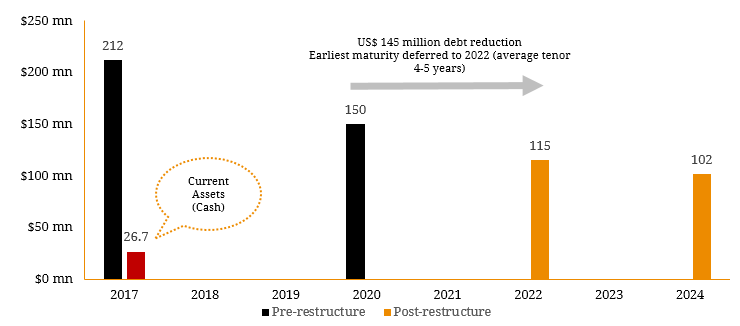

Amidst decade-low uranium prices and over-supply of yellowcake (impure uranium oxide obtained during processing of uranium ore) Paladin Energy (ASX: PDN) announced an ambitious capital restructure plan earlier this year. The capital restructure proposed the exchange of its existing 2017 convertible bonds (US$212 million) and 2020 convertible bonds (US$150 million) into US$115 million of new secured bonds due 2022, US$102 million of new 2024 convertible bonds and US$145 million of Paladin shares. The company received approval from 86.6% of holders of 2017 Convertible Bonds and 75.1% of holders of 2020 Convertible Bonds (above the required 75% of each bondholder group). Figure 1: Impact of Restructure on PDN’s Debt Profile  Source: Company Reports, BondAdviser Since then however, Paladin has faced considerable barriers to this capital restructure. The company’s battle with its joint-venture partner China National Nuclear Corp Overseas Uranium Holding (CNNC) over its Langer Heinrich mine took a sour turn, with PDN accusing CNNC of derailing the restructure plan. CNNC already owns a 25% stake in Langer Heinrich. In July 2016 Paladin and CNNC that would increased CNNC’s to 49% for (additional 24% for $US 175 million) but the deal was never consummated. Now CNNC has argued that the Restructure triggered an “Event of Default” clause which grants it the option to buy out Paladin’s remaining 75% at (its substantially lower) fair market value. Figure 2: PDN’s Historical Trading Performance

Source: Company Reports, BondAdviser Since then however, Paladin has faced considerable barriers to this capital restructure. The company’s battle with its joint-venture partner China National Nuclear Corp Overseas Uranium Holding (CNNC) over its Langer Heinrich mine took a sour turn, with PDN accusing CNNC of derailing the restructure plan. CNNC already owns a 25% stake in Langer Heinrich. In July 2016 Paladin and CNNC that would increased CNNC’s to 49% for (additional 24% for $US 175 million) but the deal was never consummated. Now CNNC has argued that the Restructure triggered an “Event of Default” clause which grants it the option to buy out Paladin’s remaining 75% at (its substantially lower) fair market value. Figure 2: PDN’s Historical Trading Performance  Source: Bloomberg, BondAdviser Further, PDN’s 30% stake sale in Manyingee Uranium mine for US$10 million fell victim to WA State Government’s change in policy as prospective buyer Avira energy was unable to complete its capital raising within the 31st March deadline. Meanwhile, Paladin is fighting back and renegotiating ‘standstill’ agreements with current bondholders which would prevent the company from creditor takeover. A standstill agreement between a creditor (bondholders) and borrower (Paladin) is an agreement in which the lender stops demanding the repayment of the loan. A new deal is negotiated, usually altering the loan’s original repayment schedule. This is used as an alternative to bankruptcy of foreclosure if the borrower can’t repay the loan. The effect of the standstill arrangements for Paladin is that forthcoming payments due upon maturity of the 2017 Convertible Bonds (due April 2017) and interest payments due under the 2017 and 2020 Convertible Bonds (due March and April 2017) will be deferred with the consent of a binding majority of holders of the two series of bonds. The company was also granted a waiver by creditor Nedbank Ltd in relation to Paladin failing to satisfy the minimum asset value threshold required by its Revolving Credit Facility with Nedbank. The waiver, which was originally due to lapse on 31 March 2017, has been extended to 30 June 2017. Paladin’s shares were suspended since the CNNC option and will remain in suspension until it has resolved how to progress the Restructure proposal or an alternative. Thus, while Paladin previously illustrated an example of an impressive restructuring plan, it now demonstrates how crucial it is to have all stakeholders on board for successful execution. It will remain to be seen if the company navigates current obstacles and successfully stages an unlikely turnaround.

Source: Bloomberg, BondAdviser Further, PDN’s 30% stake sale in Manyingee Uranium mine for US$10 million fell victim to WA State Government’s change in policy as prospective buyer Avira energy was unable to complete its capital raising within the 31st March deadline. Meanwhile, Paladin is fighting back and renegotiating ‘standstill’ agreements with current bondholders which would prevent the company from creditor takeover. A standstill agreement between a creditor (bondholders) and borrower (Paladin) is an agreement in which the lender stops demanding the repayment of the loan. A new deal is negotiated, usually altering the loan’s original repayment schedule. This is used as an alternative to bankruptcy of foreclosure if the borrower can’t repay the loan. The effect of the standstill arrangements for Paladin is that forthcoming payments due upon maturity of the 2017 Convertible Bonds (due April 2017) and interest payments due under the 2017 and 2020 Convertible Bonds (due March and April 2017) will be deferred with the consent of a binding majority of holders of the two series of bonds. The company was also granted a waiver by creditor Nedbank Ltd in relation to Paladin failing to satisfy the minimum asset value threshold required by its Revolving Credit Facility with Nedbank. The waiver, which was originally due to lapse on 31 March 2017, has been extended to 30 June 2017. Paladin’s shares were suspended since the CNNC option and will remain in suspension until it has resolved how to progress the Restructure proposal or an alternative. Thus, while Paladin previously illustrated an example of an impressive restructuring plan, it now demonstrates how crucial it is to have all stakeholders on board for successful execution. It will remain to be seen if the company navigates current obstacles and successfully stages an unlikely turnaround.