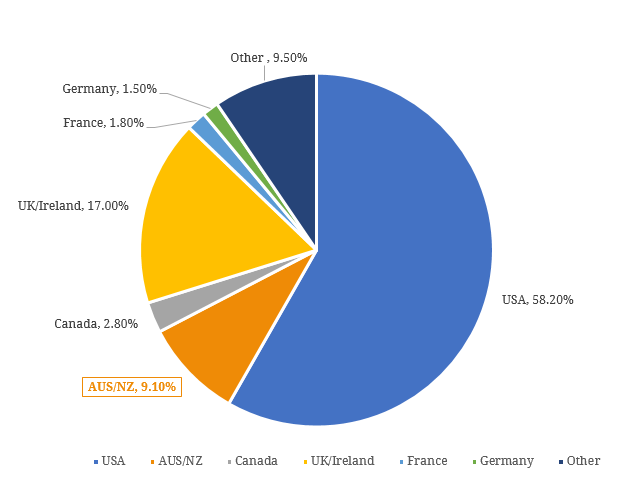

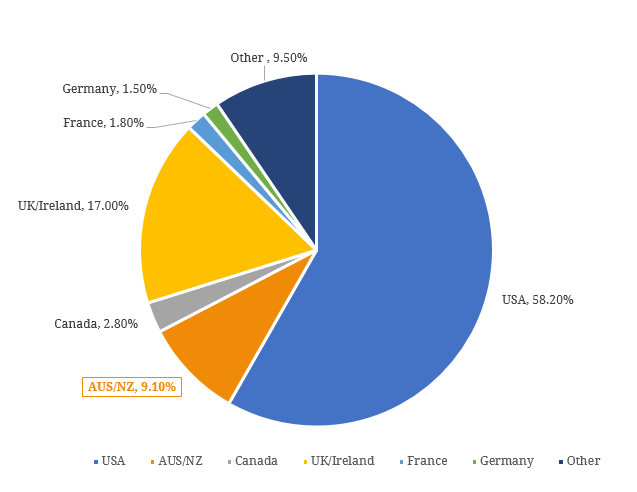

Tabcorp recently announced that it had successfully priced US$1.4 billion long-term notes to investors in the US Private Placement (USPP) market. The placement comprises four USD and two AUD-denominated tranches, with maturities evenly spaced between 8 – 18 years. The notes will be issued in June 2018. All USD proceeds will be swapped into AUD, resulting in total AUD proceeds of $1.82 billion, and which will be used to fully repay the $1.8 billion bridge financing facility put in place for the Tatts acquisition as well as to repay existing bank debt. Assuming reasonable pricing, this successful USPP deal is positive for the new Tabcorp, giving it long-term stable debt funding at lower costs. Whilst the acronym USPP may not be a household term in Australia, it is not unusual to hear news of Australian corporates tapping into the USPP market, leading some to ask – what is the USPP market for issuers and investors? The USPP is a market for privately issued debts in the US. Although it is well established, it is still only a fraction of the total size of the public fixed income market (~5%) and generally receives much less attention from the investing public. Whilst public corporate bonds are almost always rated by credit ratings agencies, USPP market debt is often not. This has led to some often incorrect assumptions of lower quality and higher credit risks of USPP bonds. In fact, many issuers in the USPP market are investment grade rated and it is not uncommon to see them issue debt in both the public bond market and in the USPP market. For issuers who are not rated, they are generally well-established corporates which could be investment grade if they chose to be so. This helps to also explain why predominant investors in the USPP market are insurance companies with low risk tolerance thus it is important not to confuse USPP debt with mezzanine debt or private equity. This nature of the USPP market means that there is usually low or little credit risk premia associated with USPP issuances. There is often, however, an illiquidity premium associated with USPP debt, which can range anywhere between 10 to 50 bps or more over similar-quality, public market bonds. This is despite the fact that liquidity typically is available and a secondary market for USPP debt does exist. This has led to many to label the illiquidity premium as a “perceived” one. On the other hand, there might be some merit in arguing that due to the relatively small size and market participant constraints of the USPP market, a small “perceived” illiquidity premium might be justified. The most important fact about the USPP market, amongst its other features, is its flexibility. Almost every aspect of a bond’s structure can be negotiable: issuers may issue in multiple currencies, with multiple maturities, in customised repayment structures or covenants, just to name a few. In essence, the USPP market determines on a case-by-case basis what such flexibility may cost the issuer. It is thus not surprising that the flexibility offered by the USPP market has attracted issuers with a broad range of needs that may not fall under the “conventional issuance” band. This is exemplified by the Tabcorp issuance – multiple currency tranches (USD and AUD), multiple maturity tranches (8 – 18 years) and for the purpose of funding a major acquisition (or refinance of), rather than the usual purposes of working capital and/or general corporate use. In fact, Australian corporates have been fairly active in the USPP market, well known Australian names such as TransGrid, Monash University, WorleyParsons, Charter Hall, FMG, Scentre, Brisbane Airport and ConnectEast have all been issuers before. Joining Australian issuers are other non-American names, which together frequently comprise almost 50% of total issuances (see Figure 1). Figure 1. Issuer Composition in USPP Market