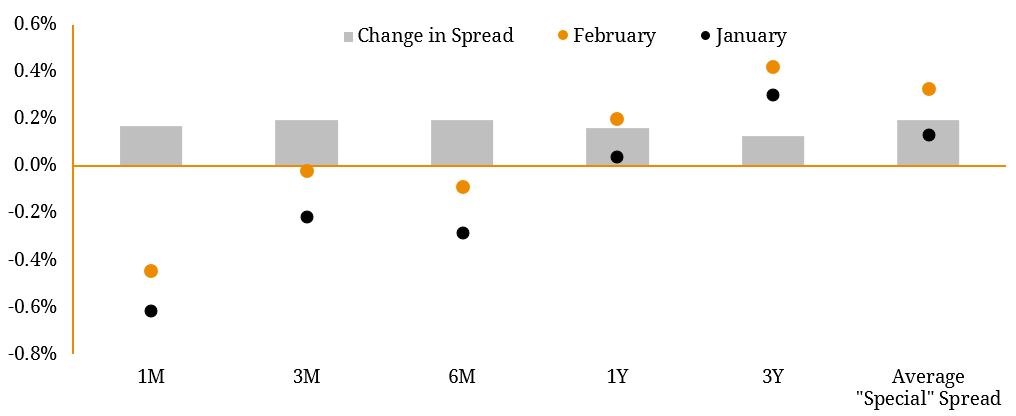

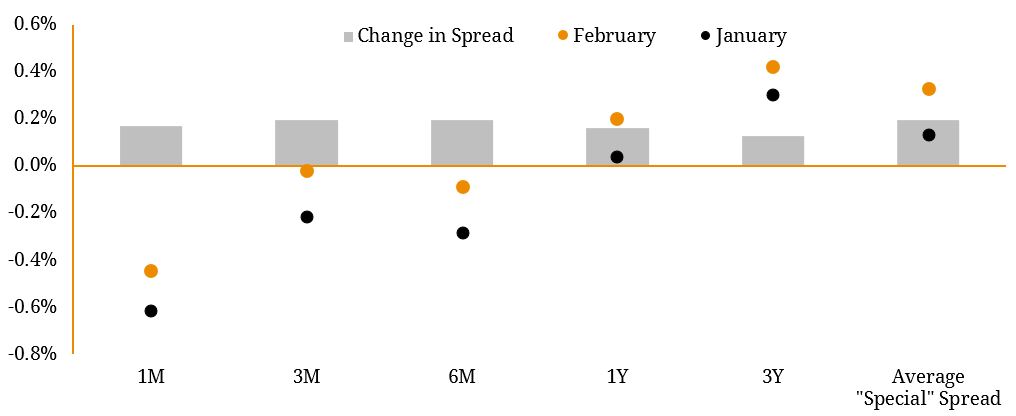

Markets extended their January gains through February in a month largely dominated by reporting season news. From a rates perspective, caution was preached by both the Fed and RBA – firming their neutral stances on monetary policy. On the domestic front, the RBA further distanced itself from previous guidance, which was posturing that the next move was up rather than down. Governor Lowe has now revised his position to a more neutral stance. This follows a series of negative economic metrics including a modest GDP, (downgrade of ¼ of a percentage point), the fall in house prices, especially in Melbourne and Sydney, and softer household spending. Markets now foresee a rate cut over the next year in what would be an unwelcome announcement for TD investors. Globally, Trump’s extension of the trade-talk deadline and his softening rhetoric toward China has buoyed hopes among markets that an end to the trade war may be approaching. Figure 1. Term Deposit Spread Over Relevant BBSW: February 2019 vs January 2019