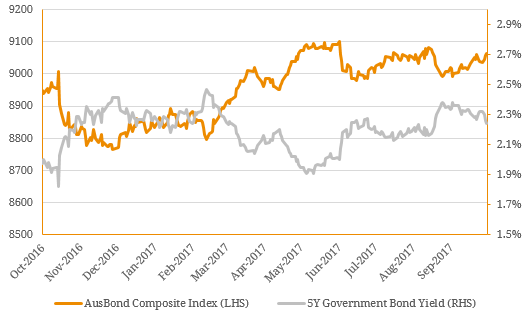

Despite mixed economic signals, Australian investors are generally preparing for the rising interest rate environment in coming years. While the Reserve Bank of Australia (RBA) has kept the cash rate on hold for 15 consecutive months, there is consensus that the next move will be up with only timing being the real unknown. Consequently, a question that has been raised is how Additional Tier 1 (AT1) hybrids will fare in the rising interest rate environment. One of the foundations of traditional fixed income is the inverse relationship the asset class has with movements in interest rates. Specifically, fixed rate bonds will decrease in value in a rising interest rate environment and increase in value in a decreasing interest rate environment. This has been evident in the past year where interest rate volatility has been negatively correlated to the flagship AusBond Composite Index which comprises 100% fixed rate securities (Figure 1). Figure 1. AusBond Composite Index v 5Y Government Bond Yield  Source: BondAdviser, Bloomberg This correlation is referred to as ‘duration’ and represents an instrument’s price sensitivity to underlying movements in interest rates. The reason for this is that when interest rates increase to levels above the security’s fixed coupon rate, the market will be offering a superior yield to the instrument. As a result, the value of the security declines and hence, the price falls. On the other hand, if interest rates decline, the fixed rate security is now more attractive to current market yields and hence, the price increases. This sensitivity will increase for longer-term instruments such as Government bonds. For this reason, the duration of the AusBond Government Bond Index has historically always been higher than the AusBond Corporate Credit Index which includes relatively shorter-dated corporate bonds (Figure 2). Figure 2. Duration of AusBond Indices

Source: BondAdviser, Bloomberg This correlation is referred to as ‘duration’ and represents an instrument’s price sensitivity to underlying movements in interest rates. The reason for this is that when interest rates increase to levels above the security’s fixed coupon rate, the market will be offering a superior yield to the instrument. As a result, the value of the security declines and hence, the price falls. On the other hand, if interest rates decline, the fixed rate security is now more attractive to current market yields and hence, the price increases. This sensitivity will increase for longer-term instruments such as Government bonds. For this reason, the duration of the AusBond Government Bond Index has historically always been higher than the AusBond Corporate Credit Index which includes relatively shorter-dated corporate bonds (Figure 2). Figure 2. Duration of AusBond Indices  Source: BondAdviser, Bloomberg However, as Figure 2 illustrates above, the duration of the AusBond Credit FRN Index has remained close to zero since inception. In contrast to other AusBond indices, this index comprises only floating rate securities where the coupon rate resets periodically (typically either quarterly or semi-annually). For this reason, any movements in interest rates experienced over the period will be captured when the floating rate component of the interest rate resets, essentially removing any risk that investors will forego higher interest rates should they arise as would be the case if the coupon rate was fixed. The above logic applies for the listed AT1 hybrid market where all instruments are floating rate. While duration stays low throughout the security’s term, it will follow a jagged-edge like pattern. This reflects the decline in duration during the coupon period before the floating rate resets and duration sharply increases again. However, as demonstrated in Figure 2, duration is considerably lower in comparison to fixed rate securities. Figure 3. Example of AT1 Historical Hybrid Duration

Source: BondAdviser, Bloomberg However, as Figure 2 illustrates above, the duration of the AusBond Credit FRN Index has remained close to zero since inception. In contrast to other AusBond indices, this index comprises only floating rate securities where the coupon rate resets periodically (typically either quarterly or semi-annually). For this reason, any movements in interest rates experienced over the period will be captured when the floating rate component of the interest rate resets, essentially removing any risk that investors will forego higher interest rates should they arise as would be the case if the coupon rate was fixed. The above logic applies for the listed AT1 hybrid market where all instruments are floating rate. While duration stays low throughout the security’s term, it will follow a jagged-edge like pattern. This reflects the decline in duration during the coupon period before the floating rate resets and duration sharply increases again. However, as demonstrated in Figure 2, duration is considerably lower in comparison to fixed rate securities. Figure 3. Example of AT1 Historical Hybrid Duration  Source: BondAdviser So, if not a rising interest rate environment, what will be the largest driver of future AT1 hybrid valuations? A catalyst is challenging to identify and even more so, to time correctly, but history has shown AT1 hybrids have reacted violently in a heightened risk environment. A sound proxy for this is equity volatility and as Figure 4 illustrates, trading margins have broadly moved in sync with periods of share market distress. Figure 4. Major Bank Average AT1 Trading Margin vs Bank Equity Index Volatility

Source: BondAdviser So, if not a rising interest rate environment, what will be the largest driver of future AT1 hybrid valuations? A catalyst is challenging to identify and even more so, to time correctly, but history has shown AT1 hybrids have reacted violently in a heightened risk environment. A sound proxy for this is equity volatility and as Figure 4 illustrates, trading margins have broadly moved in sync with periods of share market distress. Figure 4. Major Bank Average AT1 Trading Margin vs Bank Equity Index Volatility  Source: BondAdviser, Bloomberg As a result, a more appropriate risk parameter is credit duration. In comparison to interest rate duration, credit duration measures an instrument’s sensitivity to changes in its trading margin which is a significant input hybrid valuation. This is because the interest rate margin on AT1 hybrid instruments is set at issuance and then generally remains fixed throughout the term. For this reason, the credit duration will follow the same relationship direction as described for fixed rate instruments and interest rate duration. This impact is shown in Figure 5 which depicts the average change in price for increasing interest rates and trading margins highlighting the different sensitivities. Figure 5. Average Change in AT1 Hybrid Price for Rising Interest Rates v Rising Trading Margin

Source: BondAdviser, Bloomberg As a result, a more appropriate risk parameter is credit duration. In comparison to interest rate duration, credit duration measures an instrument’s sensitivity to changes in its trading margin which is a significant input hybrid valuation. This is because the interest rate margin on AT1 hybrid instruments is set at issuance and then generally remains fixed throughout the term. For this reason, the credit duration will follow the same relationship direction as described for fixed rate instruments and interest rate duration. This impact is shown in Figure 5 which depicts the average change in price for increasing interest rates and trading margins highlighting the different sensitivities. Figure 5. Average Change in AT1 Hybrid Price for Rising Interest Rates v Rising Trading Margin  Source: BondAdviser Given AT1 hybrid securities typically react adversely in a volatile environment, credit duration is a more appropriate risk parameter in quantifying capital downside. While a rising interest rate environment is becoming more and more likely in coming years, we expect this will have a limited impact on hybrid valuations. Of course, an elevated interest rate environment could have a negative impact from a fundamental perspective (higher borrowing costs could hurt consumers and businesses) but we expect the any unwinding monetary easing policy by the RBA to be conducted in a measured and disciplined manner. Nonetheless, risk-driven environments remain the primary risk to AT1 hybrid valuations and understanding these equity-like features is of major importance for any AT1 investor.

Source: BondAdviser Given AT1 hybrid securities typically react adversely in a volatile environment, credit duration is a more appropriate risk parameter in quantifying capital downside. While a rising interest rate environment is becoming more and more likely in coming years, we expect this will have a limited impact on hybrid valuations. Of course, an elevated interest rate environment could have a negative impact from a fundamental perspective (higher borrowing costs could hurt consumers and businesses) but we expect the any unwinding monetary easing policy by the RBA to be conducted in a measured and disciplined manner. Nonetheless, risk-driven environments remain the primary risk to AT1 hybrid valuations and understanding these equity-like features is of major importance for any AT1 investor.