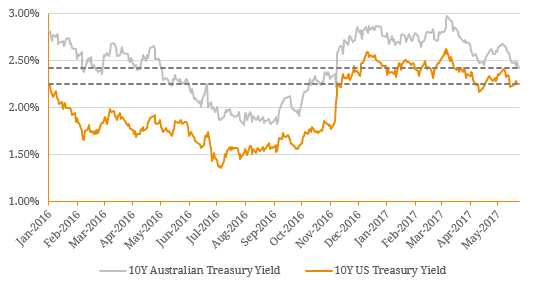

After a brief hiatus, the media-dubbed ‘Reflation Trade’ has re-emerged as a key talking point in financial markets. Donald Trump’s victory in the US Election and his focus on pro-growth policies gave global markets the confidence to think the inflation tide had finally turned. However following a string of allegations surrounding the President, this trajectory has somewhat stuttered. In light of this increased uncertainty, investor inflation expectations have moderated with both the Australian and US 10-Year Treasury yields sitting close to their lowest point since November 2016. Figure 1. 10Y US and Australian Treasury Yields  Source: Bloomberg Figure 2. US 5-Year, 5-Year Forward Inflation Expectation Rate

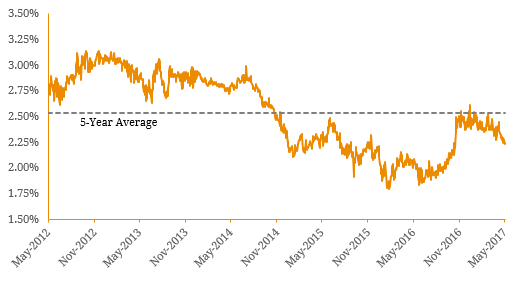

Source: Bloomberg Figure 2. US 5-Year, 5-Year Forward Inflation Expectation Rate  Source: Bloomberg While long term yields have waned, it is arguable this could be partly driven by geopolitical uncertainty and subsequent ‘flight to quality’ sentiment rather than a return to deflation. Tensions in North Korea remain elevated and the UK election next month leaves investors susceptible to an unanticipated result. For this reason, the recent pull-back in yields could be a temporary bump in the road against the broader trend of global economic recovery. Figure 3. World GDP Y/Y Growth

Source: Bloomberg While long term yields have waned, it is arguable this could be partly driven by geopolitical uncertainty and subsequent ‘flight to quality’ sentiment rather than a return to deflation. Tensions in North Korea remain elevated and the UK election next month leaves investors susceptible to an unanticipated result. For this reason, the recent pull-back in yields could be a temporary bump in the road against the broader trend of global economic recovery. Figure 3. World GDP Y/Y Growth  Source: IMF Nonetheless, domestic inflation expectations remain anchored to the US (Figure 4). While the domestic drivers of inflation are important to monetary policy, market based measures are the ones that matter to investors as future inflation is a primary driving source of yields. This is particularly important for fixed rate investments, as higher inflation will erode the purchasing power of interest payments and the principal at final maturity over time. For this reason, ‘Reflation’ abroad is an important factor for Australian fixed income investors. Figure 4. Australia and US 10-Year Inflation Expectations

Source: IMF Nonetheless, domestic inflation expectations remain anchored to the US (Figure 4). While the domestic drivers of inflation are important to monetary policy, market based measures are the ones that matter to investors as future inflation is a primary driving source of yields. This is particularly important for fixed rate investments, as higher inflation will erode the purchasing power of interest payments and the principal at final maturity over time. For this reason, ‘Reflation’ abroad is an important factor for Australian fixed income investors. Figure 4. Australia and US 10-Year Inflation Expectations  Source: Bloomberg On this basis, we believe the ‘Reflation’ story is not over yet. Recent commentary from the US Federal Reserve has signaled the central bank is on track to raise US interest rates in June 2017, for the 4th time since the GFC, and another rate hike is on the cards later in the year. If US economic data begins to pick up (particularly wage growth) against market expectations and the Fed’s forecasts or Trump progresses with pro-growth policies, it is likely we will enter the next stage of the ‘Reflation Trade’. We will continue to monitor the interest rate situation closely and will conduct an in-depth analysis in our mid-year fixed income outlook in July 2017.

Source: Bloomberg On this basis, we believe the ‘Reflation’ story is not over yet. Recent commentary from the US Federal Reserve has signaled the central bank is on track to raise US interest rates in June 2017, for the 4th time since the GFC, and another rate hike is on the cards later in the year. If US economic data begins to pick up (particularly wage growth) against market expectations and the Fed’s forecasts or Trump progresses with pro-growth policies, it is likely we will enter the next stage of the ‘Reflation Trade’. We will continue to monitor the interest rate situation closely and will conduct an in-depth analysis in our mid-year fixed income outlook in July 2017.