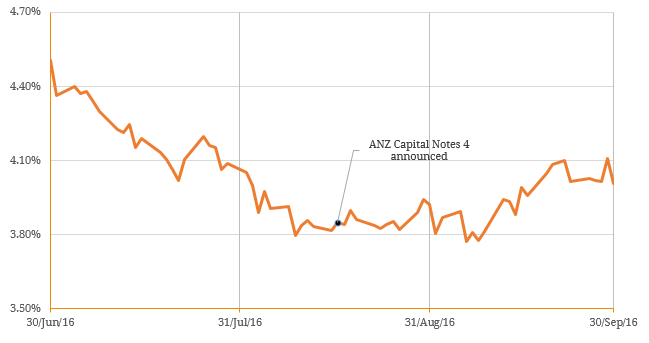

During the September quarter, the listed interest rate security market performed strongly with credit spreads across most securities tightening as investors continued to seek higher yielding investments against the backdrop of a low interest rate environment. Securities received a boost in August as the Reserve Bank of Australia (RBA) reduced the official cash rate from an already low rate of 1.75% to 1.50%. The RBA noted that “the likelihood of lower interest rates exacerbating risks in the housing market has diminished” because “supervisory measures have strengthened lending standards in the housing market”. As a result, markets have decreased the probability of further cash rate cuts over the remainder of 2016. ASX listed tier 1 bank hybrids (representing the bulk of the market) performed well at the start of the quarter before pulling back to trade within 0.30% range (Figure 1). This was driven primarily by supply-side factors as ANZ issued ANZ Capital Notes 4 (ASX Code: ANZPG) which replaced the ANZ Convertible Preference Shares 2 (ASX Code: ANZPA). Unlike the previous 3 major bank hybrid issues which allocated stock to substantial cornerstone institutional investors, this issue appears to have been largely spread amongst retail investors. Overall, the majority of ASX listed debt securities issued by financial institutions performed strongly with the exception of BOQPD. Figure 1. Average Trading Margin of Major Bank Tier 1 Hybrids over September Quarter  Source: BondAdviser Figure 2. Financial ASX-Listed Debt Security Returns over September Quarter

Source: BondAdviser Figure 2. Financial ASX-Listed Debt Security Returns over September Quarter  Source: BondAdviser Non-financial corporate ASX listed debt securities also performed strongly over the quarter with the standout performer being the Seven Group TELYS4 (ASX Code: SVWPA), returning a massive 26.2% (Figure 3). This was driven by Seven Group Holdings (ASX Code: SVW) announcing the on-market purchase of up 10% of TELYS4 (ASX Code: SVWPA) on the 3rd of August 2016. Crown’s CWNHA and CWNHB hybrids have also performed well as the group’s credit profile has improved significantly since the start of the year. On the other hand, Nufarm’s perpetual NSS (ASX: NFNG) has slowly risen in price since April 2016. We note that all these securities were consistent with our Buy recommendations made in earlier in the year. Figure 3. Non-Financial Corporate ASX-Listed Debt Security Returns over September Quarter

Source: BondAdviser Non-financial corporate ASX listed debt securities also performed strongly over the quarter with the standout performer being the Seven Group TELYS4 (ASX Code: SVWPA), returning a massive 26.2% (Figure 3). This was driven by Seven Group Holdings (ASX Code: SVW) announcing the on-market purchase of up 10% of TELYS4 (ASX Code: SVWPA) on the 3rd of August 2016. Crown’s CWNHA and CWNHB hybrids have also performed well as the group’s credit profile has improved significantly since the start of the year. On the other hand, Nufarm’s perpetual NSS (ASX: NFNG) has slowly risen in price since April 2016. We note that all these securities were consistent with our Buy recommendations made in earlier in the year. Figure 3. Non-Financial Corporate ASX-Listed Debt Security Returns over September Quarter  Source: BondAdviser Outlook Liquidity conditions in the listed market have continued to improve in 2016 as evidenced by strong investor demand for major bank tier 1 hybrids. Australian corporate issuance into the ASX-listed debt & hybrid market remains low with the only new issue in the 2nd half being the Qube Subordinated Notes (ASX: QUBHA) announced on the 30th of August 2016. With Woolworths and Origin Energy both confirming that their subordinated notes (ASX: WOWHC, ORGHA) will be redeemed in November and December, respectively, non-financial listed corporate securities are becoming more scarce. Overall we continue to favour credit risk exposure to investment grade issuers which offer acceptable risk-return ratio as markets have exhibited increased volatility. We expect market volatility to remain over the coming quarter for a variety of reasons including the final month of US presidential election campaign and ongoing anticipation of the US Federal (Fed) Reserve rate hike. The principal effect of the Fed maintaining a slow pace in normalising interest rates together with further easing of monetary policies from other countries (such as Australia) around the globe (diverging monetary policy) will be that credit spreads are likely to remain relatively volatile. As a result, we maintain a defensive investment position and wait for opportunities when they become available which makes sense due to the natural asymmetric risk profile of ASX listed debt securities.

Source: BondAdviser Outlook Liquidity conditions in the listed market have continued to improve in 2016 as evidenced by strong investor demand for major bank tier 1 hybrids. Australian corporate issuance into the ASX-listed debt & hybrid market remains low with the only new issue in the 2nd half being the Qube Subordinated Notes (ASX: QUBHA) announced on the 30th of August 2016. With Woolworths and Origin Energy both confirming that their subordinated notes (ASX: WOWHC, ORGHA) will be redeemed in November and December, respectively, non-financial listed corporate securities are becoming more scarce. Overall we continue to favour credit risk exposure to investment grade issuers which offer acceptable risk-return ratio as markets have exhibited increased volatility. We expect market volatility to remain over the coming quarter for a variety of reasons including the final month of US presidential election campaign and ongoing anticipation of the US Federal (Fed) Reserve rate hike. The principal effect of the Fed maintaining a slow pace in normalising interest rates together with further easing of monetary policies from other countries (such as Australia) around the globe (diverging monetary policy) will be that credit spreads are likely to remain relatively volatile. As a result, we maintain a defensive investment position and wait for opportunities when they become available which makes sense due to the natural asymmetric risk profile of ASX listed debt securities.