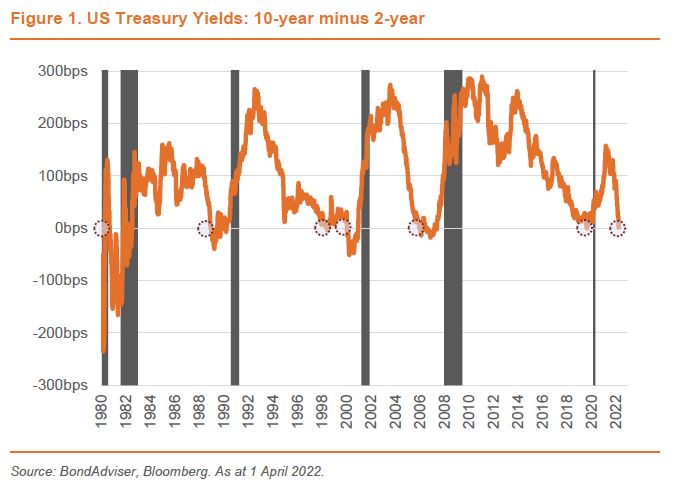

Many in markets are aware the US Treasury yield curve is inverting. This means yields at the short-end are higher than the long-end. Historically this has been bad for banks (they borrow short and lend long) and economic sentiment more generally. Further discussion is tacked onto the inversion, with regard to correlation and causation. In other words, just because there is a historic relationship, that does not mean will be one in the future – unless such relationship is that of cause and effect.

For instance, and in keeping with the titled theme, the new Top Gun trailer was released on 30 March 2022. The ten-year and two-year curve inverted the next day. The original Top Gun, released in 1986, appropriately contained the topical line “because I was inverted”. Did the release of the new trailer for the upcoming Paramount film cause the yield curve to invert? Well, no it did not, but now there is a historic relationship between Top Gun trailer releases and yield curve inversions. In statistical terms, this relationship is spurious – which is another word for rubbish. Is yield curve inversion also spurious?

Historically, every US recession since the 1950s has been preceded by an inversion of the ten- and two-yield curve. However, not all inversions have preceded a recession. Illustrating the somewhat puzzling relationship was the inversion seen in August 2019. Did bond market investors really predict COVID-19? Again, no it didn’t. What we can take-away is that inversion signals that bond market expects future growth to worsen. This is a function of inflation, which is currently rampant and needs controlling. Such control may be exerted by raising interest rates – which, as an input cost to households and businesses, in turn reduces economic growth.

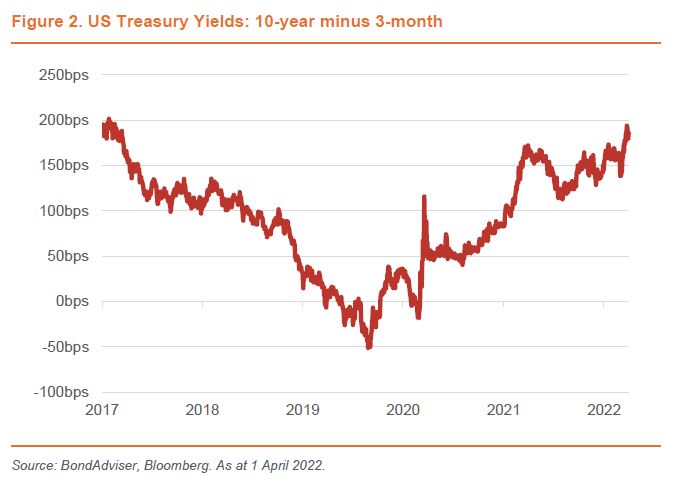

More positively, the Federal Reserve’s favourite yield curve, being the ten-year minus the three-month, is steep and getting steeper. Whilst recession red-flags are emerging, it is not yet all hands-on deck – and the growth outlook is somewhat safe for the near term. The flatness of curves both in the US and domestically, could also be a consequence of relentless buying of bonds on central bank balance sheets – rather than that of an impending growth shock.

As the hiking cycle begins to accelerate, this spread between ten-year and three-month yields will narrow, as short-term yields move in parallel with policy rates. Hence, at the June Federal Reserve meeting, this spread could have likely narrowed to 88 basis points. Roll-off to the Fed’s balance sheet would only accelerate such narrowing (as SOMA is unwound, Treasury will likely issue through short-term bills – increasing supply).

Market expectations, based on the most likely path of rates (as compared to a probabilistic average – the more commonly quoted figure), have futures plotting a path to a US policy rate of 3.00% in March 2023. Domestically, our ten-year yield currently sits at 2.84% (3/4/22). We see upward pressure remaining on longer term rates and remain underweight duration. There will be a time to scale-in and add duration-based ballast, but with path of rates still quite uncertain and the inflation outlook bleak, now is not the time to buzz the tower.