US inflation hit a 40 year high in February 2022 at 7.9% – up from 7.5% as reported by the US Labor department a month earlier. Bloomberg reported that the primary reasons for this outcome lay not just in the rising cost of petrol, but also food and housing costs. Looking even closer at the inputs that go into the inflation calculation in the US, there is a component known as “core prices” which excludes the impact from volatile price movements (think the cost of bananas after a cyclone in Queensland). Even taking these impacts out in a particularly volatile period for markets, prices in the US were generally up half a percent from January 2022.

The current US administration would have it believed that this is all due to Russia invading Ukraine (“Putin’s price hike”), however, it is important to note that the prices for many goods in the US (not just petrol) were rising strongly well before Putin commenced his European war. This distinction must be made as otherwise some may be prone to suggest that the significant hike in inflation over the last year was due solely to what could be a relatively short period of geo-political folly on the part of Russia. It is vastly more likely that the US is in for a much more sustained period of price rises that will not only frustrate Americans, but will influence the balance sheets of banks all over the world, including Australia.

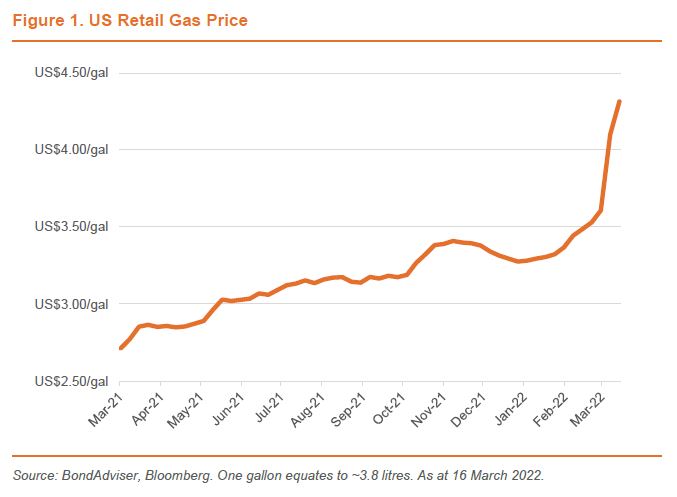

The USD price per gallon was already up 20% between March ’21 and November ’21 – well before the Ukraine events unfolded. This was also between 12 and 18 months after the onset of Covid in the US which was a worse scenario in 2020 for markets.

Food prices in the US rose by more than fuel over the month to February 2022 (7.0% to 7.9%). This would be difficult to pin on Putin regardless of political priorities.

To combat this extraordinary inflationary activity, US Rates will likely rise by 0.25% tonight (16 March), particularly noting the comments from the Federal Reserve this month in favour of such a move. This will be the first time rates have risen in the US since 2018. Over the remaining months of 2022, we could see the US provide for further rate rises of at least a further 1% in total.

One of the most direct relationships between US inflation, the related rate rises, and the Australian economy are Australian bank balance sheets being impacted by higher borrowing costs from US markets. The major banks in Australia, which depend on the much larger and more liquid markets offshore to fund their businesses, will have to respond as their costs materially increase. We have already seen this is various rate rises in fixed rate loans for mortgage borrowers in recent months. These rate rises occurred without any prompting from an Australian RBA target cash rate increase.

Australian banks must, and will, actively manage their interest rate risk outside official moves in order to maintain appropriately managed balance sheets. This may surprise a lot of recent home loan borrowers in the next year or so, as well as economic forecasts for Australia in 2023.