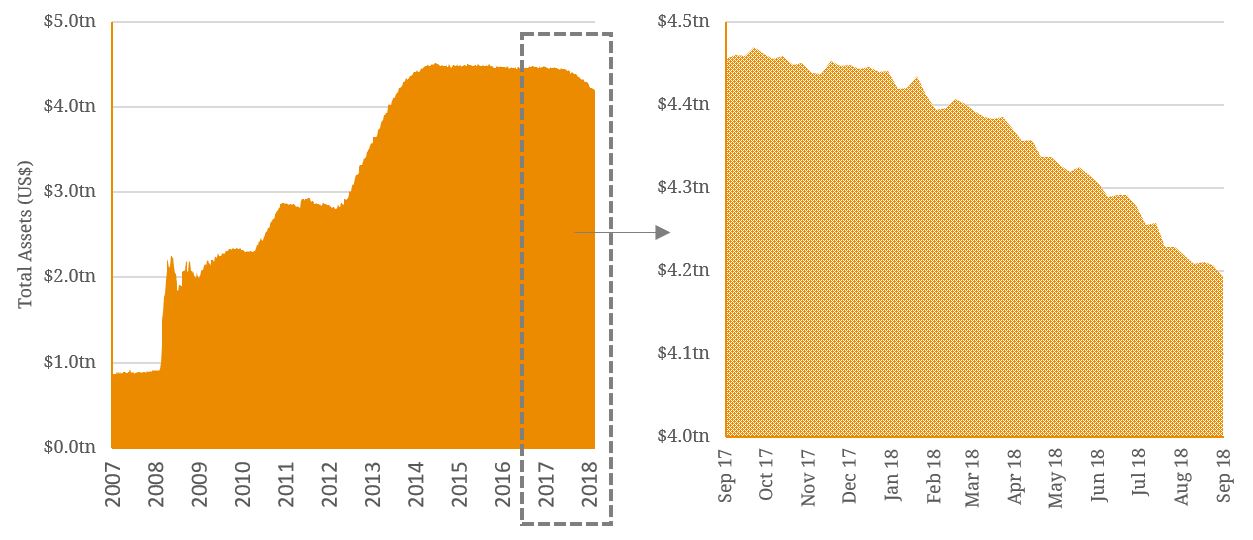

Quantitative easing (QE) was first pioneered by the Bank of Japan (BoJ) way back in 2001, when it was employed as a stimulative economic policy, after the BoJ ran short-term rates down to zero. QE’s mechanism for stimulation is the purchase of debt securities by central banks (in the secondary market), causing the central bank’s reserve supply to increase and subsequent heightened liquidity allowing lenders to pass on credit to companies and households. Quantitative tightening (QT) is the mirror image of QE whereby central banks allow these purchased securities to mature without replacing them. This reduces monetary supply within the financial system and means the Treasury must find new buyers of government debt. Given these massive asset purchases (QE) drove up the price of assets, it stands to some logical reason that doing the opposite (QT) would likely have the reverse effect in the market. Following the global financial crisis (GFC), in October 2008 the U.S Federal Reserve (Fed) attempted to revive the flow of credit by rapidly employing QE and purchasing bonds. The Fed continued to purchase bonds up until 2014, albeit also branching out to purchase other assets including US$1.8 trillion worth of Mortgage-Backed Securities (MBS), which represented over a quarter of the MBS market, in addition to swaps and overnight loans of securities. Figure 1. Total Assets of the U.S. Fed; Long Term (LHS) and Month-on-Month (RHS)  Source: BondAdviser, St Louis Fed Under the previous Federal Reserve chair, Janet Yellen, it was announced that QT would begin on 1 October 2017 under the guise of policy normalisation arising from the strength of the US economy. Since then, current Fed chairman Jerome Powell has been rather scathing of QE, stating it is a “habit forming” policy that increases moral hazard; whereby investors take on more risk with the knowledge that the Fed will backstop losses. Other Fed officials have echoed similar sentiment that large bond holdings are distorting financial markets, prompting investors to be less risk-averse than they otherwise would be. Figure 2. Net Asset Purchases for the C-3 Banks Are Forecast to Decline Further in 2018…

Source: BondAdviser, St Louis Fed Under the previous Federal Reserve chair, Janet Yellen, it was announced that QT would begin on 1 October 2017 under the guise of policy normalisation arising from the strength of the US economy. Since then, current Fed chairman Jerome Powell has been rather scathing of QE, stating it is a “habit forming” policy that increases moral hazard; whereby investors take on more risk with the knowledge that the Fed will backstop losses. Other Fed officials have echoed similar sentiment that large bond holdings are distorting financial markets, prompting investors to be less risk-averse than they otherwise would be. Figure 2. Net Asset Purchases for the C-3 Banks Are Forecast to Decline Further in 2018…  Source: BondAdviser, Bloomberg Intelligence, Bloomberg Economics Estimates Since QT began a year ago, the Fed’s total assets balance has declined by 6.3%. This maiden anniversary has also coincided with the Fed balance sheet falling below US$4 trillion for the first time since 2014. On average, throughout 2018 the total asset value held by the Fed has fallen by US$5.1 billion per week. More recently, ramping up of QT has seen US$40bn of bond holdings mature per month without replacement which has significantly restricted money market supply. On a global scale, the combined C-3 central banks – the Fed, European Central Bank (ECB) and BoJ – have seen their balance sheets increase by US$76 billion in the first half of the year (1H18) compared to US$703 billion in the preceding half (2H17). In other words, more than US$ 500 billion dollars of liquidity has effectively gone missing from global markets in a relatively short space of time. Figure 3. Yields on Short-Term Treasury Bills Have Been on the Rise Over the Last 12 Months…

Source: BondAdviser, Bloomberg Intelligence, Bloomberg Economics Estimates Since QT began a year ago, the Fed’s total assets balance has declined by 6.3%. This maiden anniversary has also coincided with the Fed balance sheet falling below US$4 trillion for the first time since 2014. On average, throughout 2018 the total asset value held by the Fed has fallen by US$5.1 billion per week. More recently, ramping up of QT has seen US$40bn of bond holdings mature per month without replacement which has significantly restricted money market supply. On a global scale, the combined C-3 central banks – the Fed, European Central Bank (ECB) and BoJ – have seen their balance sheets increase by US$76 billion in the first half of the year (1H18) compared to US$703 billion in the preceding half (2H17). In other words, more than US$ 500 billion dollars of liquidity has effectively gone missing from global markets in a relatively short space of time. Figure 3. Yields on Short-Term Treasury Bills Have Been on the Rise Over the Last 12 Months…  Source: BondAdviser, Bloomberg Although presented to investors as being a slow and gradual policy, the QT process has agitated markets (with greater volatility compared to “Goldilocks returns” in 2017). Furthermore, market commentary regarding QT has been broadly negative, with some analysts labelling QT as the primary driver of asset-class performance throughout 2018. Figure 3 shows the rapid rise in short-term Treasury bill yields, amplified by further issuance by Treasury, which in turn has propagated strength in the US Dollar. In terms of a normalised balanced sheet, the Fed still has some way to go before it reaches that point. Contractionary pressures of higher interest rates alongside sustained QT will require a robust market to pick-up the shortfall of central banks. As credit tightens and asset prices fall, central bankers need to be wary that the illiquidity nexus that spawned QE may rear its head again, however this time it would be through QT.

Source: BondAdviser, Bloomberg Although presented to investors as being a slow and gradual policy, the QT process has agitated markets (with greater volatility compared to “Goldilocks returns” in 2017). Furthermore, market commentary regarding QT has been broadly negative, with some analysts labelling QT as the primary driver of asset-class performance throughout 2018. Figure 3 shows the rapid rise in short-term Treasury bill yields, amplified by further issuance by Treasury, which in turn has propagated strength in the US Dollar. In terms of a normalised balanced sheet, the Fed still has some way to go before it reaches that point. Contractionary pressures of higher interest rates alongside sustained QT will require a robust market to pick-up the shortfall of central banks. As credit tightens and asset prices fall, central bankers need to be wary that the illiquidity nexus that spawned QE may rear its head again, however this time it would be through QT.