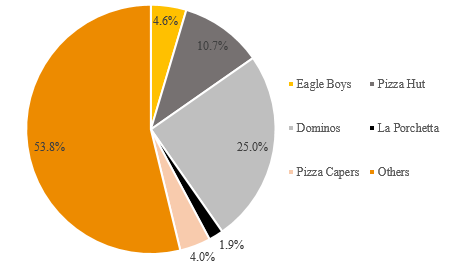

In recent weeks, the downfall of Eagles Boy Pizza has been a hot topic in the world of food retailing. On the 14th of July 2016, the third-largest pizza chain (behind Domino’s and Pizza Hut) was placed into voluntary administration among growing debt concerns and a highly competitive landscape. While all Eagle Boys store continue to trade, the national franchise has been put on the market. The past few years has been difficult for the group, which has continuously lost market share forcing almost half of its stores to close down in 2014-15 (340 stores at its peak). According to IBISWorld, it is estimated that the chain has lost almost half its market share in 4 years. This follows after an aggressive price war between competitors Domino’s and Pizza Hut which eroded cashflow. As a result, Eagle Boys found itself unable to pay its debts and eventually triggered voluntary administration as the only option. Figure 1. Pizza Take-Away Industry Market Share  Source: IBISWorld So why did Eagle Boys lose so much ground against Domino’s and Pizza Hut? The answer lies in its inability to adapt, in particular to consumer preferences. Across many food retailing industries, Australians have begun to favour premium and healthy produce and has forced many fast food outlets to adjust their strategies or suffer the consequences. In regards to the pizza industry, this trend has played into the hands of smaller pizza store operators perfectly due to the relative ease of incorporating premium produce into their products. For larger operators with more extensive supply chains and higher cost bases, this is a more difficult task. While these dynamics have had serious ramifications for Pizza Hut and Eagle Boys, Domino’s has been able to oppose this trend by focusing on technology-driven convenience and making use of its extensive store network. Another trend that has been detrimental to large pizza chains has been the rise of online ordering platforms such as Menulog and Deliveroo. This has given smaller competitors access the wider market that once only larger operators had access to. Due to the changing competitive landscape, Eagle boys had difficulties to refinance with its banker, National Australia Bank (NAB). As a result of poor operations, NAB forced the chain into reliance of short-term debt on a monthly basis (whereby the norm is a three-year facility). This significantly restricted financial flexibility over the final years of trading. The situation worsened and as a result, the group’s net liability (i.e. liabilities minus assets) position grew against falling revenues. At the time of voluntary administration, Eagle Boys owed debts $30 million with $26.1 million owed to unsecured creditors. Figure 2. Eagle Boys Pizza Revenue and Net Liability Position

Source: IBISWorld So why did Eagle Boys lose so much ground against Domino’s and Pizza Hut? The answer lies in its inability to adapt, in particular to consumer preferences. Across many food retailing industries, Australians have begun to favour premium and healthy produce and has forced many fast food outlets to adjust their strategies or suffer the consequences. In regards to the pizza industry, this trend has played into the hands of smaller pizza store operators perfectly due to the relative ease of incorporating premium produce into their products. For larger operators with more extensive supply chains and higher cost bases, this is a more difficult task. While these dynamics have had serious ramifications for Pizza Hut and Eagle Boys, Domino’s has been able to oppose this trend by focusing on technology-driven convenience and making use of its extensive store network. Another trend that has been detrimental to large pizza chains has been the rise of online ordering platforms such as Menulog and Deliveroo. This has given smaller competitors access the wider market that once only larger operators had access to. Due to the changing competitive landscape, Eagle boys had difficulties to refinance with its banker, National Australia Bank (NAB). As a result of poor operations, NAB forced the chain into reliance of short-term debt on a monthly basis (whereby the norm is a three-year facility). This significantly restricted financial flexibility over the final years of trading. The situation worsened and as a result, the group’s net liability (i.e. liabilities minus assets) position grew against falling revenues. At the time of voluntary administration, Eagle Boys owed debts $30 million with $26.1 million owed to unsecured creditors. Figure 2. Eagle Boys Pizza Revenue and Net Liability Position  Source: Company Reports Note: No accounts produced for 2015 Conclusion The Eagle Boys story highlights the importance of understanding industry dynamics and assessing the proactivity of management. While debt is usually the likely cause of a company’s demise, it is what drove the debt issues that is of greater emphasis. In the case of Eagle Boys, growing competition, advancing technology and changes of consumer preferences can all be attributed to the chain’s financial distress. However, unlike Domino’s, management’s inactivity was the real driver behind Eagle Boy’s downfall. As a result, it is imperative to determine whether a company’s strategy is aligned with the likely future of industry it is operating in. If not, it is reasonable to expect they will end up in the same boat as Eagle Boy’s Pizza.

Source: Company Reports Note: No accounts produced for 2015 Conclusion The Eagle Boys story highlights the importance of understanding industry dynamics and assessing the proactivity of management. While debt is usually the likely cause of a company’s demise, it is what drove the debt issues that is of greater emphasis. In the case of Eagle Boys, growing competition, advancing technology and changes of consumer preferences can all be attributed to the chain’s financial distress. However, unlike Domino’s, management’s inactivity was the real driver behind Eagle Boy’s downfall. As a result, it is imperative to determine whether a company’s strategy is aligned with the likely future of industry it is operating in. If not, it is reasonable to expect they will end up in the same boat as Eagle Boy’s Pizza.