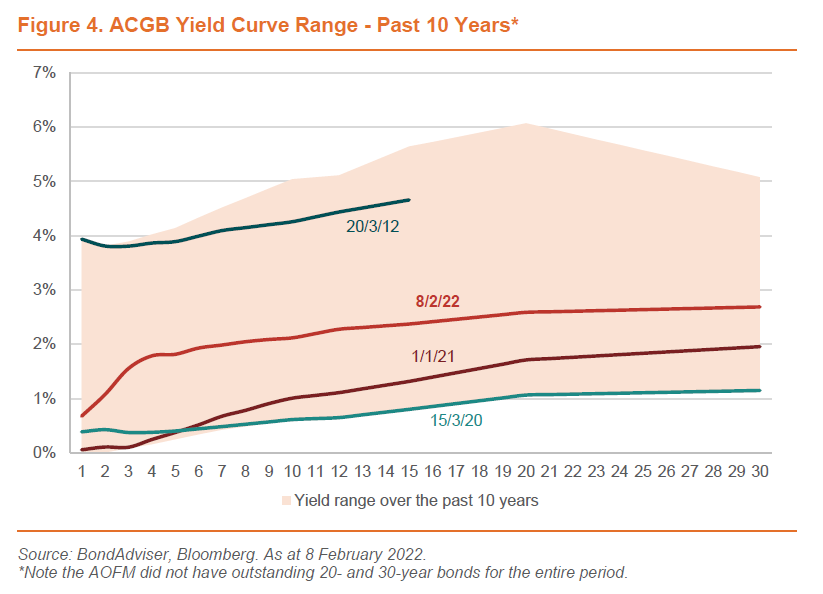

For the first half of 2022, we expect the RBA to be dovish compared to other developed markets central banks. Unfortunately, this has a political angle, firstly, in terms of avoiding hiking into an election, and secondly, to assist in achieving the cycle average of inflation targets, given the announced review into the RBA. This should see domestic yields and duration outperform on a relative basis. The problem with such dovishness is that the longer-term policy risk from falling behind and then catching up becomes a much more visceral reaction – as we saw with the ECB last week and the RBA in November 2021.

Corporates

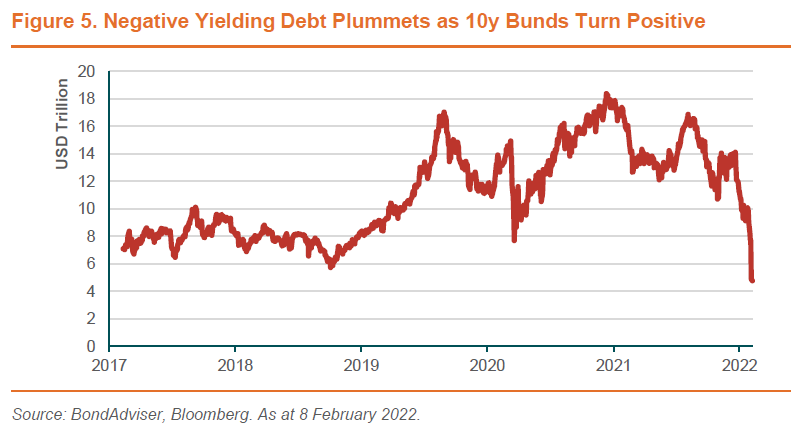

The rise in rates more recently has seen negative yielding debt nosedive. This has been a function of bear-flattening in the US and in the EU, where both central banks have been caught pants-down with respect to notions of transitory inflation. Notably, yields on 10-year German Bunds have turned positive for the first time since May 2019.

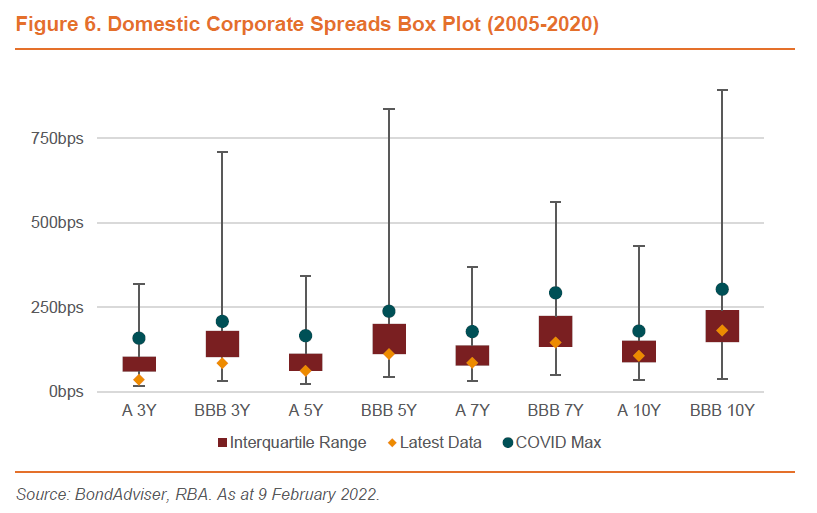

Domestic investment grade corporate spreads remain historically low, albeit with some more recent widening. In the local high yield market we have seen tightening, however we still believe spreads are wider compared to the tightening seen in the more liquid USD market.

In November 2021, we took an overweight stance on non-financial corporates – as a mechanism to hide from widening spreads in financials. This has been effective and we moderate this stance to a neutral weighting – furthermore in the high grade space, where possible, we are moving into shorter dated, better-quality and more liquid credits – RBA repo eligible bonds are particularly attractive in this sense. This is a function of three reasons, firstly, the widening of senior unsecured financial spreads is making for some attractive primary market opportunities, secondly on a relative basis the spread differential between corporates and financials has tightened, whereby the credit risk of lower rated corporates is not being sufficiently compensated.

Thirdly, a more nuanced point relates to that of the changes in superannuation benchmarking, which we touched on in our 2021 Research Review. Given APRA is benchmarking fixed income returns to that of the AusBond Composite index, we believe demand for non-financial corporates will fall as super funds rotate into a benchmark hugging strategy that requires a large amount of government exposure. We question the merits of such broad-based benchmarking, believing that it is not in line with the “SAMURAI” principals of performance evaluation – namely with respect to being inappropriate as a catch-all – given the enormous size of the universe, fixed income mandates are incredibly customisable and as such the performance benchmark should better reflect the underlying portfolio characteristics.

This change in the demand dynamic may eventually be a positive for those whose returns are not linked to a superannuation benchmark. Wider spreads result in higher yields and the regulatory arbitrage means that selling total return swaps on the AusBond Comp index to superannuation funds could be quite lucrative business.

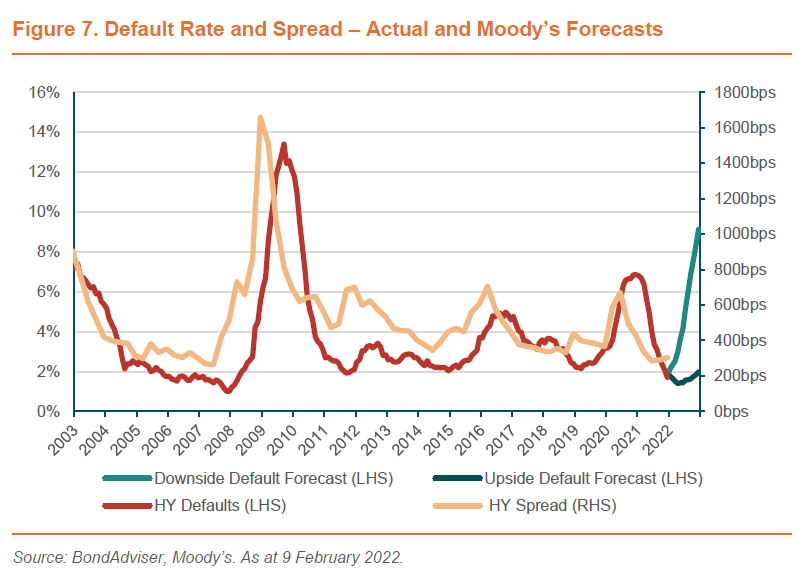

There is no doubt the recent economic conditions have been goldilocks-like for high yield corporates. Rates have been low; liquidity has been strong, and growth has been robust. We expect this to change in 2022 as rates increases and liquidity falls. Lower rated and zombie companies may struggle to both service and refinance debt. The risk of this is not well priced, with spreads being historically very low. Selection here is crucial and we are avoiding beta to focus on idiosyncratic opportunities.

Financials

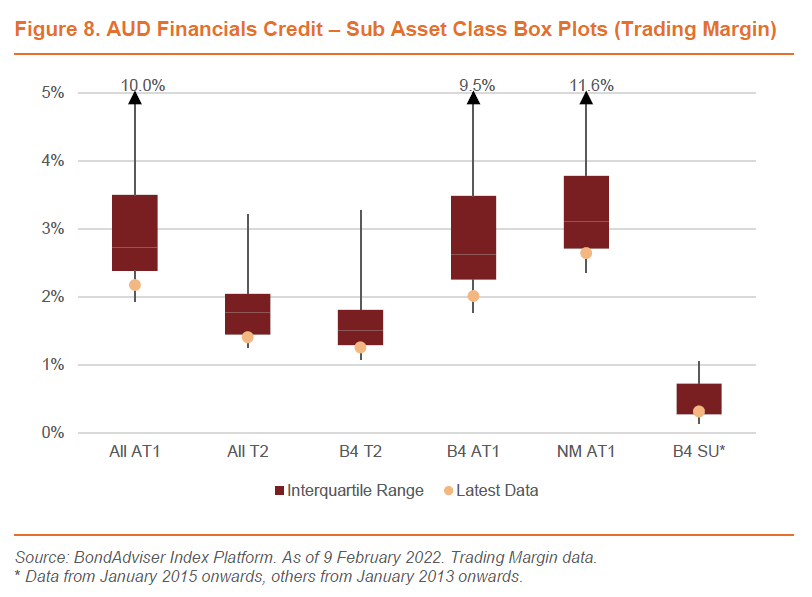

The de-facto bailout that is the Term Funding Facility (TFF), has led to extremely accommodative funding conditions as supply of financial paper has evaporated – whilst the money repaid to investors has aggressive bid up prices in search of a home. With the roll-off of the TFF front of mind, this dynamic is now normalising.

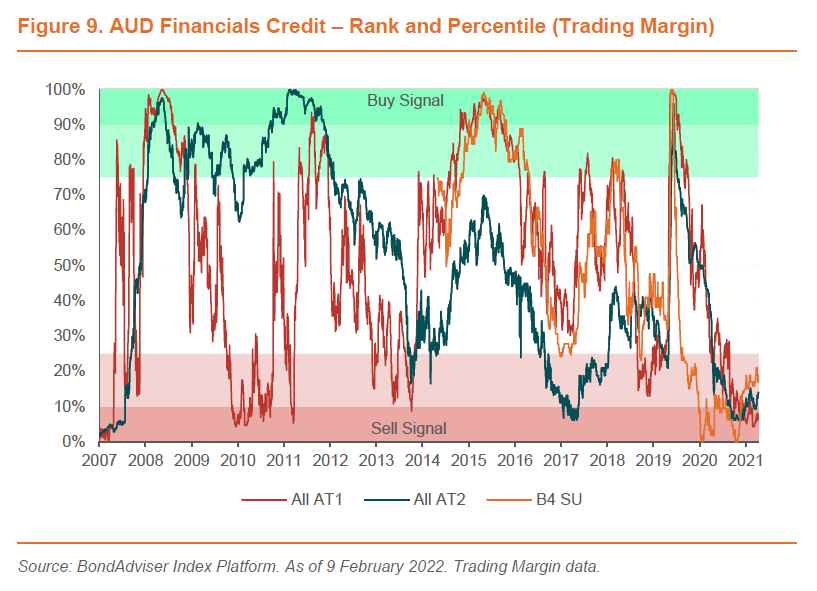

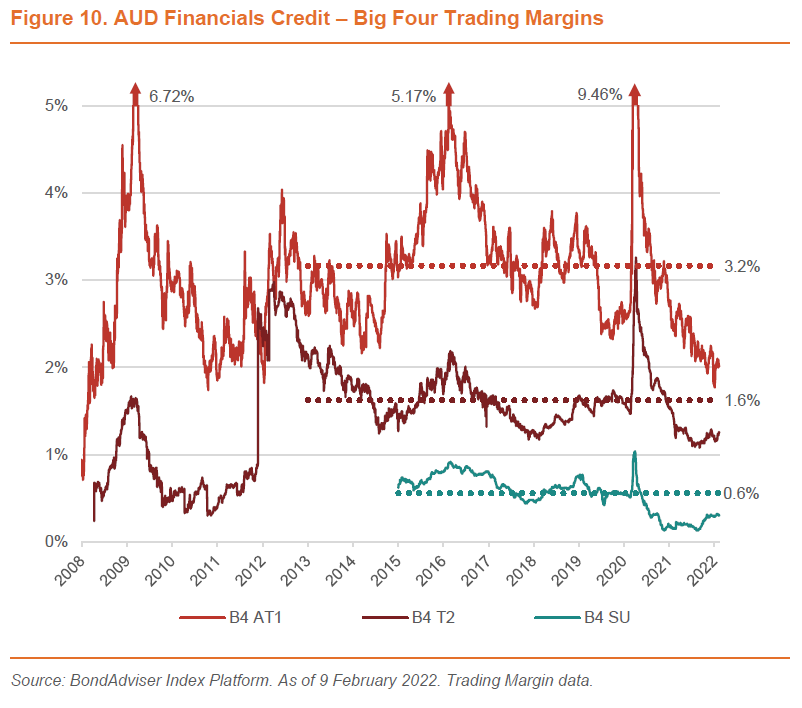

We expect senior unsecured spreads will continue to widen and this will lead the junior credit wider. Front-to-back book churn, a reduction in demand due to APRA HQLA/CLF changes and a nominally large increase in expected supply will result in credit spread headwinds. This will be a slow burn and whilst we have seen softening already, spreads are still historically low by means of our index platform and in terms of a fixed term interpolated calculation. We note here that our index platform is weighted by market capitalisation – so it is heavily influenced by the change in portfolio tenor. The fixed term calculation solves for this issue.

These dynamics makes the environment difficult for broad exposure in the junior Tier 2 and AT1 hybrid sphere. Accordingly, we are making a concentrated emphasis on relative value in terms of selecting and exiting securities to generate outperformance.

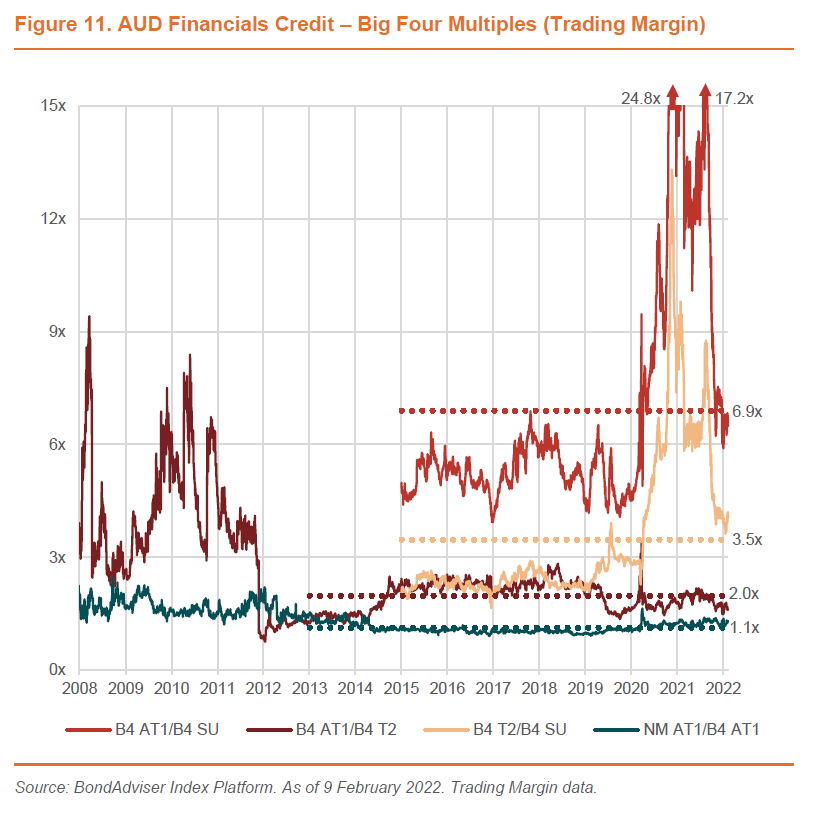

In 2021 we called for our Big Four AUD AT1 index (BAB4AT1DFTR) to trade in towards a credit spread of +200bps. The aforementioned dynamic, in conjunction with a traditionally less liquid and sophisticated market that lags senior paper, manifests in our expectation of a widening of spreads – in effect a reversion towards the mean.

Importantly, improvements in capital absorption means we do not think the prior mean is an accurate reflection of the current structural risk. We believe the new mean is lower, but nonetheless retracement is likely. On the other hand, it can be argued that the multiple of our AT1/SU index trading margins is still high, however this does not account for the increasing term of the AT1 market and shortening term of the senior market in the past two years. Our narrative for Tier 2 is broadly similar to AT1 and we have no issues with circa $20 billion of expected supply being absorbed.

Alternatives

In an environment where inflation is increasing, alongside historically low cash returns, sourcing real income is needed to avoid erosion of purchasing power. Sourcing higher returns requires taking more risk and traditional asset classes are historically expensive. In the alternatives universe, taking additional risk, in terms of complexity and illiquidity premia is still being well rewarded – despite crowing in of investors and competitors.

We have discussed private credit at lengths and it is increasingly forming a key building block of our portfolios as a return-seeking asset class. Real returns and floating rate coupons are big positives in the current cycle that more than offset the illiquidity. Additionally, the structural protections (first lien, custom covenants) and diversified underlying counterparty risk provide a strong defence against capital losses.

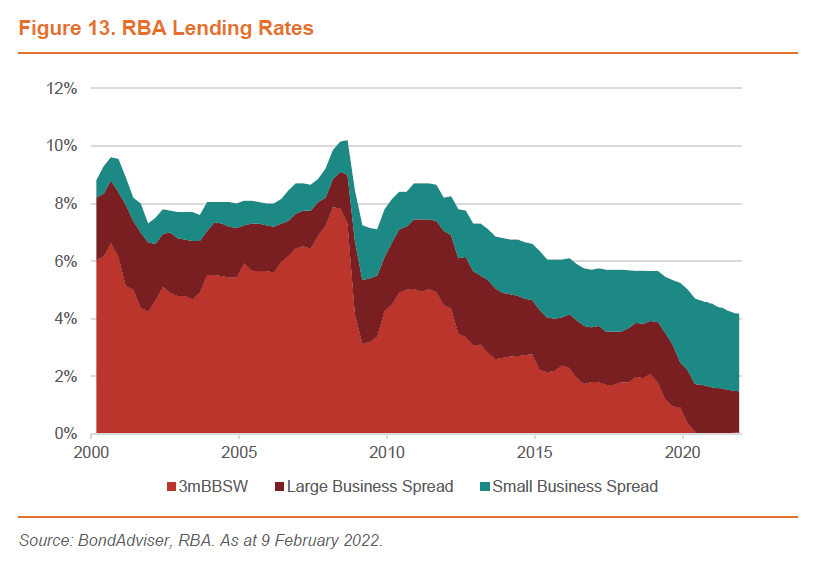

According to the RBA’s data, the margin in small business lending increased during COVID and has remained somewhat constant thereafter. Large business spreads have also been relatively elevated and constant. Whilst we are concerned with some domestic anecdotes that covenants and conditions are loosening in the local syndicated market (which is largely hidden to the end fund investor), we believe the domestic market still retains strong protections relative to overseas.

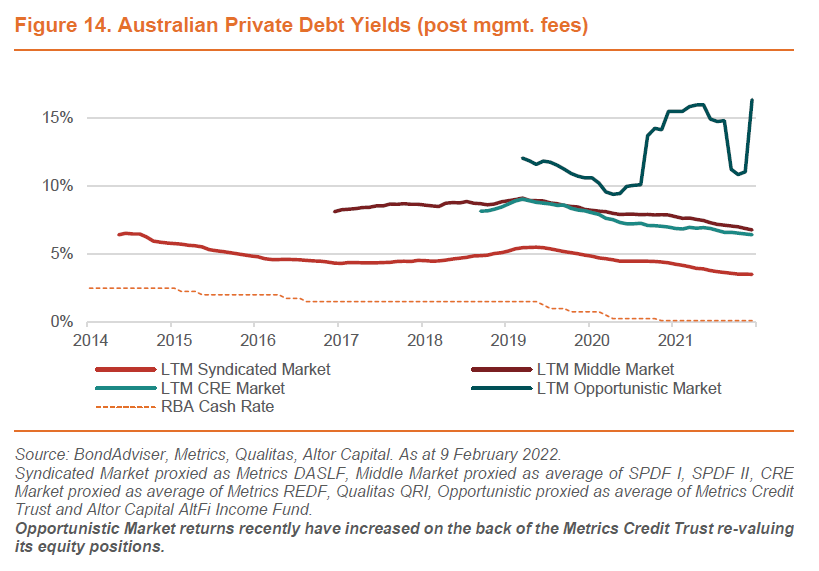

Net yields in private credit have trended downwards but compared to the fall in the RBA cash rate, margins have arguably improved. This is most evidently seen in 2H20-1H21 in the opportunistic private credit sub-sphere, where a tick-up in returns was likely a function of COVID induced capital scarcity and special situations.