August saw forecasts for the RBA cash rate slashed further, in response, lenders have consolidated in cutting their Term Deposit (TD) offerings. Whilst some lenders, in a bid to attract to market share, initially maintained some value for savers, these strategies have proven unsustainable as we saw 16 rate reductions in August across all three tenors.

In the short-term (ST) market, ANZ, which had previously bucked the consensus by increasing its offering over recent months, has dealt a blow to TD investors by slashing its ST rate by 45 basis points (bps) to 1.60%. Westpac made a similar move, cutting its ST offer by 40 basis points, bringing its rate to the bottom of the ST range (1.55%). With less significant reductions from BEN (-0.25%), NAB (-0.15%) and BOQ (-0.15%), the latter now offers the most value for investors with 1.90%.

Bank of Queensland also offers the most generous MT rate for investors, 1.90%, despite a 20-basis point cut this month. ANZ, which slashed its MT offer as well by 50 bps, offers the next best rate for investors with a slim 1.60%. WBC, which cut its MT rate by 0.25% this month, offers the poorest value for investors with 1.40%.

Every considered lender cut its long-term offer, as expectations of the long-term interest rate environment spiral downwards. CBA and WBC led the reductions, cutting their rates by 20 basis points so that both now offer 1.55%, a marginal premium over each bank’s short-term offer. BOQ, which cut its LT rate by 10 basis points offers the most value in the LT (1.75%), noting this is 15 bps less than both its ST and MT – calling into the question the sustainability of its premium. ANZ cut its rate by 15 basis points to 1.70%, which is the next-best offer for investors.

Note: Short Term (~3M), Medium Term (~6M), Long Term (~12M)

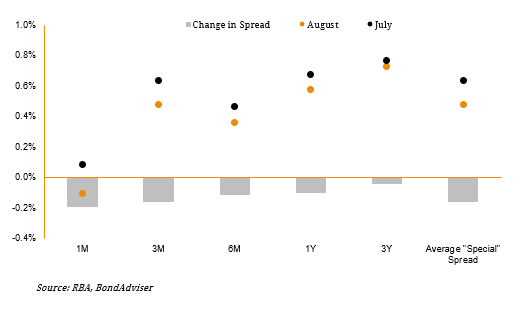

Figure 1. Term Deposit Spread Over Relevant BBSW: August 2019 vs July 2019

Source: RBA, BondAdviser

For full details, charts and commentary, please click here for the full pdf version.