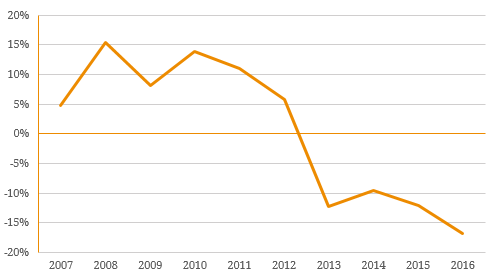

Ten Network Holdings Limited (ASX: TEN) shares were suspended for trading on the ASX on 9th June 2017. Its shares closed at $0.16 on the day, down more than 84% from a year ago, after it fell into administration with key billionaire investors, James Packer, Lachlan Murdoch and Bruce Gordon failing to offer their support for a new debt facility that would kick in when the existing one expires. TEN has a $200 million debt facility from its biggest lender, the Commonwealth Bank — effectively a line of credit —that is due to expire on December 23. TEN had drawn down $45.5 million from the $200 million facility at the end of its first half. Although it is not known exactly how much of the debt facility was left to draw down, it is believed the group was ploughing through $10 million a month when it fell into administration. The broadcaster’s woes are nothing new, it has made large losses every year since 2013 and with cash flow deterioration to match. Its TV shows have consistently been trounced in the ratings by rival free-to-air stations Seven, Nine and the ABC. While receivership would not effect TEN’s ability to keep broadcasting, it may complicate the administration process. Given that TEN is loss making, there seems no obvious means of repaying the loan before it comes due. The interest on the loan, along with establishment fee, commitment fee, plus fees to the shareholders for backing the loans will also come due. Figure 1. Channel TEN Operating Cash Flow to Total Liabilities