Click here for a print friendly version.

Walk the Talk

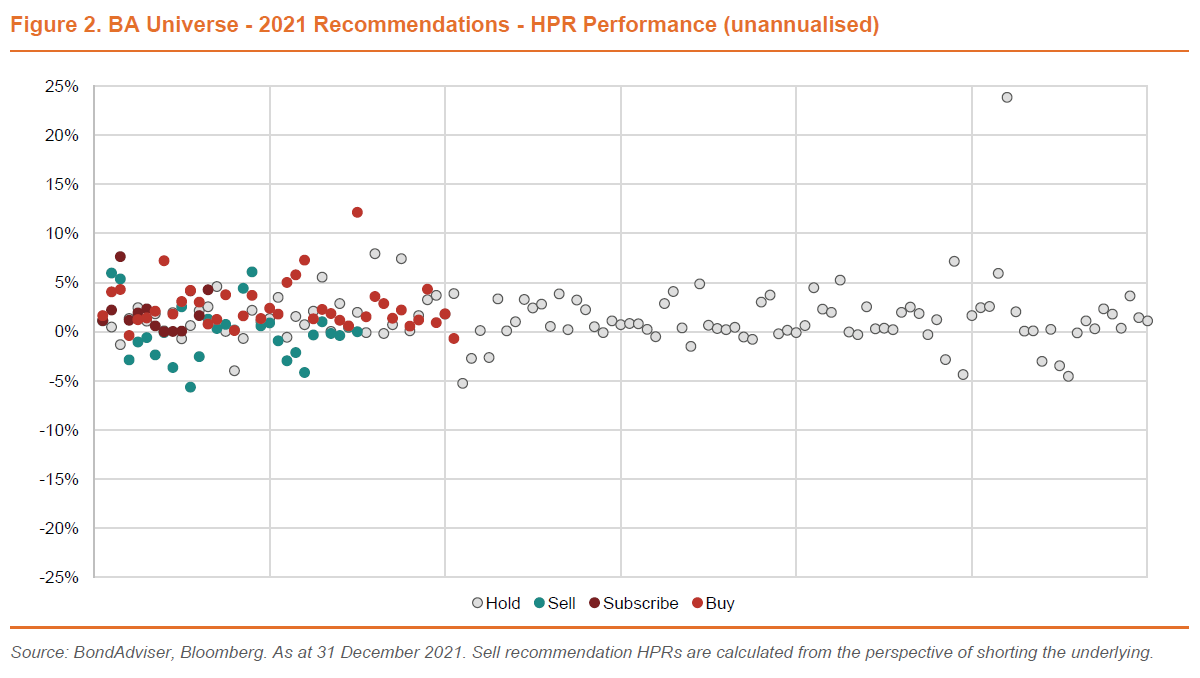

BondAdviser’s desk, occasionally in WFH format, was active across a tumultuous 2021, providing over 360 recommendations, across 145 unique securities and 55 different issuers.

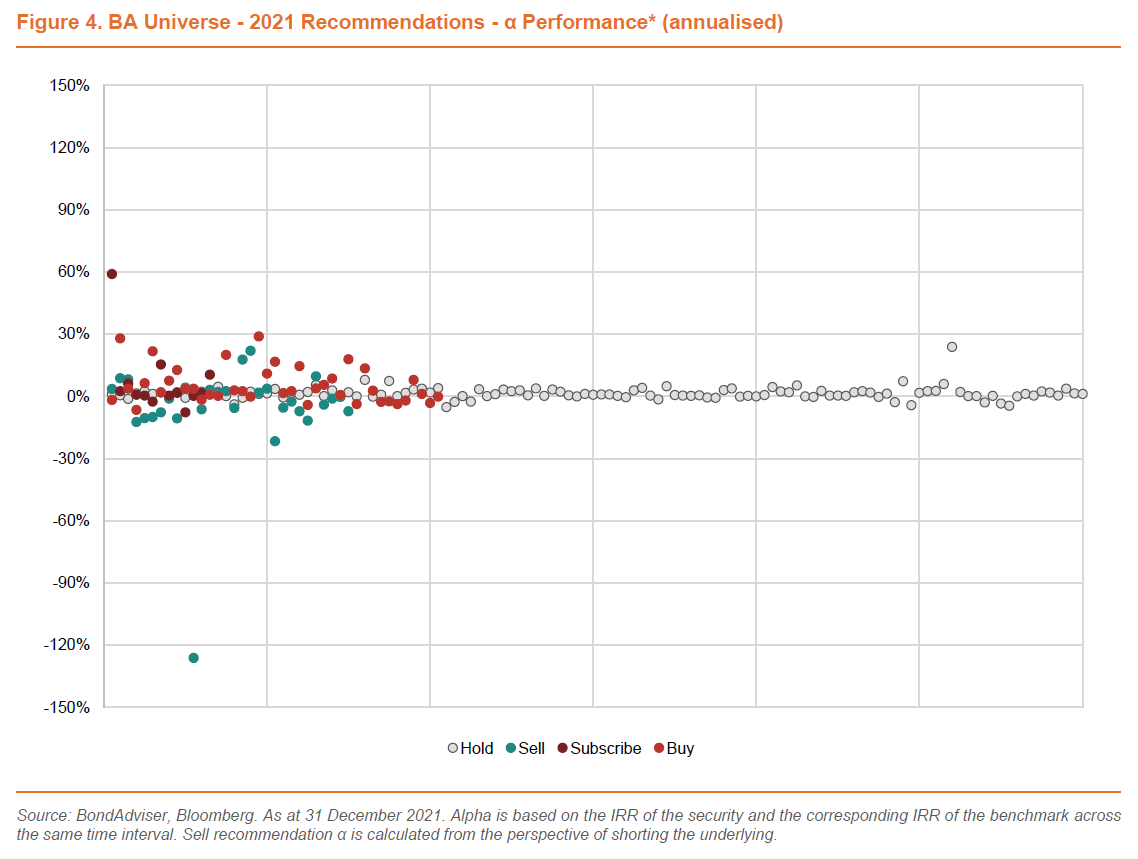

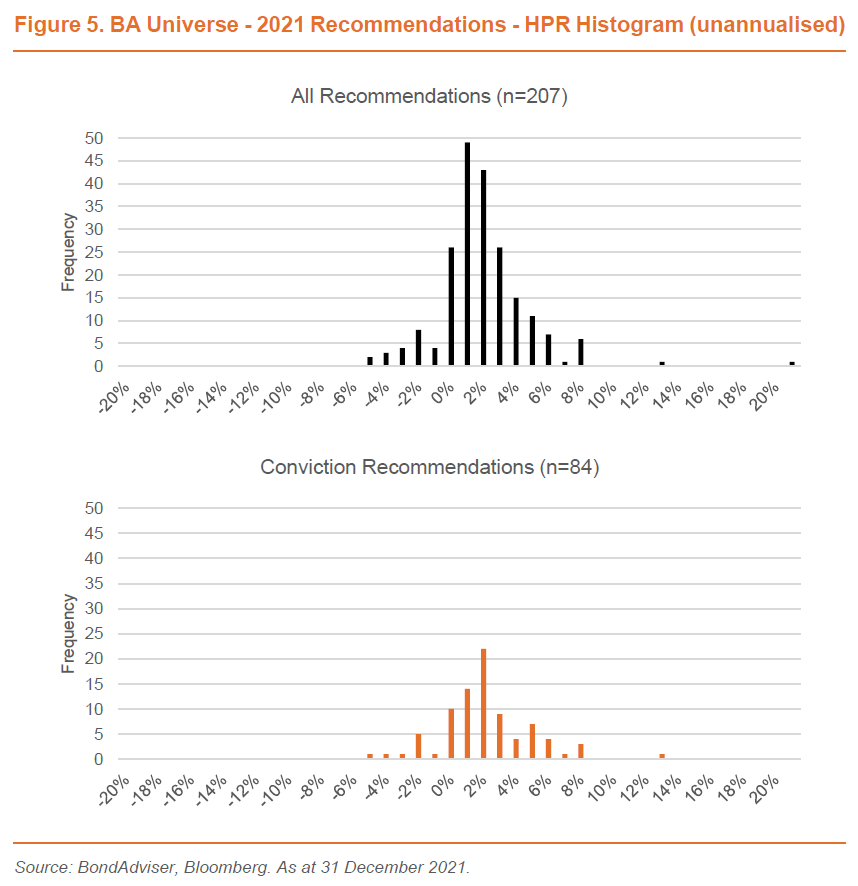

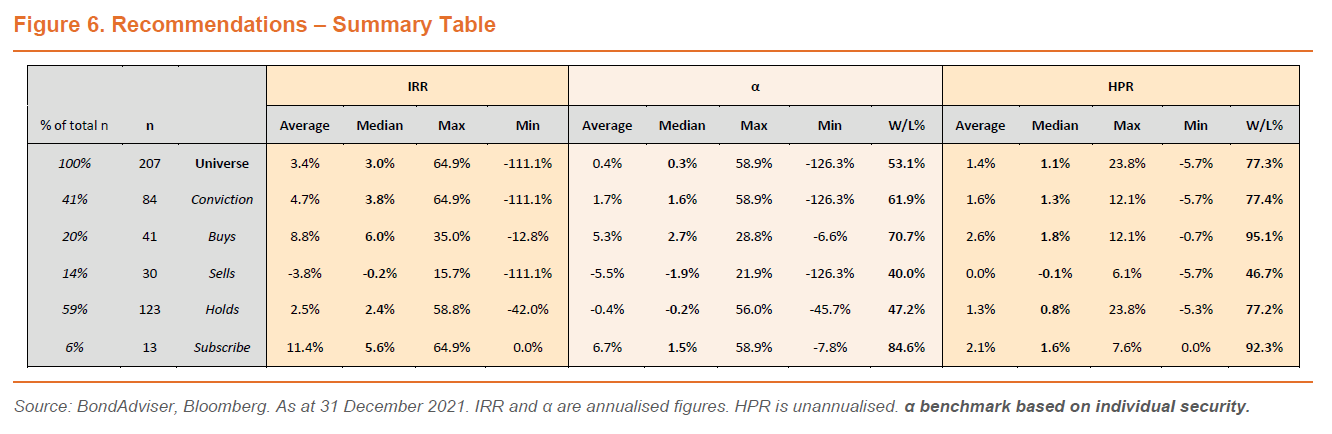

More importantly, the vast majority (62%, [n=84]) of our conviction recommendations (defined as Buy, Sell, or Subscribe) added alpha against that of the respective security benchmark. When using APRA’s benchmark, this increases to 75%.

Other highlights include; 1) an average 8.8% IRR on our Buy recommendations [n=41], 2) a 100% IRR win/loss ratio on our Buy recommendations across: i) High Yield [n=18], ii) Non Financial Corporates [n=19], iii) Non-Major Bank AT1 Hybrids [n=8], and 3) maintained a strong focus on capital preservation with a 95% CVaR of -4.1% [n=207] on a HPR basis, across the recommendation universe.

In this piece, we outline our method in reviewing performance, highlight some key charts and data, and reference the best and worst of the desk for 2021.

Method in the Madness

This analysis only uses recommendations on credit securities (i.e. bonds/hybrids/convertibles) and not our Fund Research. All BondAdviser recommendations are timestamped and stored externally in digital format. Such data has been extracted and performance has been calculated in the form of the unannualised holding period return (HPR) and the annualised internal rates of return (IRR). The start date of performance is determined by the date of a change in rating. The final date of performance is also determined by the date of a change in rating, or where such date is not applicable, the maturity/call date – or in the event of the security remaining outstanding, the last trading date of the year.

This accounts for why the analysis pool consists of 207 recommendations, whereas the total amount of recommendations for the year was 363. The “missing” recommendations, for example, is where a Hold recommendation is updated, but remains a Hold. We make this distinction in a better attempt to model hypothetical portfolio performance.

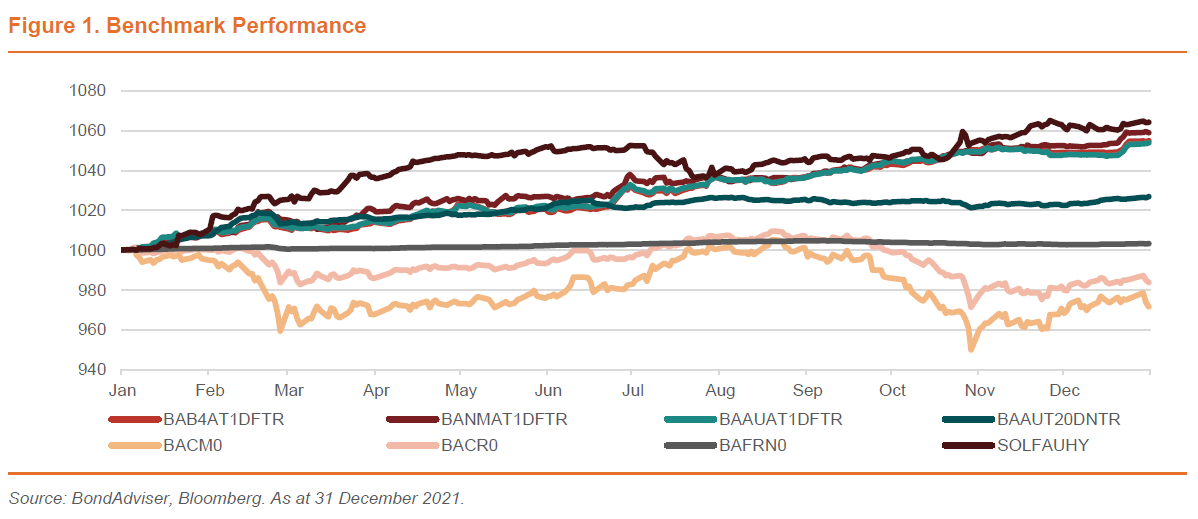

In determining alpha (α), we have opted to be more granular with our assessment – compared to that of simplifying the analysis with a broadly used metric such as the AusBond Composite Index (BACM0). In using a more characteristic benchmark than BACM0, generally, our investment grade securitites that are fixed rate are compared against the AusBond Credit Index (BACR0), investment grade floating rate securities are compared against the AusBond Credit FRN Index (BAFRN0), while high-yield or non-rated securities are compared against the Solative FIIG Australian High Yield and Non-Rated Bond Index (SOLFAUHY).

Otherwise, regulatory capital is compared against our proprietary index platform, which uses a rules-based, market-weighted calculation of total return (on a franked basis where applicable). Tier 2 securities are compared against the BondAdviser Australian Tier 2 Index (BAAUT20DNTR), which excludes issuers of risk outside that of Australia and New Zealand. AT1 Hybrid Securities are compared in two formats, firstly, against that of the Australian issuer, AUD market (BAAUAT1DFTR) and secondly, against a more comparable risk profile, split up by the Big Four banks (BAB4AT1DFTR) and the non-majors (BANMAT1DFTR). Unlike all the other benchmarks, these two differ slightly in that securities must have an expected term to call of greater than a year.

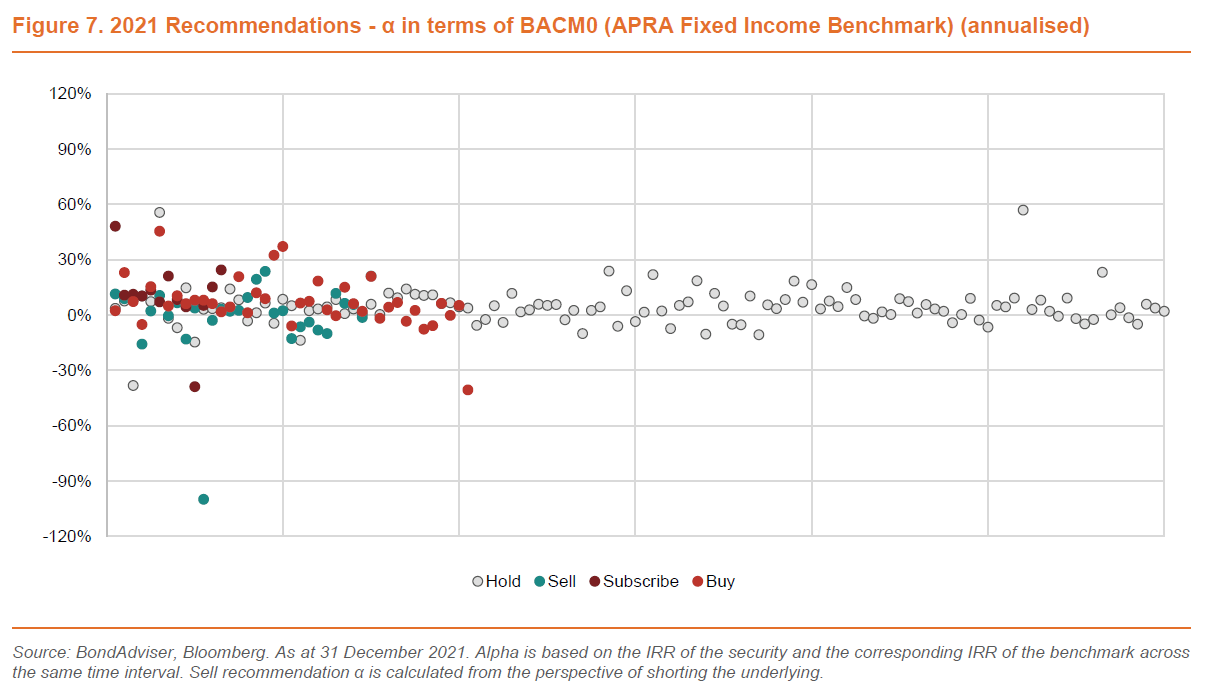

We have used BACM0 as a low watermark in some charts for reference. Additionally, exclusive to Figures 7-8, we have calculated alpha differently, based on APRA’s requirements of using BACM0 as the benchmark.

Analysing our results is done across multiple criteria, including nominal returns, time adjusted returns and opportunity costs. Furthermore, we separate recommendations by type; in terms of Subscribe, Buy, Hold and Sell. Lastly, we separate by sub-asset type. Subscribe is a primary market recommendation, of which we issued 13. This year we did not issue any Do Not Subscribe recommendations. The remaining recommendations are in the secondary market. Across 2021 we crystalised 41 Buys, 30 Sells and 123 Holds.

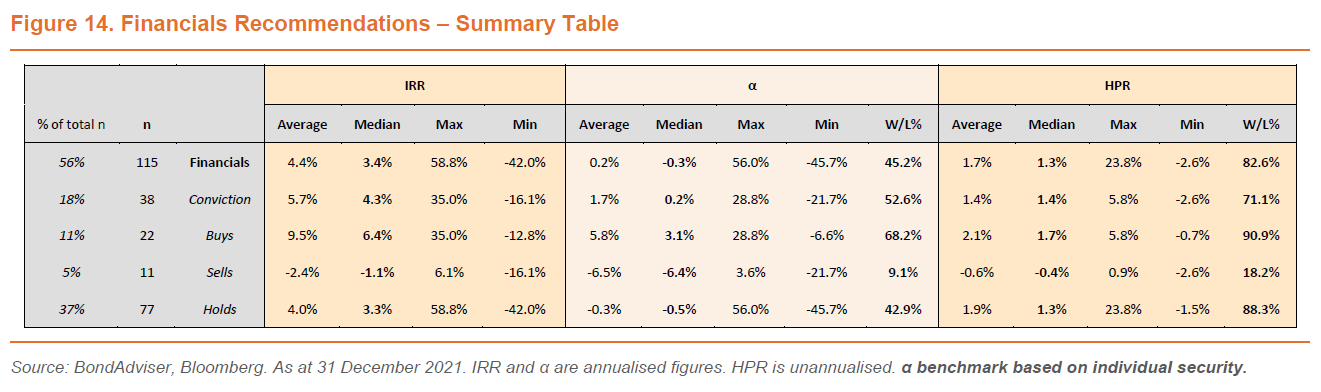

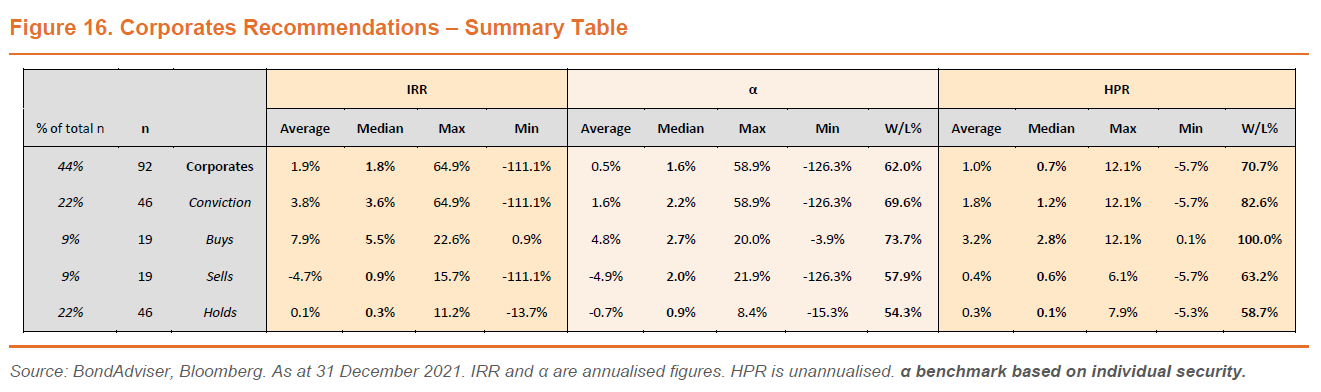

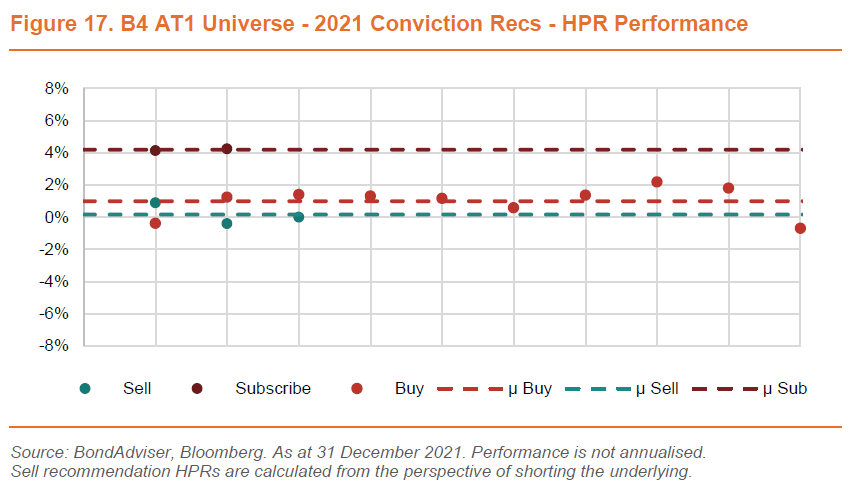

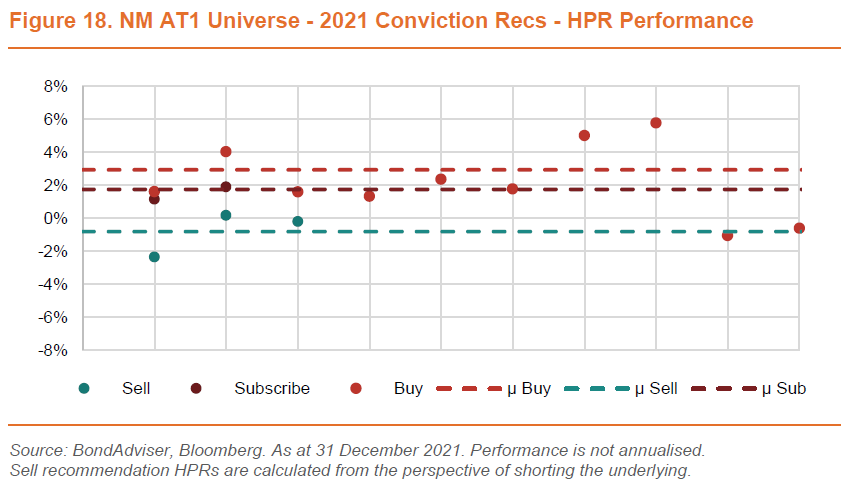

In terms of sub-asset classes, we have divided up amongst 1) investment grade vs high yield, 2) financials vs corporates and 3) for the AT1 hybrid class we have divided by Big Four banks vs non-major banks and financials.

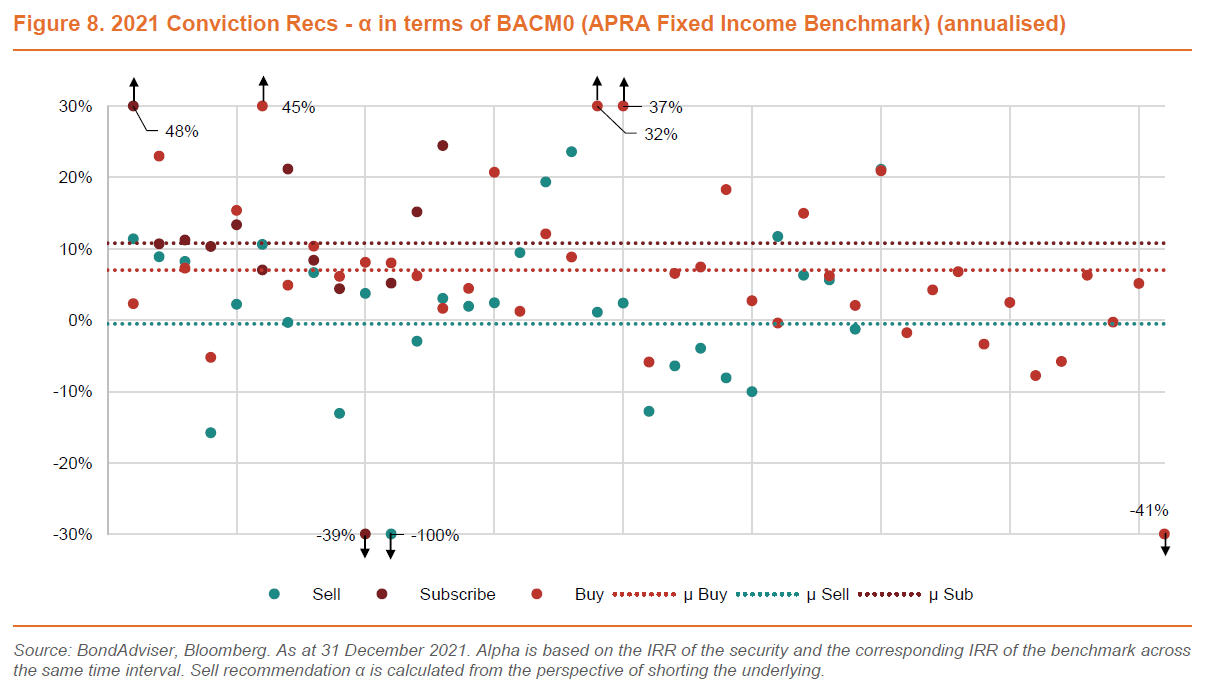

Benchmarking Against Your Future, Your Super

Much has been written about the changes in superannuation benchmarking. Our opinion on these changes is not the purpose of this section. Rather, for Figure 7 and 8, we change our calculation of alpha (α). Instead of referencing a benchmark that better corresponds to the risk-return characteristics of the security, we use the catch-all fixed income index that has been stipulated by APRA. This is the widely known, but largely government bond comprised (and duration heavy), AusBond Composite Index (BACM0).

Under such benchmarking criteria, performance of recommendations has been robust. Median alpha on conviction recommendations [n=84] is 6.2% (mean of 4.9%). Furthermore the alpha win/loss ratio increases to 75% on conviction recommendations.

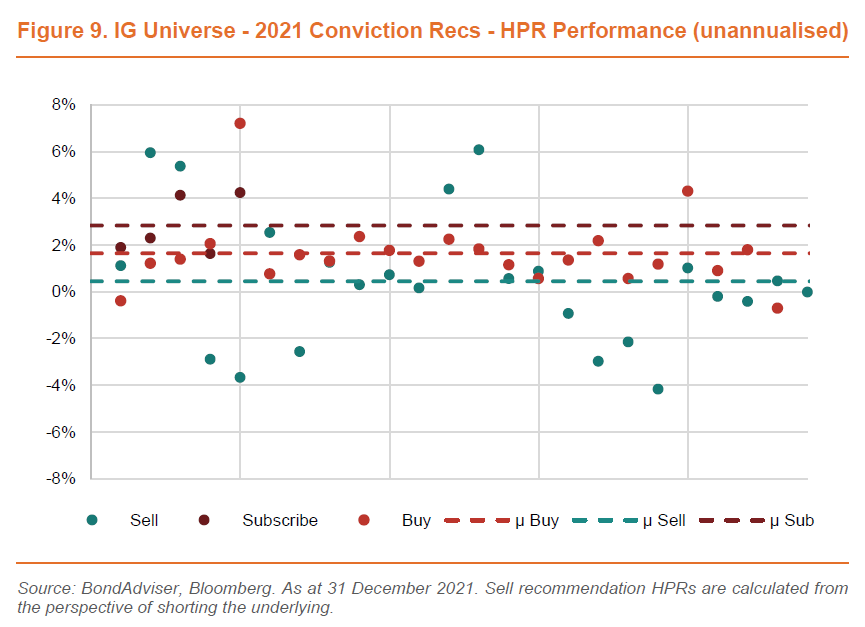

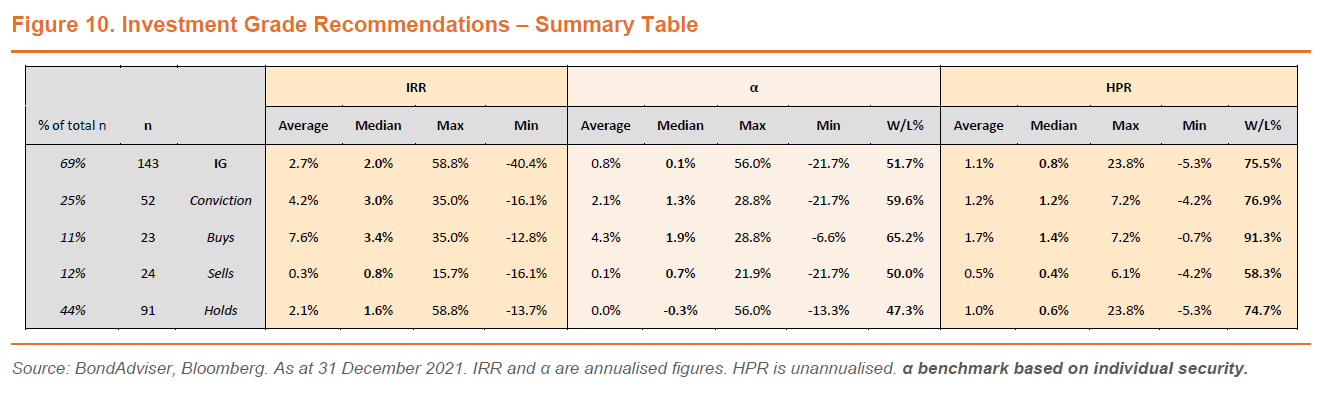

Investment Grade – Tough Got Going

Our strongest performance in the investment-grade universe was a function of being underweight duration. Turning short the long-end of Lendlease (ASX: LLC) in August saw our Sell recommendations on the 3.7% 2031 and 3.4% 2027 tranches mark 22% and 18% of IRR alpha respectively. Similarly, our shorts on the long-end of Aurizon (ASX: AZJ), which were entered in February, also saw marks of 9% and 8% of IRR alpha respectively – this was especially impressive given the long period of negative carry.

In terms of weakness, we closed out our short position on Coles (ASX: COL) 2.1% 2030 in August, after initiating in February. Negative carry and some capital loss saw a negative IRR of -7.8% incurred, from a HPR perspective, this was a more modest -3.7%. Patience is a virtue, and subsequently the price traded downwards as benchmark yields rose. If we had maintained a Sell recommendation here we would have been able to mark a 2.1% IRR profit.

Similarly on the weakness front, we maintained caution at the long end of Qantas (ASX: QAN), recommending a Sell between February and October on the 2.95% 2029 and 5.25% 2030 bonds, believing the duration and long-term credit uncertainty was not being adequately compensated. Positively, we offset this with Buy recommendations at the short-end, where unencumbered assets and fresh equity raises made repayment a near certainty by our modelling. IRRs on the 7.75% 2022 and 7.5% 2021 bonds netted 2.4% and 2.0% respectively, acting to mitigate the pain on the -4.8% and -2.6% loss on the long-end shorts.

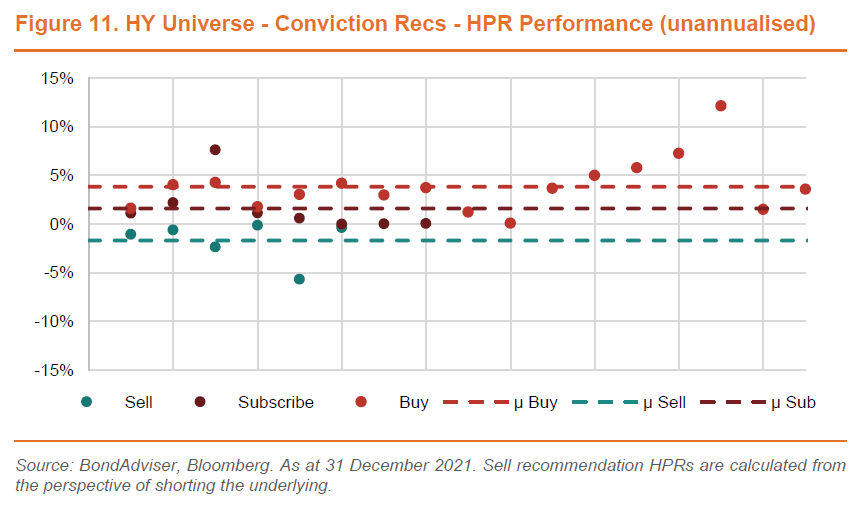

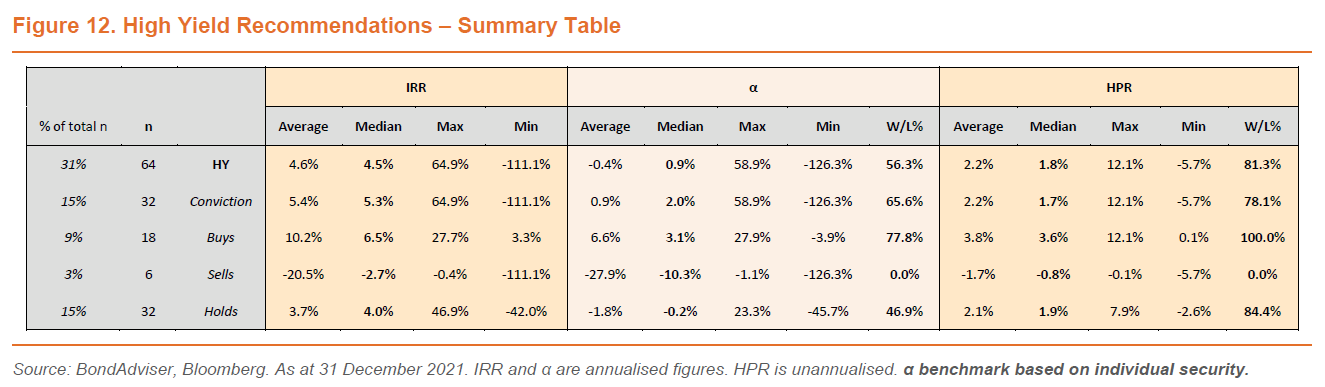

High Yield – Who You Calling Junk?

We have advocated strongly for broad exposure to the domestic high yield market over 2021, whilst we appreciate liquidity is always difficult here, our recommendations performed exceptionally well, with a median conviction IRR, α, and HPR of 5.3%, 2.0% and 1.7% respectively. Across our 18 Buy recommendations, none made a loss and 78% outperformed the benchmark. Outperformance here was no cakewalk, the benchmark index returned 6.6% for the year.

Our confidence in Centuria (ASX: CNI) was founded upon long WALEs and outstanding creditworthiness of most tenants. Such confidence was well repaid, our Subscribe recommendation for the C2FHA IPO has marked 11.2% (IRR). Furthermore, our Buy recommendation between February and August in the 2023 FRN returned 8.7% (IRR).

Strong performance was also seen across Buy recommendations in Avanti’s (AVAF) 5.5% 2024 – returning a 16.1% IRR and MoneyMe’s (ASX: MME) 8.25% 2025 – also returning a 16.1% IRR, after a 5% call premium was received for an early redemption. Both of these structures benefited from security pledged to bondholders – a key comfort to our recommendations in an opaque market where fundamental research is critical.

In terms of weakness, our Sell recommendation on Ramsay’s (ASX: RHC) RHCPA’s suffered against a large coupon cost, but the IRR loss was modest at -1.5% as the capital price of the security fell. Furthermore, Subscribe recommendations on Australia Unity’s AYUPA and NAOS Emerging Opportunities (ASX: NCC) NCCGA were underwhelming, returning -4bps and 3bps respectively on an IRR basis. Both these instruments are complex and relatively unique, being preferred equity in the case of AYUPA and a listed convertible in the case of NCCGA. Whilst we continue to believe the embedded option in NCCGA is underpriced, we appreciate there will likely be a better entry point on slippage in low liquidity. In the case of AYUPA, an upsizing of the tap from $160 million to $230 million saw a large degree of expected secondary demand lifted.

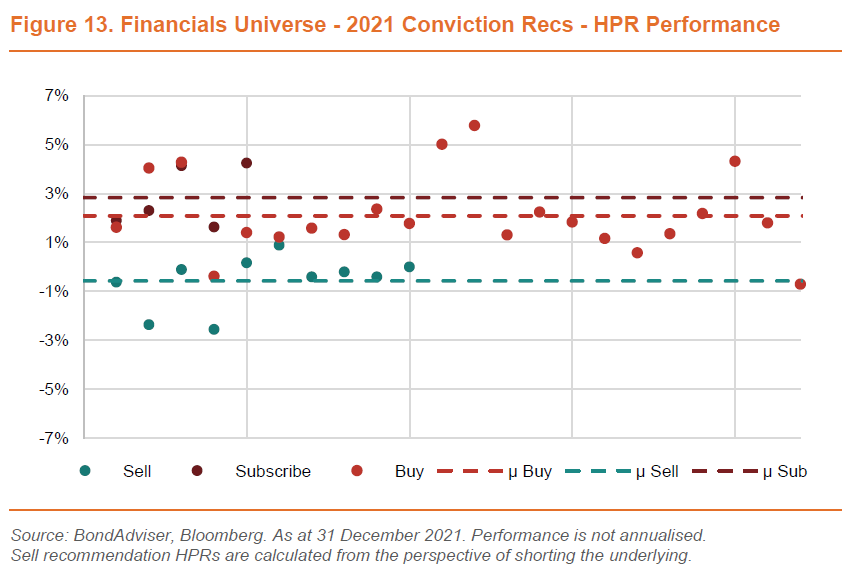

Financials (Banks, Insurers and Div Fins) – TFF Grants Tailwinds

The Term Funding Facility (TFF) radically changed the dynamic of the financial debt capital markets, as banks rationally sourced funding from a very cheap loan as compared to longer-term senior unsecured funding. As maturities rolled-off, redeployment was needed and benefits were seen in secondary across the capital structure – as we expected and noted several times. Our discussion here excludes AT1 hybrids which are discussed below, however, we note the performance is included here within the data.

Underperformance here was largely related to idiosyncratic risk factors. Our Sell recommendation on Genworth’s (ASX: GMA) 10NC5 2030 bonds gave back -6.4% of alpha (annualised), however given the serious event risk of CBA, being the largest client, possibly being lost, we opted to take profits and source liquidity whilst available. The market did not care much for this narrative and spreads continued to price on the assumption of CBA being retained. Given the increase in competition in the LMI space, we thought this was somewhat cavalier.

We also gave back alpha on being short Clearview’s (ASX: CVW) 10NC5 2030 bonds, albeit a more modest -1.1%, noting that the HPR was actually positive (+11bps ). Whilst fundamentally sound, the “For Sale” sign was put up by management and its private equity majority owners. We issued a Sell recommendation noting that a change of control does not require a call or conversion. With the possibility of a weaker credit and recovery profile, paired with limited upside, we expected to see some selling pressure.

We held an overweight tilt to Tier 2 for much of 2021 and this was well rewarded. Some of the best recommendations in the Tier 2 space came from QBE Insurance Group’s (ASX: QBE) 10NC5 2036, NAB’s chronically undervalued NABPE, and a riskier position in AMP’s 10NC5 2027, which respectively provided IRRs of 9.3%, 6.7%, and 4.9%.

Corporates – Lots of Alpha on Offer

Numerous capital raises, and largely strong earnings and outlooks, manifested rosy fundamentals for most in the corporates sphere. In our coverage this was perhaps best illustrated by Civmec (ASX: CVL), which benefited from higher commodities prices, a splurge in infrastructure spending and a continued ramp-up in defence spending. Cashflow was so ample the bond was redeemed early in November for a 1% call premium. We retained a Buy recommendation in February that earnt a 3.9% IRR. Our initial Subscribe recommendation in November 2018 (we maintained a Buy throughout the entire secondary trading period) resulted in an IRR of 7.4% (not part of 2021 research review data).

In more down beaten sectors such as retail, advantageous structuring can result in excellent risk adjusted returns. David Jones 4.5% 2025 bond illustrated this, providing a 14.2% IRR return on a Buy recommendation that was cornerstoned by confidence in overcollateralisation of first lien status on the flagship real estate assets. This IRR return did not fall into the 2021 data as the recommendation was first made in September 2020, however we maintained a Buy in March 2021, which saw an IRR of 3.4% – which was included in the data.

A big win was in Nufarm’s (ASX: NUF) NFNG, which returned a HPR of 12.1% and IRR of 20.6%. Although our opinion has now changed, we believed the prospect of redemption was being underpriced and the improvements in the credit profile post Lat-Am divestment was also being underpriced.

Undoubtably, the most volatile name under our coverage was Crown (ASX: CWN). Whilst we correctly called the downgrade in the credit rating, the take-over bid from Blackstone was the source of our largest loss for the year in terms of IRR, being -111% (annualised figure) on a CWNHB Sell recommendation – although the HPR loss, for an Extreme risk rated security was a more reasonable -5.7% (unannualised). Initially, through our cashflow modelling, we thought the market was overpricing the ability for CWNHB to be redeemed organically. Evidently, we did not place enough emphasis on the probability of exogenous events such as a takeover bid. Subsequently, we have clawed back some of these losses with Buy recommendations, providing 3.7% and 1.2% from an unannualised HPR perspective.

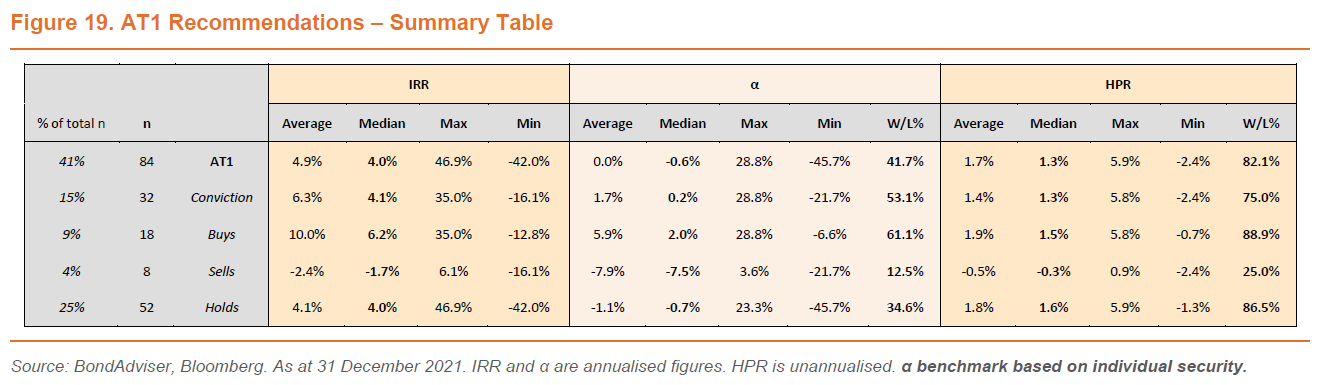

AT1s – Regulatory Benefits Squeeze Spreads Tighter

Hybrids, often overlooked as poor value in relation to corresponding bank equity, have performed exceptionally well in the past 5 years – providing a material return for far less volatility. We turned overweight on AT1 Hybrid beta in May 2021 and retained this stance in July 2021, through until November 2021 and have been well rewarded.

We had been bullish on the unlisted Members Equity hybrid’s since issuance and the subsequent takeover by BOQ means we expect margins to continue to trade tighter. Our Buy recommendations here have provided the largest AT1 HPRs at 5.8% and 5.0% (unannualised) respectively for the Wholesale Notes II and Wholesale Notes I.

In terms of annualised IRR, performance was strong across MQGPC, ANZPF, and AMPPB which all had Buy recommendations that returned 35.0%, 34.7% and 27.7% respectively. Weakness was realised on Sell recommendations on CBAPH, BOQPE, and BENPG returning -16.1%, -4.3%, and -2.7% as relative value shorts were impacted by negative carry and market spreads squeezing tighter.

Click here to continue viewing the full set of data and charts.