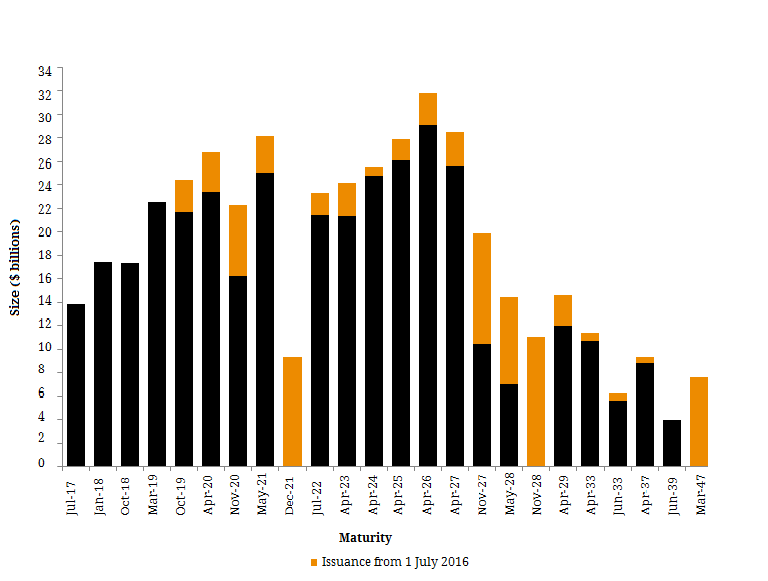

On the 23rd of February 2017, the Australian Office of Financial Management (AOFM) (which manages the country’s debt sales), sealed a record $11 billion government bond deal. This was just one month after it set the previous record issuance of $9.3 billion (January 2016). The AOFM confirmed the bond will have a coupon of 2.75% and was priced at a yield of 3.005% to November 2028 (~11.5 years). The issue was well received attracting bids totaling $20.9 billion, substantially higher than the $9.3 billion January issuance which had total bids of ~$15.3 billion (Figure 2). The level of over-subscription shows continued confidence in Australia’s outlook and the ongoing attractiveness of Treasury yields have compared to overseas sovereign debt issues. This also belies the fear surrounding a possible downgrade of our AAA status by the major credit rating agencies. Figure 1. Treasury Bonds on Issue  Source: AOFM, BondAdviser as at 24th February 2017 Figure 2. Offers on recent issuance by the AOFM

Source: AOFM, BondAdviser as at 24th February 2017 Figure 2. Offers on recent issuance by the AOFM  Source: AOFM, BondAdviser In July last year, Standard and Poor’s (S&P) put Australia’s AAA sovereign rating on ‘Negative’ outlook, revealing the possibility of a one-in-three chance of a potential downgrade within two years, if the federal government did not meet its fiscal budget targets. However, issuance levels suggest investors aren’t overly sensitive to the potential rating downgrade and rather, investment is being driven the attractiveness of yields on a global scale. Overall, the recent $11 billion deal attracted interest from a large number of domestic investors (85%), while off-shore allocation was 15% (30% for the previous 2 issues) which is the lowest level for an Australian treasury issuance. The AOFM head of investor relations Ian Clunies-Ross attributed this to the security’s term stating “offshore investors participate more keenly when we extend our yield curve like a 15-, 20- or 30-year bond”. The AOFM confirmed that gross treasury bond issuance in the year to June 2017 is expected to be around $100 billion, in line with the targets issued last year. Currently, the face value of federal government securities is $467.9 billion and is expected to increase to $496 billion by June 2017 and $604 million by 2020. While it is pleasing to see the strong liquidity and a large investor appetite Australian government bonds in the current market conditions, we will continue to monitor how the government manages its growing debt pile in the coming years.

Source: AOFM, BondAdviser In July last year, Standard and Poor’s (S&P) put Australia’s AAA sovereign rating on ‘Negative’ outlook, revealing the possibility of a one-in-three chance of a potential downgrade within two years, if the federal government did not meet its fiscal budget targets. However, issuance levels suggest investors aren’t overly sensitive to the potential rating downgrade and rather, investment is being driven the attractiveness of yields on a global scale. Overall, the recent $11 billion deal attracted interest from a large number of domestic investors (85%), while off-shore allocation was 15% (30% for the previous 2 issues) which is the lowest level for an Australian treasury issuance. The AOFM head of investor relations Ian Clunies-Ross attributed this to the security’s term stating “offshore investors participate more keenly when we extend our yield curve like a 15-, 20- or 30-year bond”. The AOFM confirmed that gross treasury bond issuance in the year to June 2017 is expected to be around $100 billion, in line with the targets issued last year. Currently, the face value of federal government securities is $467.9 billion and is expected to increase to $496 billion by June 2017 and $604 million by 2020. While it is pleasing to see the strong liquidity and a large investor appetite Australian government bonds in the current market conditions, we will continue to monitor how the government manages its growing debt pile in the coming years.