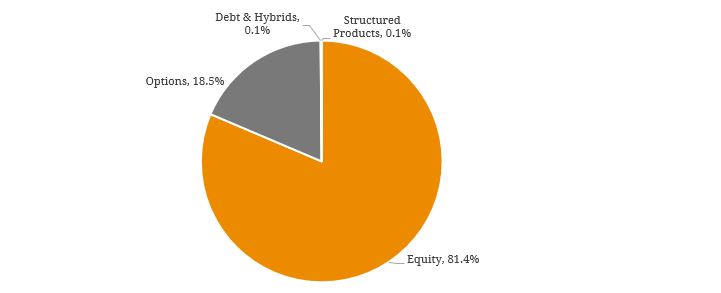

Liquidity is an important consideration for any investor, whether it be in equities, fixed income or alternative asset classes. Liquidity is the degree to which an asset or security can be readily bought or sold at a mutually agreeable market price, and this visible by the trading volume of a given security, with a higher level of trading activity leading (in ordinary times) to a more liquid market in which investors can enter and exit with ease. Global and domestic bond markets have been hit by significant events that can be linked to liquidity factors in recent years, including the 2013 “Taper Tantrum”, as the U.S. Federal Reserve announced plans to scale back quantitative easing (QE) and the October 2014 “Bond Flash Crash”, when market panic saw a flight to safety and the U.S. Treasury yield fell from 2.20% to as low as 1.86% in just 12 minutes (figure 1). Figure 1. Historical U.S. 10-Year Treasury Yield  Source: BondAdviser, Bloomberg There are varying factors that can help explain liquidity (or lack thereof) in bond markets relative to equity markets, including the nature of securities, trading mechanisms and the change in propensity for risk in the post-GFC economic environment. Equities are inherently a more liquid asset class as they are fundamentally standardised, meaning investors know that they are purchasing a small portion of the specific company or fund they are buying into. In contrast, bonds are largely bespoke in nature and even bonds of the same type or from the same issuer can have vary greatly. One such example is that of U.S. conglomerate General Electric (NYSE: GE) which has only one equity stock but over 1,000 types of bonds with different yields and maturities. Hence, assigning value and quickly matching buyers and sellers in a market with many different products and little uniformity can be a time-consuming process that contributes to illiquidity. By and large, equities are traded on central exchanges such as the Australian Securities Exchange (ASX) or the New York Stock Exchange (NYSE). These exchanges, supported by a number of other market participants such as clearinghouses, promote liquidity in the market through reduced information asymmetry and high levels of transparency. Critically, the existence of a liquid, secondary market is key to a sustainable, viable asset class and this is seen with the sheer volume of traded securities in the ASX versus that of the Australian domestic bond market. The absence of a liquid secondary market in which investors can trade their securities crimps growth as investors are more reluctant to buy and sell securities knowing that they may not have an opportunity to enter or exit the market at a later date at a desired price (i.e. liquidity risk). Bond markets generally do not have a central trading place with the vast majority of bonds sold over-the-counter (OTC). Figure 2 below shows that even those securities that make up the domestic listed debt and hybrid market have much lower daily traded volumes than their equity peers. Figure 2. Average Percentage of ASX Daily Trade Volume by Product Type (November 2018)

Source: BondAdviser, Bloomberg There are varying factors that can help explain liquidity (or lack thereof) in bond markets relative to equity markets, including the nature of securities, trading mechanisms and the change in propensity for risk in the post-GFC economic environment. Equities are inherently a more liquid asset class as they are fundamentally standardised, meaning investors know that they are purchasing a small portion of the specific company or fund they are buying into. In contrast, bonds are largely bespoke in nature and even bonds of the same type or from the same issuer can have vary greatly. One such example is that of U.S. conglomerate General Electric (NYSE: GE) which has only one equity stock but over 1,000 types of bonds with different yields and maturities. Hence, assigning value and quickly matching buyers and sellers in a market with many different products and little uniformity can be a time-consuming process that contributes to illiquidity. By and large, equities are traded on central exchanges such as the Australian Securities Exchange (ASX) or the New York Stock Exchange (NYSE). These exchanges, supported by a number of other market participants such as clearinghouses, promote liquidity in the market through reduced information asymmetry and high levels of transparency. Critically, the existence of a liquid, secondary market is key to a sustainable, viable asset class and this is seen with the sheer volume of traded securities in the ASX versus that of the Australian domestic bond market. The absence of a liquid secondary market in which investors can trade their securities crimps growth as investors are more reluctant to buy and sell securities knowing that they may not have an opportunity to enter or exit the market at a later date at a desired price (i.e. liquidity risk). Bond markets generally do not have a central trading place with the vast majority of bonds sold over-the-counter (OTC). Figure 2 below shows that even those securities that make up the domestic listed debt and hybrid market have much lower daily traded volumes than their equity peers. Figure 2. Average Percentage of ASX Daily Trade Volume by Product Type (November 2018)  Source: BondAdviser, ASX Without a central trading platform, the secondary bond market is facilitated by broker-dealers (who serve the role of market makers). Broker-dealers tend to be large institutions (i.e. investment banks) which profit on the difference between the bid (buying) and ask (selling) prices or the “bid-ask spread”. This spread, as well as representing a profit margin, also captures illiquidity costs, with a higher spread inferring less ability for parties to converge on a given price driven by lack of transparency and higher information asymmetry, and hence, greater illiquidity. Due to a combination of the above (and other structural factors), the Australian bond market lacks the level of depth and liquidity seen in offshore markets such as the U.S. and Europe. As a result, it is not uncommon to see higher bid-ask spreads and reduced trading volumes which make domestic bonds potentially more illiquid relative to domestic equities or offshore bond markets. Whilst this can create greater risk to investors, active credit strategies and robust portfolio management can utilise tactical and strategic allocations to reduce overall risk, increase diversification benefits and generate stable returns when executed efficiently and effectively.

Source: BondAdviser, ASX Without a central trading platform, the secondary bond market is facilitated by broker-dealers (who serve the role of market makers). Broker-dealers tend to be large institutions (i.e. investment banks) which profit on the difference between the bid (buying) and ask (selling) prices or the “bid-ask spread”. This spread, as well as representing a profit margin, also captures illiquidity costs, with a higher spread inferring less ability for parties to converge on a given price driven by lack of transparency and higher information asymmetry, and hence, greater illiquidity. Due to a combination of the above (and other structural factors), the Australian bond market lacks the level of depth and liquidity seen in offshore markets such as the U.S. and Europe. As a result, it is not uncommon to see higher bid-ask spreads and reduced trading volumes which make domestic bonds potentially more illiquid relative to domestic equities or offshore bond markets. Whilst this can create greater risk to investors, active credit strategies and robust portfolio management can utilise tactical and strategic allocations to reduce overall risk, increase diversification benefits and generate stable returns when executed efficiently and effectively.