Equity markets started last week poorly but recovered to finish broadly unchanged (+0.13%). Bond and credit indices were weaker as the treasury bond curve pushed slightly (+0.05%) higher at the long end of the curve. Although the absolute return on credit indices were weaker, credit default swaps were driven tighter late last week (click here – albeit still wider than two weeks prior) as investors appear a bit more optimistic that financial markets are not on the verge of collapse. Cash investors continued to struggle as the positive momentum provided an opportunity for sellers to liquidate. Overall, it was a fairly flat week for most markets and bond markets continue to outperform equity markets but absolute returns returns are still low. During this short week we expect the market will continue to ponder further QE in Europe, watch how the jump in Oil (arguably some short covering) pans out and more importantly watch Chinese markets for signs of stability. As expected Standard and Poors (S&P) downgraded the credit rating on Santos to BBB- (Woodside and Origin Energy escaped further downgrades) and revised the outlook to negative on all producers following the revision of its oil price assumptions. In other news, credit rating agency Moody’s has put a big red pen through the Mining, Oil and Gas sectors saying it may downgrade 120 oil and gas companies and 55 mining companies worldwide. Most of these are based in Europe and the U.S. but a number of companies with operations in Australia were named including Rio Tinto and Origin Energy. As a precursor, Origin Energy made a statement to the ASX clarifying its financing arrangements including the fact it had significant undrawn debt facilities and that if downgraded to ‘high yield’ would have minimal effect on the company. In our opinion this may not be true. Moody’s prescribes 50% equity credit value to the hybrid (ASX Code: ORGHA) until 2061 not 2016 (like Standard and Poors). If it decides to downgrade the company it is likely to have implications in terms of collateral posting to the Energy Regulator , but more importantly reduces the probability of calling ORGHA’s in December 2016. Origin has previously said it will call the notes but this depends on the balance between wanting to keep (or possibly by then redeem) an investment grade rating or not. Interestingly Moody’s has a much lower price assumption for generic oil than Standard and Poors ($33 vs $40 a barrel in 2016, $38 vs $45 a barrel in 2017 and $43 vs $50 a barrel in 2018). While there are variations between the product (i.e. WTI vs Brent) this simply outlines the uncertainty in this sector and price volatility which is likley to remain throughout 2016. Another negative from the commodity collapse seems to be payables from junior miners. On Friday Aurizon announced it was owed ~$20million by Queensland Nickel which was placed into voluntary administration last week. They also announced that they were in discussions with a number of other small miners about contractual relief in exchange for longer term contracts. In other news the credit rating agencies seem united in their view that Woolworths exiting the home improvement business will be positive for the company and a recovery in the supermarket business is required to see the negative outlook removed. On the flip side, Wesfarmers now had their credit rating placed on negative outlook by S&P suggesting they “do not believe the funding plan adequately mitigates the financing risks associated with this transaction”. This relates to the ~$700 million acquisition of Homebase in the UK. As a result the adjusted debt load will increase by about A$2.5 billion. S&P expect Wesfarmers’ debt to EBITDA will be about 2.75x and funds from operations to debt will be about 26% following the acquisition. In our opinion it is a little to early to change the outlook and we will wait and see how 2016 plays out for Wesfarmers before adjusting our outlook.

Click below for Interactive Charts

Chart 1: Bloomberg AUSBond Composite Index (Monthly)

Chart 2: Bonds vs Equities 2014/15 (Monthly)

Interest Rates

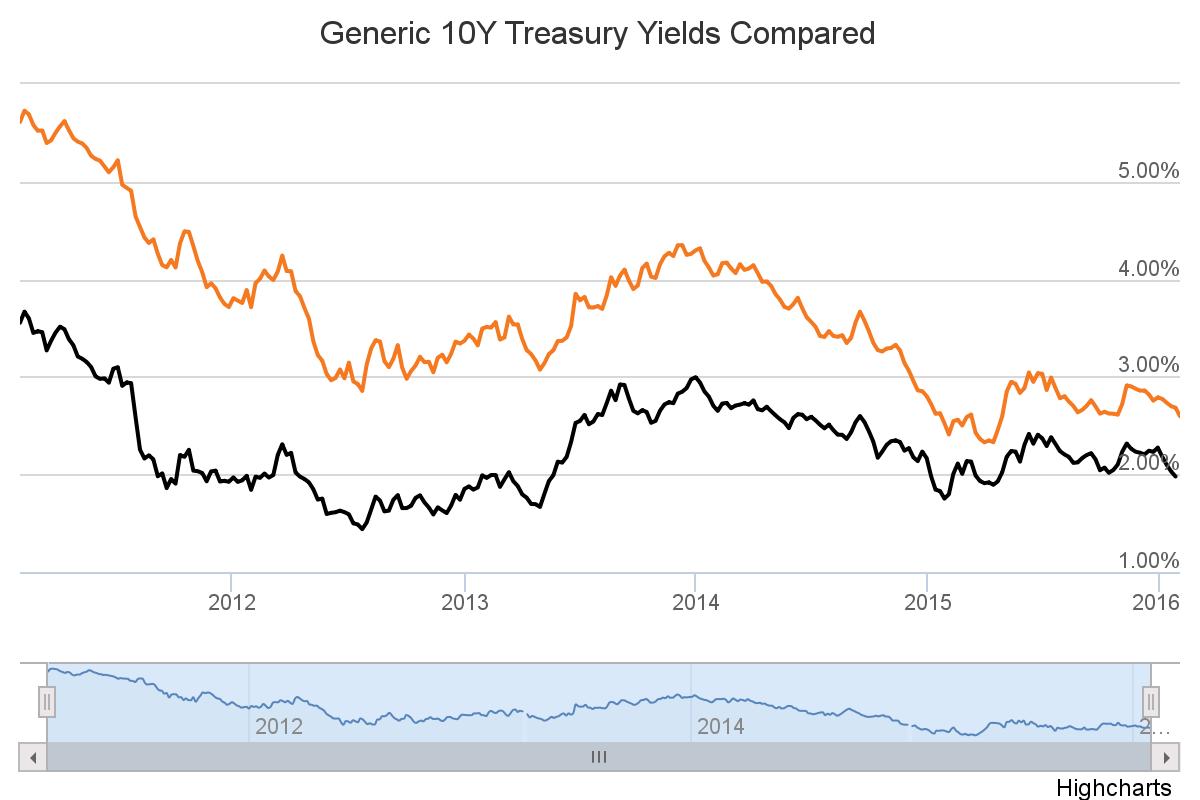

Domestic economic releases were relatively meaningless last week but this week is another story. On Wednesday inflation data for the December 2015 quarter is released and while headline expectations are low (0.3% or 1.6% annualised) they are slightly better than the actual data from the September quarter (0.5% or 1.5% annualised). This is a key driver for interest rate expectations and the shape of the yield curve in 2016. The solid employment trend, low cost of debt and declining oil price suggests that inflation should be increasing. But this is not happening anywhere throughout the developed world. A low reading will put pressure on the RBA to cut rates again whereas a high reading will put off any chance of a cut. In February, the 10-year bond yield hit an all-time low of 2.27% before lifting to highs near 3.15% on June 11. In early November 2015 there was a progressive increase in yield from ~2.60% to a high of 2.99%. However, since mid December the flight to quality has meant the 10Y yield has dropped to 2.75%. The 3-year bond has followed a similar pattern and broke out of its recent yield range (1.90 – 2.1%) in November/December 2015 reaching a high of 2.18% on 7 December 2015 but is now back to 1.95%. On 22 January 2016, the ASX 30 Day Interbank Cash Rate Futures February 2016 contract was trading at 98.045 indicating a 19% expectation of an interest rate decrease to 1.75% at the next RBA Board meeting (unchanged on the week).