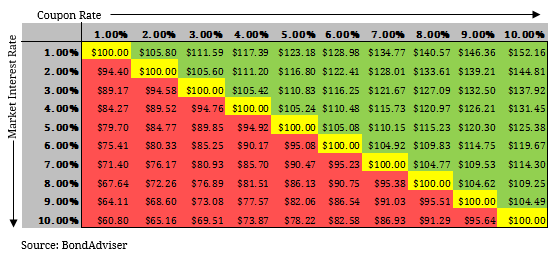

Although fixed income is generally less volatile than other asset classes, it is not immune to fluctuations in value. While equities experience a relatively even probability of capital upside and downside, bonds and other debt securities are subject to an asymmetric price structure. This essentially means that fixed income has limited upside and substantial downside. This reiterates the importance of avoiding losers when debt investing. To help explain this concept we will use two key drivers of bond prices. 1.Interest Rates When interest rates rise, new issuance of fixed income securities typically offer relatively higher yields to compete with existing securities in the market. As this occurs, these existing securities that offer smaller interest payments (lower coupon rates) become less attractive to investors. As a result, the price of the existing securities will fall (and yields will rise) and trade at a discount to remain competitive with newer bonds with higher coupon rates. On the other hand, if interest rates fall the existing security will be relatively more valuable (as yields drop and prices rise) at a higher coupon rate than other securities being issued at a lower coupon rate. This means that there is an inverse relationship between interest rates and bond prices. However, investors must consider their upside and downside. In theory the interest rate can range between zero and some infinite value. If we assume a 5% current interest rate then, the price upside is within the 0-5% range while the price downside is in the 5 – 100% range (i.e. default situation with no recovery). This demonstrates the asymmetric nature of bond prices. To illustrate the interest rate – coupon relationship (also known as interest rate risk), we will use a fixed rate 3-year bond. Figure 1. Fixed Rate 3-Year Bond Interest-Rate Sensitivity Table

- If the coupon rate equals the market interest rate, Market Price = Par Value.

- If the coupon rate is less than the market interest rate, Market Price is less than Par Value.

- If the coupon rate is greater than the market interest rate, Market Price is greater than Par Value.

2.Credit Profile The financial health of the underlying issuer affects the price investors are willing to pay for the bond as it dictates the probability of the company repaying the investor the principal. If the issuer is deemed risky, investors will require a higher return to compensate for the additional risk. If the existing coupon is not adequate, investors will discount the bond price to the point where the return earned on the potential investment is compensatory to the associated risk. In contrast, if the issuer is relatively safe, the specified coupon may be less risky and default risk is less. As a result, investors would require less return for risk compensation and the price of the bond would rise accordingly. When an issuer is able to improve its credit quality, it does so at a diminishing rate. This means that with each improvement, the credit quality of the issuer improves, but to a lesser extent. In comparison, if the credit quality of the issuer deteriorates, it does so at an increasing rate and worsens as the deterioration continues. As a result, the price upside of the underlying bond is limited by the diminishing returns in credit improvements while price downside can be amplified as deterioration continues. This again reflects the asymmetric payoff structure of bonds. Figure 2. Exponential Relationship between Credit Quality and Probability of Default