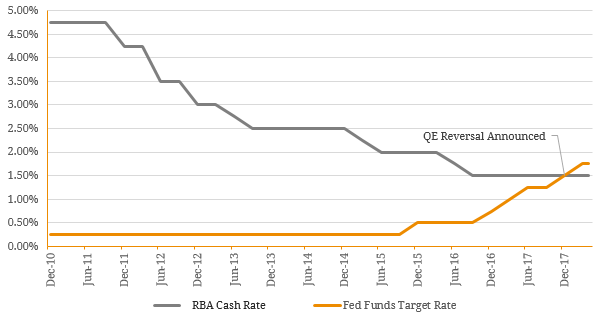

U.S. Federal Reserve chairman Jerome Powell loves an interest rate hike and is planning several of them. The recently-appointed Fed Chair is bullish on global economic health, stating that “the economy has strengthened” and in his view “inflation is moving up to target”. Direct statements like these from the moderate Republican have global markets pricing in 3-5 rate hikes in 2018 by the U.S. central bank, the first of which was announced on March 14, lifting benchmark overnight bank lending rates to 1.75%. Despite this flurry of activity in the United States, the Reserve Bank of Australia (RBA) has remained steadfast in its desire to keep rates on hold at historically-low levels, with an overnight cash rate of 1.50%. Given the significant economic ties between the two nations, and the historically close correlation between U.S. and Australian Treasuries, many may be wondering why the RBA and its U.S. counterpart have such disparate interest rate outlooks heading into 2018. The chart below shows the current base rates of both nations. Figure 1. U.S. Interest Rates are on the Rise  Source: BondAdviser, Bloomberg To analyse the underlying drivers of the central banks’ monetary policies, we must first acknowledge core divergences in U.S. and Australian economic conditions. U.S. government debt is an ever-present shadow hanging over the booming economy, whilst the RBA has to consider the much-spoken about housing market and low inflation environment. The Federal Reserve’s quantitative easing (QE) from the GFC era added almost $2 trillion to the supply of U.S. dollars and doubled the central bank’s balance sheet in the process to ~$4.5 trillion by October 2014. In September 2017, then Fed Chair Janet Yellen announced a reversal of this QE policy, meaning the Fed is currently juggling a balance sheet unwind of ~$80 billion per month coupled with Jerome Powell’s “gradual” rate hikes throughout 2018. Whilst many disagree on the impacts of QE and its unravelling, it is one factor behind the recent widening of U.S. Treasuries since the announcement, as seen below. Figure 2. U.S. and Australian 10-Year Treasury Spreads

Source: BondAdviser, Bloomberg To analyse the underlying drivers of the central banks’ monetary policies, we must first acknowledge core divergences in U.S. and Australian economic conditions. U.S. government debt is an ever-present shadow hanging over the booming economy, whilst the RBA has to consider the much-spoken about housing market and low inflation environment. The Federal Reserve’s quantitative easing (QE) from the GFC era added almost $2 trillion to the supply of U.S. dollars and doubled the central bank’s balance sheet in the process to ~$4.5 trillion by October 2014. In September 2017, then Fed Chair Janet Yellen announced a reversal of this QE policy, meaning the Fed is currently juggling a balance sheet unwind of ~$80 billion per month coupled with Jerome Powell’s “gradual” rate hikes throughout 2018. Whilst many disagree on the impacts of QE and its unravelling, it is one factor behind the recent widening of U.S. Treasuries since the announcement, as seen below. Figure 2. U.S. and Australian 10-Year Treasury Spreads  Source: BondAdviser, Bloomberg In contrast, the major banks in Australia view a 2018 rate hike as extremely unlikely, with many forecasting May 2019 at the earliest, or perhaps even 2020. This is despite the RBA having left rates unchanged at 1.5% since August 2016, with no interest rate increase since November 2010 (the longest in the RBA’s history). This decision to maintain low rates is driven by many factors, including a rampant housing market, lack of inflation and falling unemployment. Economic theory implies an inverse relationship between unemployment and inflation, based on the Phillips Curve, but thus far, this has not been the case in Australia. Figure 3 visualises the predicament that the RBA is facing, with record household debt levels, low inflation and falling unemployment creating an economic tightrope for the central bank to walk. A rise in rates would increase debt repayments, reducing household consumption and probably GDP. On the other hand, the inverse relationship between inflation and interest rates could create a deflationary scenario, which would also weigh down on GDP and employment growth. Figure 3. Record Debt, Low Inflation and Falling Unemployment. What Happens Next?

Source: BondAdviser, Bloomberg In contrast, the major banks in Australia view a 2018 rate hike as extremely unlikely, with many forecasting May 2019 at the earliest, or perhaps even 2020. This is despite the RBA having left rates unchanged at 1.5% since August 2016, with no interest rate increase since November 2010 (the longest in the RBA’s history). This decision to maintain low rates is driven by many factors, including a rampant housing market, lack of inflation and falling unemployment. Economic theory implies an inverse relationship between unemployment and inflation, based on the Phillips Curve, but thus far, this has not been the case in Australia. Figure 3 visualises the predicament that the RBA is facing, with record household debt levels, low inflation and falling unemployment creating an economic tightrope for the central bank to walk. A rise in rates would increase debt repayments, reducing household consumption and probably GDP. On the other hand, the inverse relationship between inflation and interest rates could create a deflationary scenario, which would also weigh down on GDP and employment growth. Figure 3. Record Debt, Low Inflation and Falling Unemployment. What Happens Next?  Source: BondAdviser, RBA, Bloomberg This data underscores the need for a cautious interest rate policy by the RBA, with predictions that the market will be forewarned of interest rate hikes to allow for gradual absorption by the markets. The impact of a 1% increase in the cash rate may seem small in isolation, though the cumulative effect on household consumption and borrowing costs across the economy could magnify economic deficiencies, particularly given the volatility in the markets of late, and likely cause the Australian-U.S. Treasury spreads to widen further. Whilst there are many factors driving the economic decision-making of both the Fed and the RBA, it is important to be aware of ongoing trends that could impact on the health of the Australian economy and fixed income markets. Despite a widening of interest rate and Treasury spreads, investors appear to be treading cautiously and waiting for more concrete signals from the RBA before pulling the trigger and prompting a sell-off, with Governor Phillip Lowe stating, “the most likely scenario in which interest rates are increasing is one in which the economy is strengthening, and income growth is also picking up”. Given the weak labour force and CPI data results over recent months, it appears the RBA will be sitting on the sidelines for quite some time as Jerome Powell and the Fed hike up interest rates and unwind their balance sheet in coming months. This fence-sitting by the RBA is especially likely if, as we predict, the banks themselves will raise mortgage borrowing costs independently and because of rising wholesale funding costs.

Source: BondAdviser, RBA, Bloomberg This data underscores the need for a cautious interest rate policy by the RBA, with predictions that the market will be forewarned of interest rate hikes to allow for gradual absorption by the markets. The impact of a 1% increase in the cash rate may seem small in isolation, though the cumulative effect on household consumption and borrowing costs across the economy could magnify economic deficiencies, particularly given the volatility in the markets of late, and likely cause the Australian-U.S. Treasury spreads to widen further. Whilst there are many factors driving the economic decision-making of both the Fed and the RBA, it is important to be aware of ongoing trends that could impact on the health of the Australian economy and fixed income markets. Despite a widening of interest rate and Treasury spreads, investors appear to be treading cautiously and waiting for more concrete signals from the RBA before pulling the trigger and prompting a sell-off, with Governor Phillip Lowe stating, “the most likely scenario in which interest rates are increasing is one in which the economy is strengthening, and income growth is also picking up”. Given the weak labour force and CPI data results over recent months, it appears the RBA will be sitting on the sidelines for quite some time as Jerome Powell and the Fed hike up interest rates and unwind their balance sheet in coming months. This fence-sitting by the RBA is especially likely if, as we predict, the banks themselves will raise mortgage borrowing costs independently and because of rising wholesale funding costs.