Despite market sentiment, we believe there are growing risks to credit spreads of financials. This is technical in nature rather than fundamental. After successfully trading beta on subordinated financial bonds and hybrids, the repricing of senior spreads following the roll-off of the Term Funding Facility means we now look to underweight the largest component of the AusBond Credit Index. Non-financial corporate credit fundamentals are strong and some COVID-sensitive sectors have lagged in performance – accordingly we overweight non-financial corporates.

Chinese Credit – Year of the Ox

Evergrande has fallen out of favour in the press headlines recently. Chinese credit has fallen off a cliff. Risks continue to remain elevated here and vigilance is critical – whilst we believe the Chinese Government will mediate an orderly disposal of overleveraged assets, the unknowns, particularly in terms of off-balance sheet debt, brew conditions that are ripe for a possible crisis of confidence. What is also clear is that foreign investors will be last in line to receive returns. The implications of this are difficult to determine, however, credit markets have notoriously short memories – this makes such prioritisation (homebuyers first, domestic creditors and shareholders second, foreign creditors and shareholders last) of returns entirely logical.

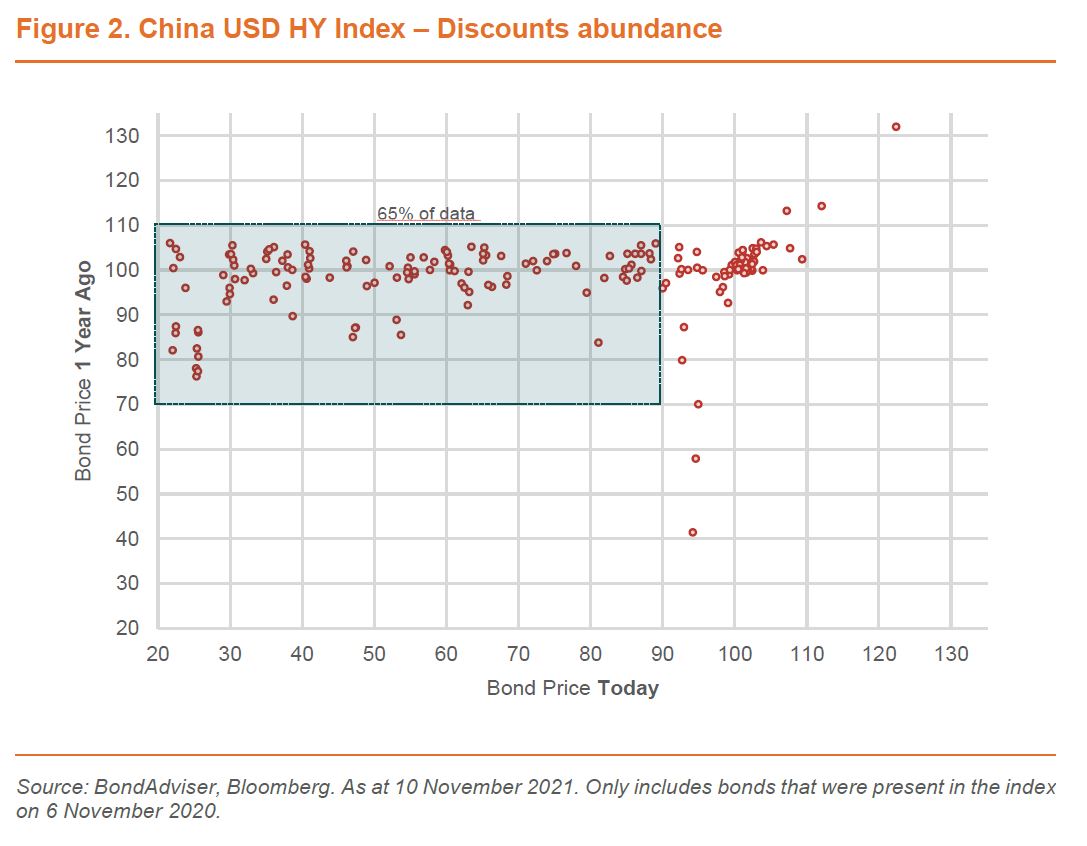

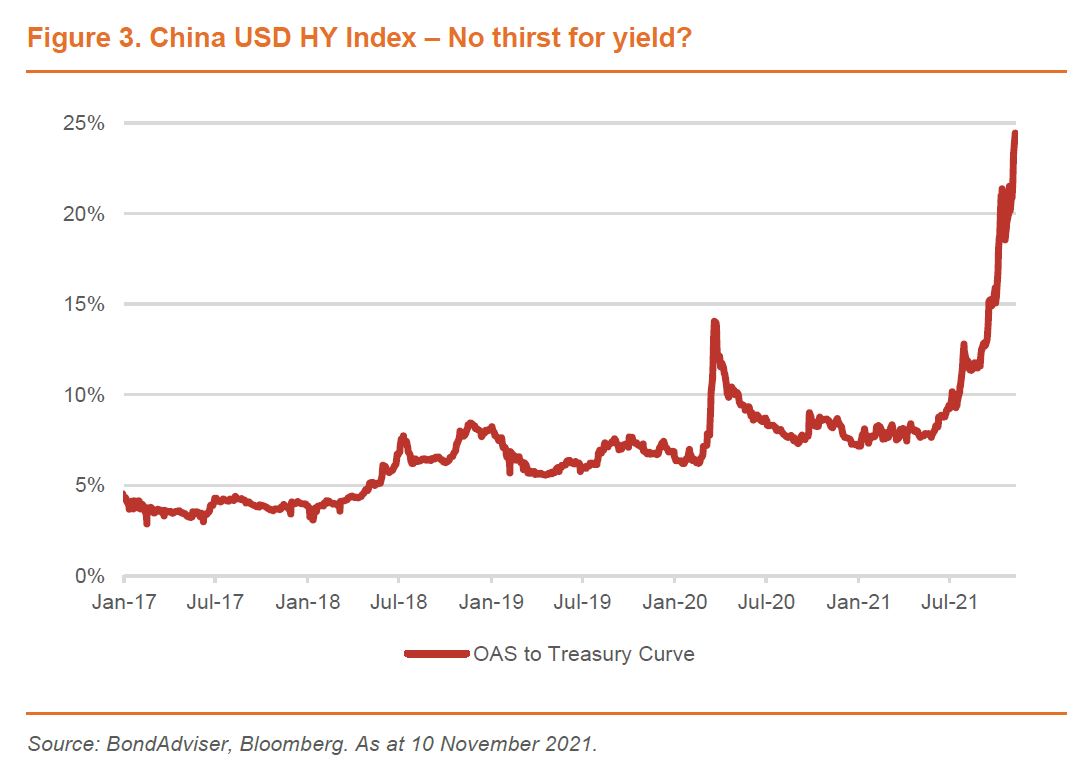

There are some serious discounts on offer in the USD Chinese High Yield index – as seen in Figure 2, of the bonds that remained in the index over the past year, 65% now trade below $90. Alarmingly, only 9% of this set previously traded at below $90. The index, on an option adjusted spread basis is now at record highs (going back to inception in July 2009). With the fall beginning in July 2021, we are somewhat surprised at the near continuous void of investor support – China has a good track record in managing corporate blow-ups: Anbang Insurance (2017), Baoshang Bank (2019), HNA Group (2020) and Huarong (2021) all come to mind.

Whilst on an ESG basis, such exposure to China may be difficult to accumulate, at these spreads and this yield thirsty environment, we wonder where all the distressed/opportunistic dry powder is?

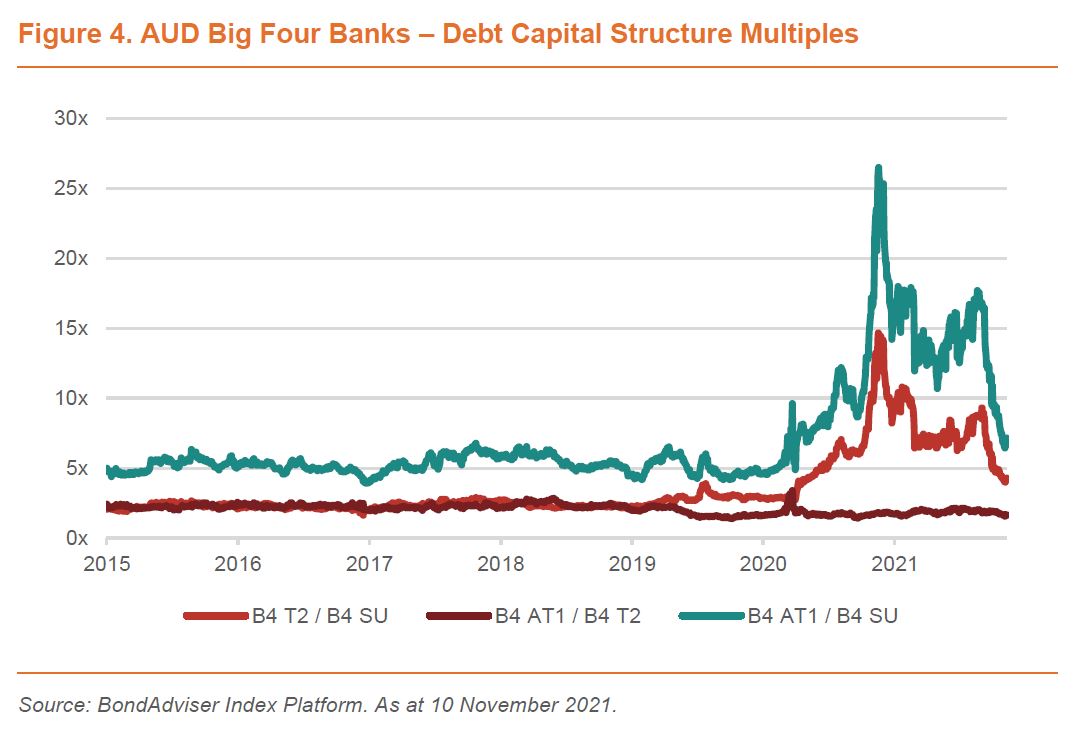

Troubles in the Chinese credit markets are currently contained and we have seen no impact domestically. Whilst much has changed locally on the rates front, spreads have remained steady. Following the COVID sell-off, we took an overweight position in subordinated Tier 2 financial bonds. Subsequently, we moved to an underweight financial seniors and overweight Additional Tier 1 (AT1) hybrids stance. With (1) spreads between the capital structure returning close to pre-COVID levels, and (2) our expectation that widening of senior spreads will cause a consequent repricing to all junior ranking capital, we have moved to an underweight financials position. Whilst we think ample opportunities remain to add alpha on a single asset basis (and note that primary deals will screen nominally more attractive) – we believe that financials will underperform corporates (on a spread basis) as economic fundamentals remain strong, benefiting beaten-up bonds (airlines, retail REITs, universities) and maintaing otherwise tight investment grade corporate spreads. Whilst this trade may be difficult to source in the local cash/ETF markets, it could also be synthetically manufactured.

Rates – Yearly Osciliations in a Matter of Days

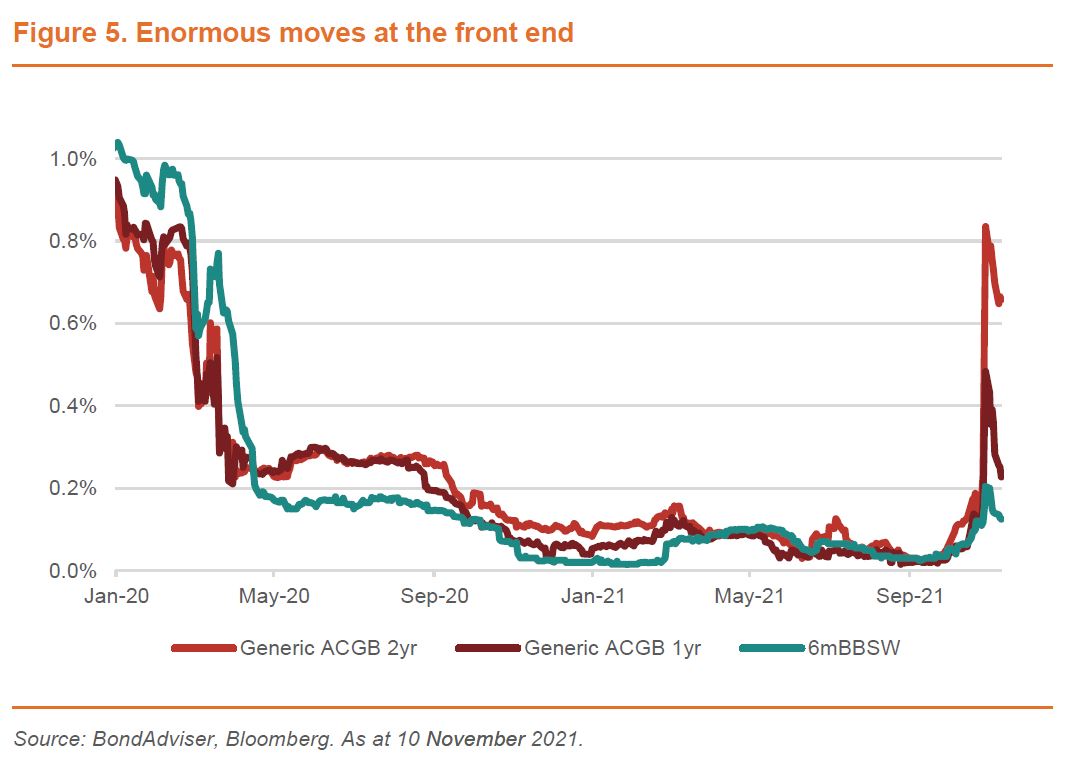

The local bond bandits have bullied the RBA boffins into submission with respect to yield curve control (YCC). In keeping with Cup day tradition, the RBA delivered another “live” meeting – whereby Melbourne traders could not fully enjoy the day off! Appropriately, and as we first suggested back in December 2020, for all the Martin Place jawboning, the RBA has now scrapped its extreme YCC policy. This was entirely appropriate. Even after: (1) some >$19 billion worth of RBA purchases on the April 2024 ACGB (Apr-24), and (2) changing the goal posts mid-game by increasing the repo-borrowing rate (more simply making the cost of shorting the Apr-24 more expensive), at the time of the meeting, the yield on the Apr-24 bond was still >7x in excess of the YCC target.

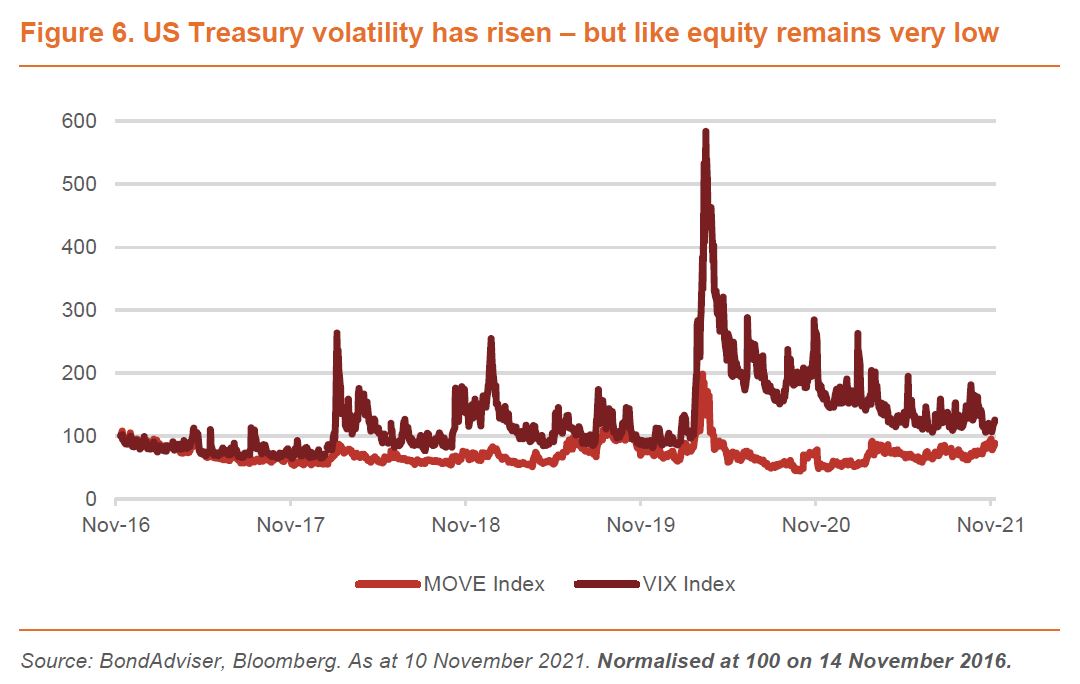

Recently, with the Fed, ECB, BoE and RBA all being hunted on inflation, there have been some gigantic moves in global interest rate derivatives and yield curves – there was no respite into the end of month with the AusBond Composite Index down 3.55% for October, that is now -4.94% YTD. We suspect many local fund managers that run duration targets of 2-3 years will have endured significant pain and furthermore, we are hearing of some brutal blow-ups in leveraged macro funds. However, despite this global volatility at the short-end, the MOVE Index, which tracks volatility on US Treasury options remains anchored, however, as the taper conversation grows louder so too do we expect an increase here.

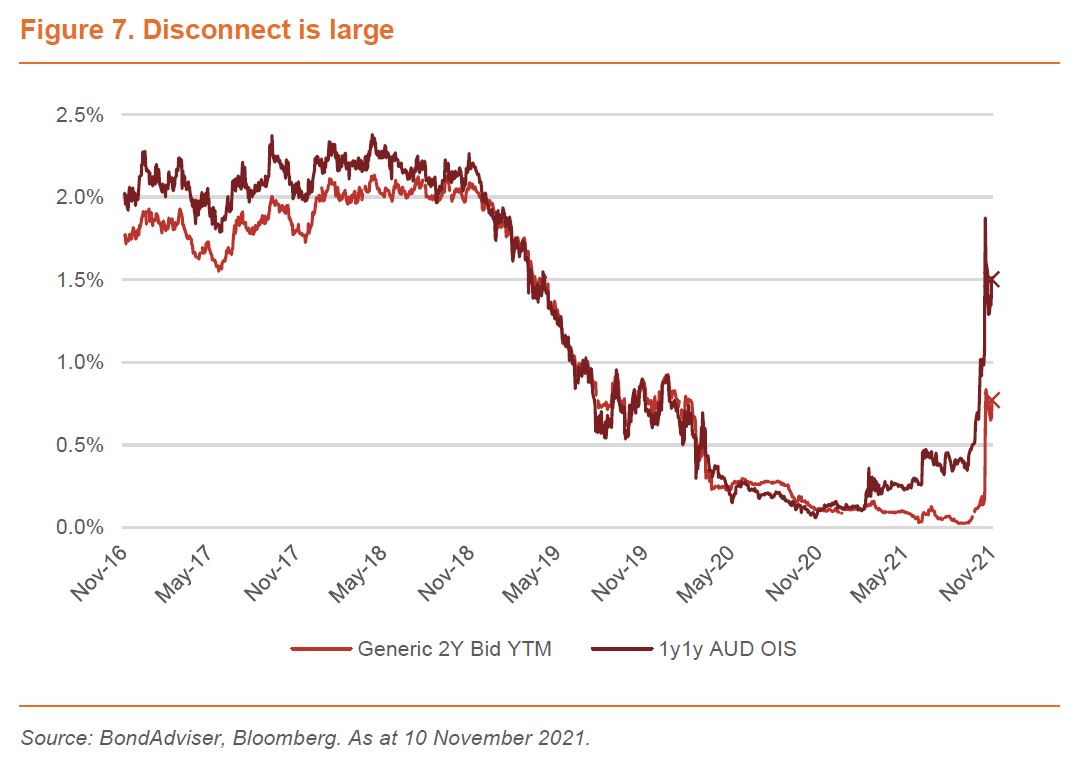

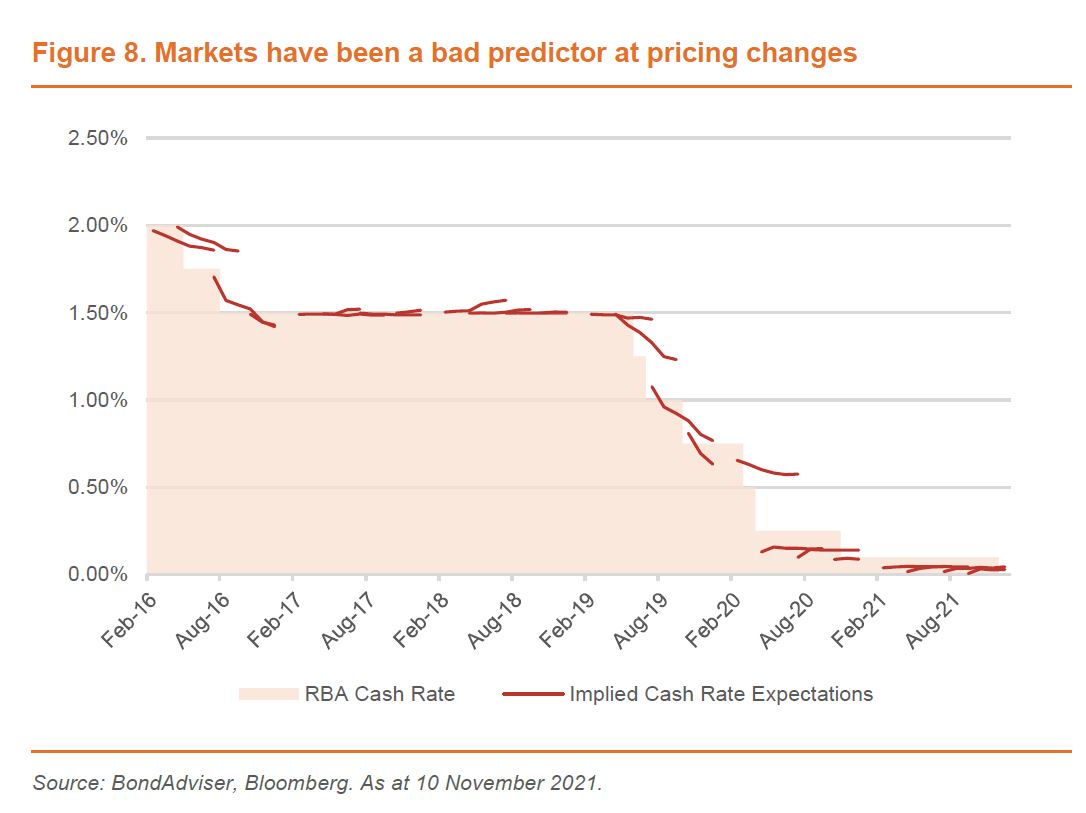

The disconnect between markets and central banks is stunning and this makes rates positioning difficult. Historically the market has been a bad predictor of short-term rates and we hazard caution on getting too confident with respect to contradicting Martin Place’s near term expectations. The April-24 ACGB has been bashed and bruised but based on 1-year rates, in 1-years time, this is set to continue – though we think some HQLA buying by banks might offset this.

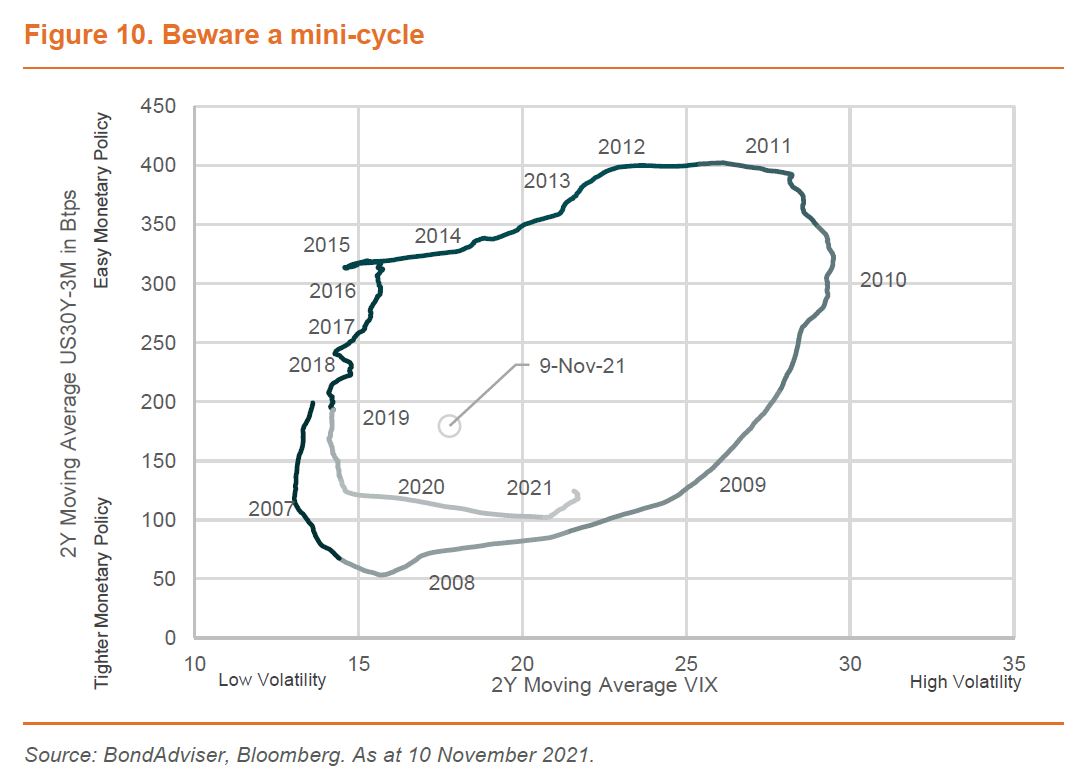

Yield curves have flattened with incredible pace, and somewhat worryingly so. Whilst a flattening yield curve warns to a looming rate hike cycle, it also signals that a recession could threaten in a few years – a mini-cycle dynamic that we first described in July 2021.

Inflation – Transitory is contingent on labour

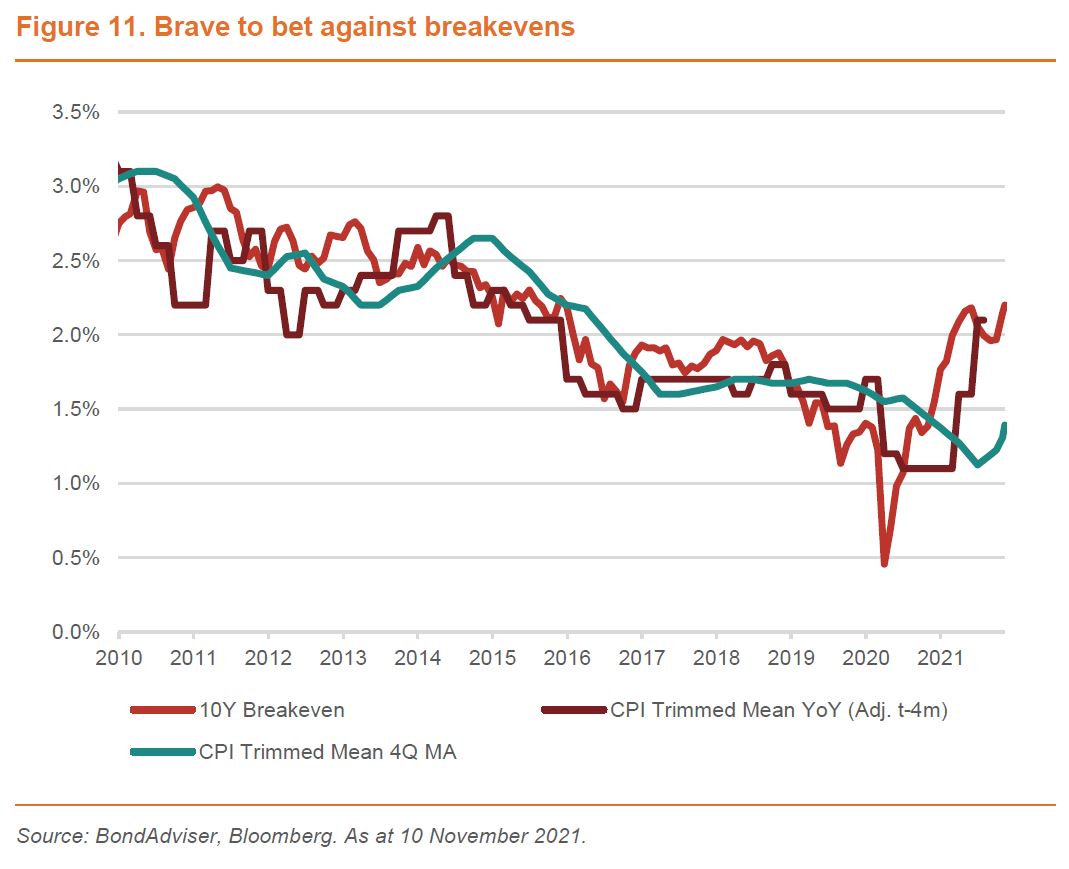

We first showed Figure 11 in December 2020 when we noted our expectations for inflation to run hot. Linkers and FRNs have significantly outperformed since, however, the breakeven rate is now suggestive of a moderation from elevated CPI levels.

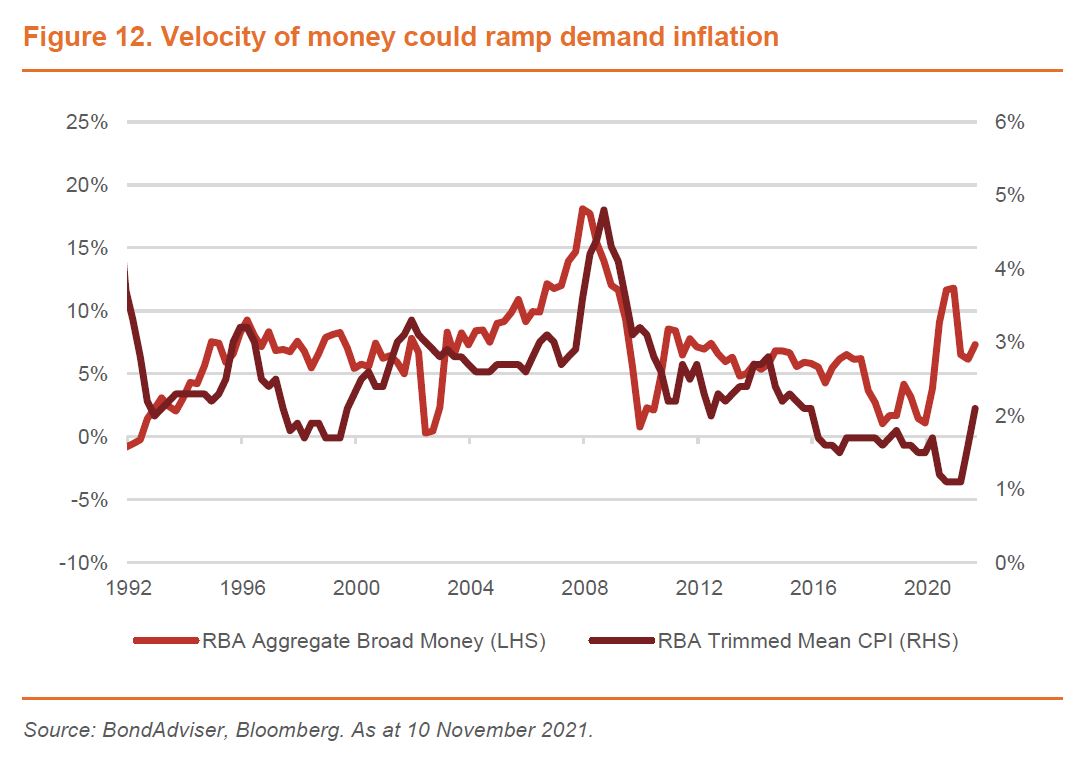

Conversely, Figure 12, which we described firstly in April 2021, more loosely suggests that inflation is set to quicken, as a function of (1) more money remaining in the system and (2) a quickening pace in the velocity of money (think transactions) alongside a more certain reopening in a vaccinated economy.

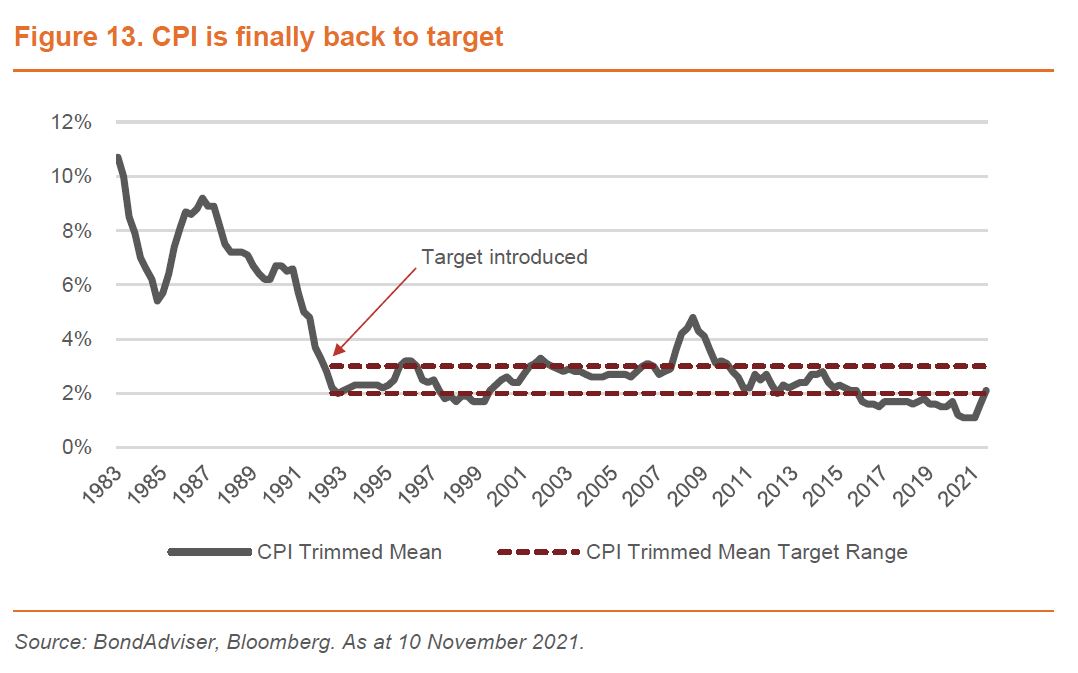

Meanwhile the RBA, after 6 years, has finally hit its inflationary target. In its latest meeting the RBA updated its forecasts, which we still see as being marginally conservative. In our view, much of policy will now hinge on the labour market and whether an increase in the participation rate (return to post-COVID normal) and immigration (low-skilled in particular) will offset building wage pressures. Importantly, the RBA also excluded the line “The central scenario for the economy is that this condition will not be met before 2024”.

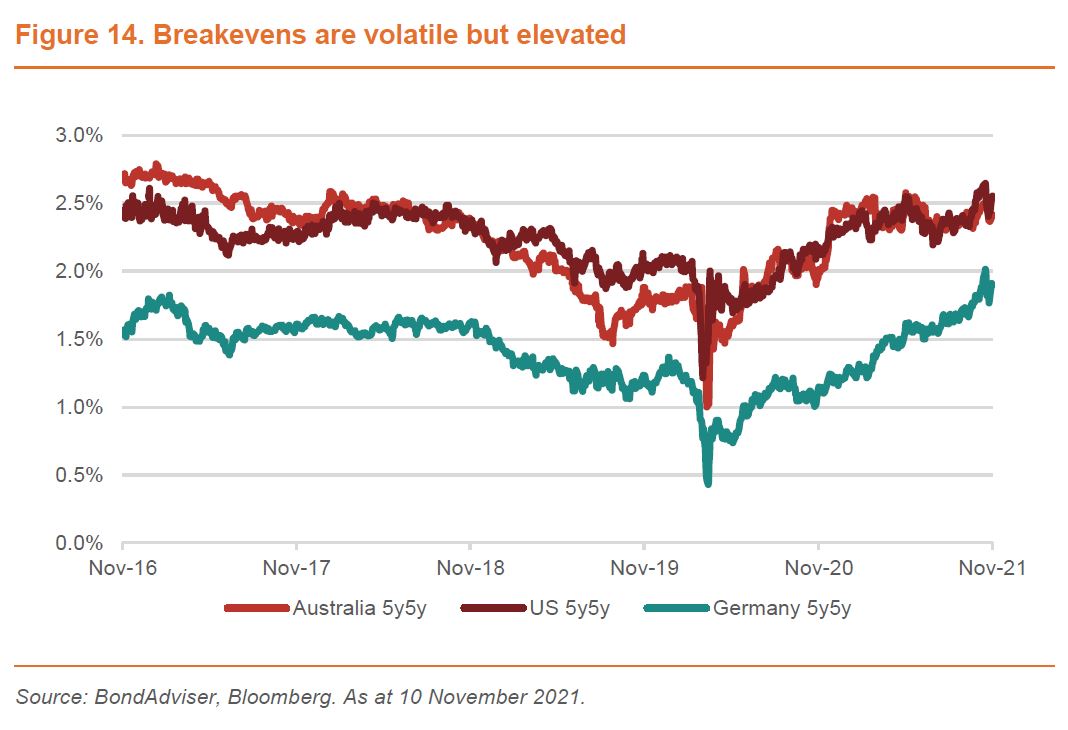

Bond markets have lost their collective nerve more recently regarding inflation. Whilst forward breakevens have retraced from highs, the levels are significantly higher than the past, as seen in Figure 14 – especially notable in the case of Germany.

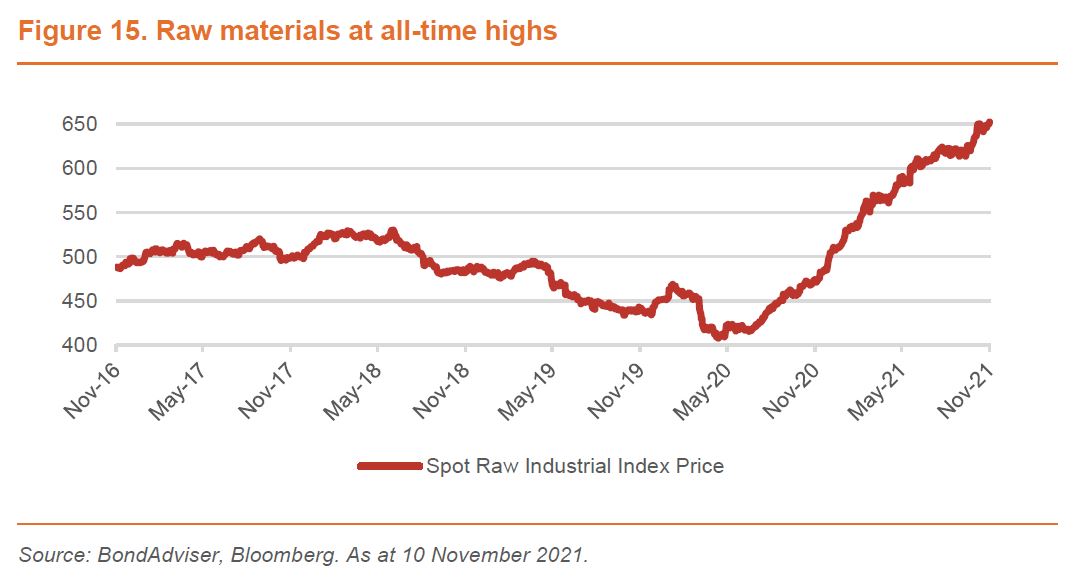

The commodities market has been volatile in assets of domestic abundance, however we note more niche areas of the market are also experiencing rapid gains. The RIND Index covers industrial materials that are not available to be traded on futures markets – this measure thus avoids speculative driven pressure and is notably at an all time high.

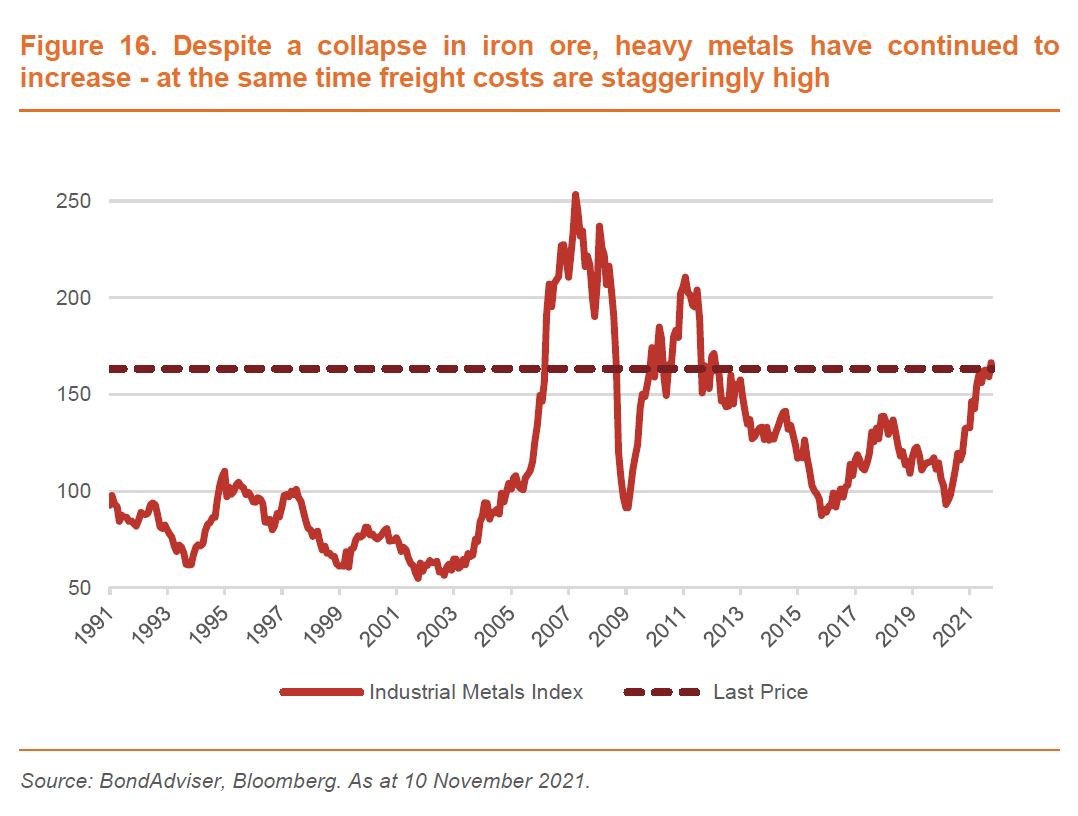

Industrial metals pricing has been driven by Chinese demand in the 21st century. Interestingly, despite China attempting to extinguish speculation in metals, prices have continued to surge – noting that iron ore in fact has fallen significantly. Regardless, it is clear that price pressures are persisting – an increase in freight cost also is indicative of real margin impacts to many businesses, and consumers may get a genuine shock when they learn that Christmas presents will not be delivered in time due to supply bottlenecks.

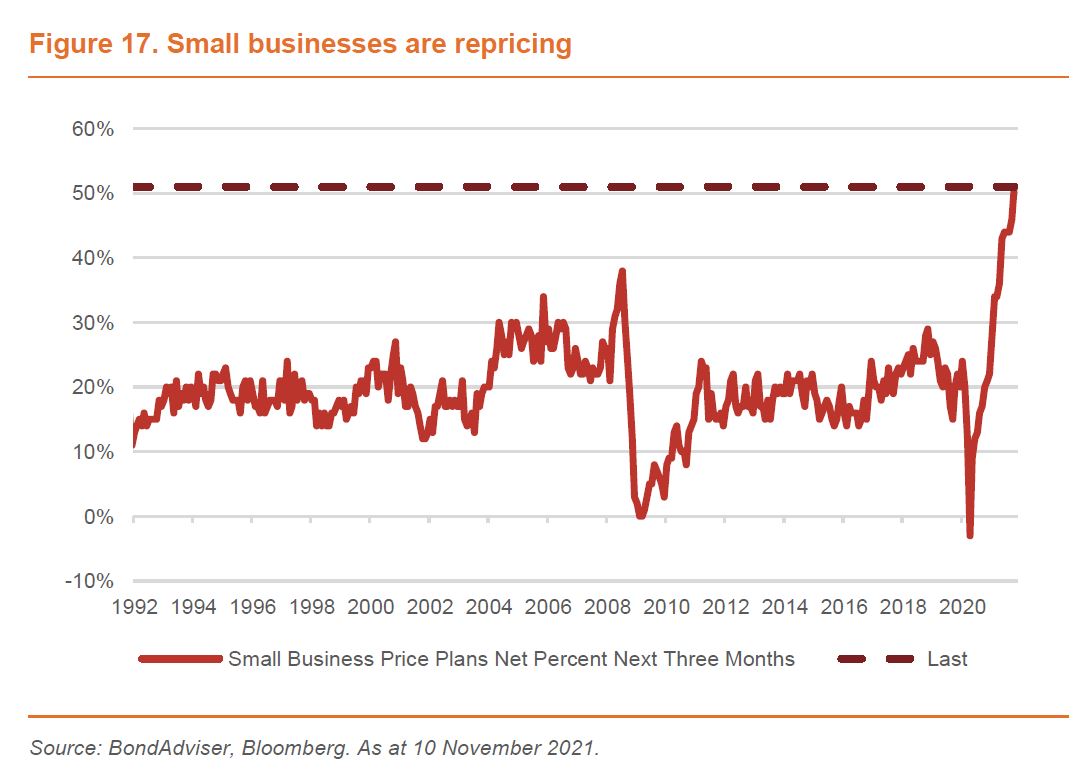

Not only are businesses having to deal with higher input costs (a problem we first identified in May 2020) but a tighter labour market means that companies need to raise prices to the consumer. This naturally occurs for two reasons, firstly to offset an increase in costs but also with limited capacity margins, prices must lift to maintain revenues.

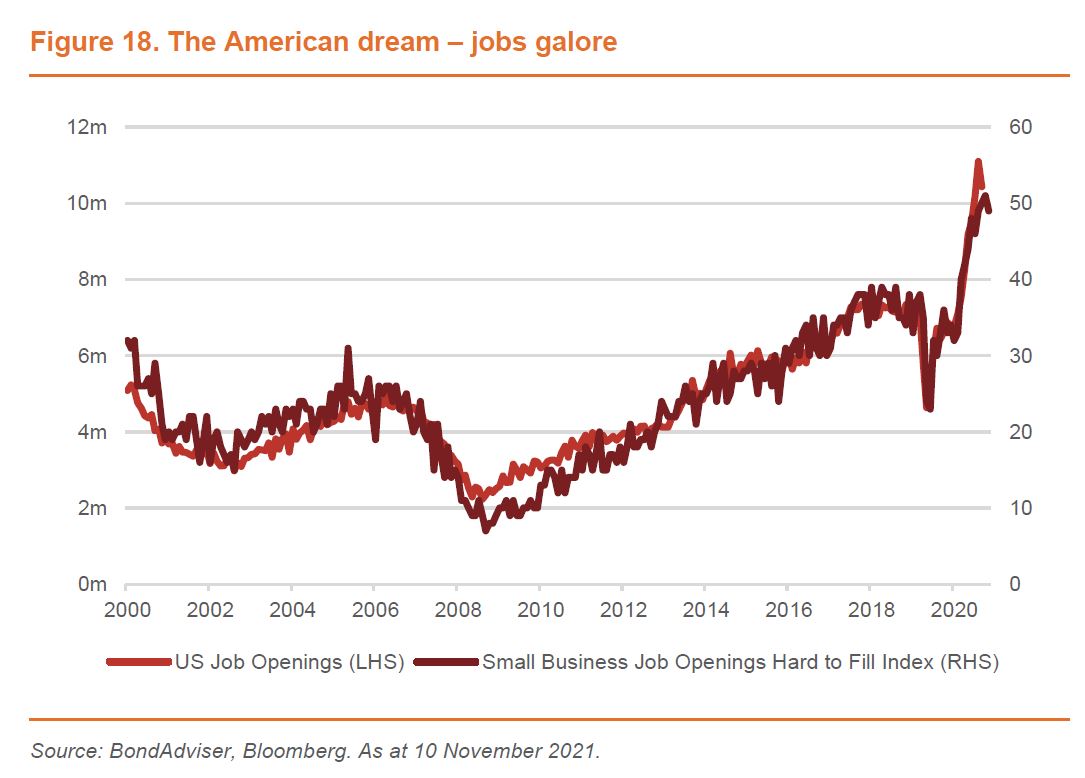

Whilst we focus primarily on Australian and US economic indicators, it is true that most Western economies are suffering from labour market pressures. Some of this can be attributable to (1) early retirement, (2) school closures making childcare difficult, and (3) a “Great Resignation” to seek better work. Regardless of the attribution, it is evident that many jobs are unfilled. This may lead to wage pressures where employers increase salaries to attract workers.

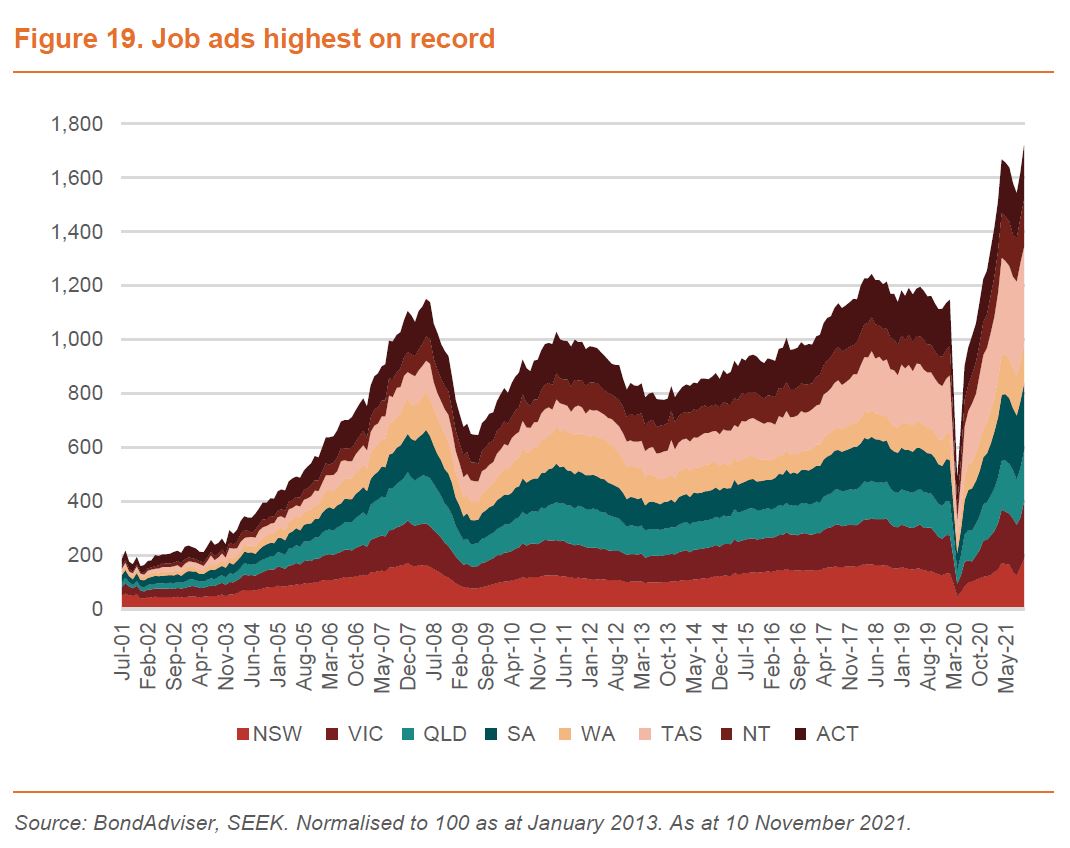

Domestically this data also rings true with Seek’s employment report for October 2021 recording the highest number of job advertisements posted in a month in the company’s 23+ year history. The reopening of Victoria and NSW drove this, but all states and territories recorded more job ads than in October 2019. Nationally, volumes were a jaw dropping 63.2% higher on 2020 and 44.0% compared to 2019. At the same time applications per job declined 5.4% month-on-month.

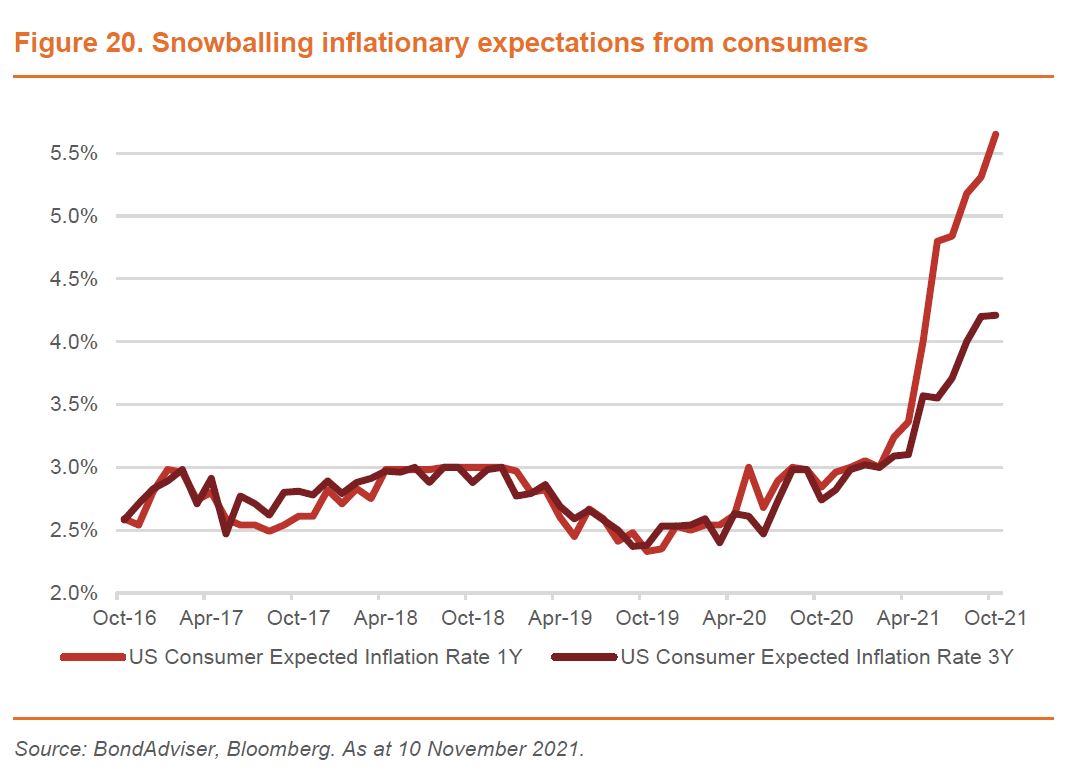

All of these impacts are filtering through to consumers – whilst the economic theory is controversial, especially given the masses no longer have experienced the consequences of high inflation, consumers form the last piece of the puzzle in terms of inflation self-perpetuation – whereby expectations of higher prices changes consumer behaviour (erosion of purchasing power accelerates near-term spending). The increase here is somewhat alarming, especially in the context of a transitory narrative that has persisted for so long.

Judging from recent government rhetoric, it appears that immigration will form a key plan to the recovery. This could soften much of potential inflationary pressures locally. However, global prices on input costs are beyond control of sensible government influence. The ice is getting thinner and the stakes are getting higher. At one extreme is Japanification, at the other is non-transitory inflation and the worst-case is stagflation. The window for rising rates without inducing policy-driven mishaps is closing. From a credit perspective we are concerned at the convexity present in the long-end of the AusBond Composite. Whilst more recently we profitability preferred the belly of the curve, we have moderated this stance. We expected continued volatility surrounding (1) benchmark yields, (2) data and (3) policy. We therefore remain underweight the long-end but move to hide in the Floating Rate Note (FRN) market.