Activity proved considerably more muted in November, with the RBA electing to leave the cash rate unchanged at 75 basis points. Rate momentum slowed after a difficult month for depositors, with less pressure on banks to preserve margins. While the RBA Board has signaled a willingness to lower rates further in 2020, the rate environment for the moment remains largely static.

In the short-term (ST) market, BEN (-0.05%) repeated its action last month, whilst CBA (-0.10%) reduced its offerings out of the majors. BEN (-0.10%) cut its medium-term offerings while BOQ (+0.10%) raised, leaving the regionals unchanged in aggregate. There was no activity for the majors, seemingly having made necessary adjustments last month with rate movements. BEN (-0.05%) completed its downward movements at all points along the yield curve, reducing term deposit rates for the long-term (LT) market. CBA (-0.05%) also reduced its offering, moving alone among the majors.

Regionals continue to offer relatively attractive returns in a depressed rate environment, with a 14-basis point premium driven by the heavy actions of the majors, slashing rates in recent months. BOQ’s medium-term deposit offers the best value at 1.65% over 6 months, while ANZ leads the majors at 1.45 over 3 months.

Note: Short Term (~3M), Medium Term (~6M), Long Term (~12M)

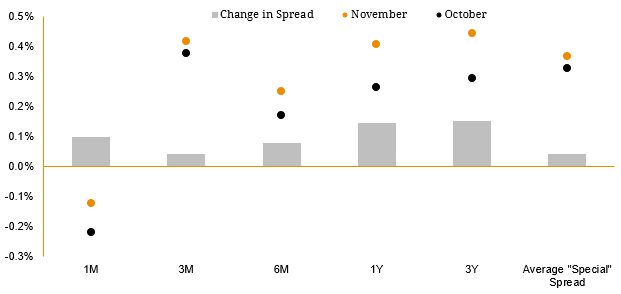

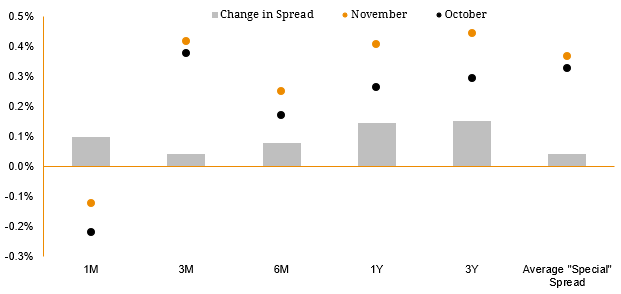

Figure 1. Term Deposit Spread Over Relevant BBSW: November 2019 vs October 2019

Source: RBA, BondAdviser For full details, charts and commentary, please click here for the full pdf version.