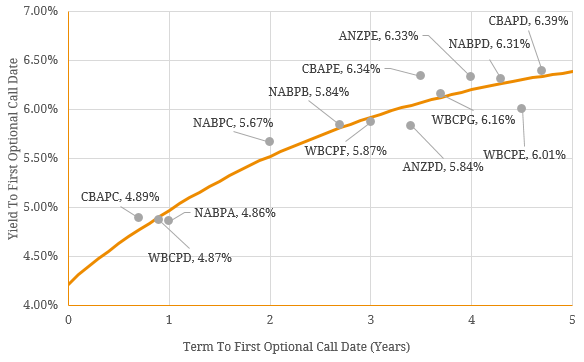

The increased interest shown by wholesale investors for Additional Tier 1 (AT1) hybrids can be neatly encapsulated by the ANZ launching the first US dollar hybrid offer to overseas investors since 2009. ANZ has been able to obtain an ATO private ruling that allows the bank to issue the hybrid via an offshore branch (London) without having to attach franking credits to distributions. While the initial pricing estimate for the fixed rate US$ AT1 security was 7.25% (BBSW ~6.1-6.2%), applicable until the first reset date in June 2026 (10 years), investor demand has been so strong (in excess of US$18 billion of bids according to the AFR) that ANZ have been able to raise US$1 billion at a rate 0.50% tighter, i.e. 6.75% (BBSW ~5.7%). Considering three domestic A$ AT1 transactions by the CBA (5.5 years), Westpac (5.4 years) & the NAB (6 years) were priced at a margin of 5.20%, 4.90% & 4.95% respectively, this is a fair premium to pay even when taking into account the 10-year optional call date (See Figure 1). Figure 1. AT1 Hybrid Credit Curve  Source: BondAdviser, as at 7 June 2016 While ANZ in November 2015 stated “it expects to fully frank dividends for the foreseeable future”, the strategy of issuing hybrids from an offshore branch does lend credence to the hypothesis they are actively managing their hybrid issuance to ensure sufficient franking credits will be available for Australian investors. This issue is effectively 3.25 years longer than the longest dated ASX listed hybrid currently on issue (ANZPF) with a first optional call date of 24 March 2023 (currently trading at a margin ~ 5.1% above the 180 day bank bill swap rate). From a technical point of view, overseas investors that specialise in investing in AT1 hybrids are attracted to the relative strength of the Australian banking system compared to some Asian & European peers. This is due to Australia’s stronger regulatory framework and the fact that Australian AT1 hybrids also have dividend stopper provisions embedded that are specifically designed to protect hybrid investors. Australian based institutional investors are also showing greater warmth towards AT1 securities, as Figure 2 shows, with ~24-26% of the three recent domestic issues being taken up by various wholesale investors. Figure 2. 2016 Hybrid Deal estimated breakdown of investor type Source: Book-build runners. ANZ’s offshore issue may also reduce the amount of domestic Tier 1 required to replace the A$2 billion ANZPA (callable on 15 December 2016) as the US$ 1 billion issue is the equivalent of ~A$ 1.35 billion based upon current FX rates. Treasurers from the other three major banks will have to weigh up the merits of issuing AT1 securities offshore. The higher outright margin of the ANZ security, albeit with a longer 5 year tenure, and the additional cash to pay out security distributions (i.e. without franking credits) does add to the expense of issuing offshore. The other three banks may also have to obtain separate ATO rulings, although most of the heavy lifting has now been done by the ANZ. Of course, the US$ transaction could also have the effect of repricing the Australian market (i.e. trading margins of A$ issues could rise to meet the US pricing point of 5.71%). On the other hand, further AT1 overseas issuance may decrease the availability of AUD issues to the public.

Source: BondAdviser, as at 7 June 2016 While ANZ in November 2015 stated “it expects to fully frank dividends for the foreseeable future”, the strategy of issuing hybrids from an offshore branch does lend credence to the hypothesis they are actively managing their hybrid issuance to ensure sufficient franking credits will be available for Australian investors. This issue is effectively 3.25 years longer than the longest dated ASX listed hybrid currently on issue (ANZPF) with a first optional call date of 24 March 2023 (currently trading at a margin ~ 5.1% above the 180 day bank bill swap rate). From a technical point of view, overseas investors that specialise in investing in AT1 hybrids are attracted to the relative strength of the Australian banking system compared to some Asian & European peers. This is due to Australia’s stronger regulatory framework and the fact that Australian AT1 hybrids also have dividend stopper provisions embedded that are specifically designed to protect hybrid investors. Australian based institutional investors are also showing greater warmth towards AT1 securities, as Figure 2 shows, with ~24-26% of the three recent domestic issues being taken up by various wholesale investors. Figure 2. 2016 Hybrid Deal estimated breakdown of investor type Source: Book-build runners. ANZ’s offshore issue may also reduce the amount of domestic Tier 1 required to replace the A$2 billion ANZPA (callable on 15 December 2016) as the US$ 1 billion issue is the equivalent of ~A$ 1.35 billion based upon current FX rates. Treasurers from the other three major banks will have to weigh up the merits of issuing AT1 securities offshore. The higher outright margin of the ANZ security, albeit with a longer 5 year tenure, and the additional cash to pay out security distributions (i.e. without franking credits) does add to the expense of issuing offshore. The other three banks may also have to obtain separate ATO rulings, although most of the heavy lifting has now been done by the ANZ. Of course, the US$ transaction could also have the effect of repricing the Australian market (i.e. trading margins of A$ issues could rise to meet the US pricing point of 5.71%). On the other hand, further AT1 overseas issuance may decrease the availability of AUD issues to the public.