Summary of key points:

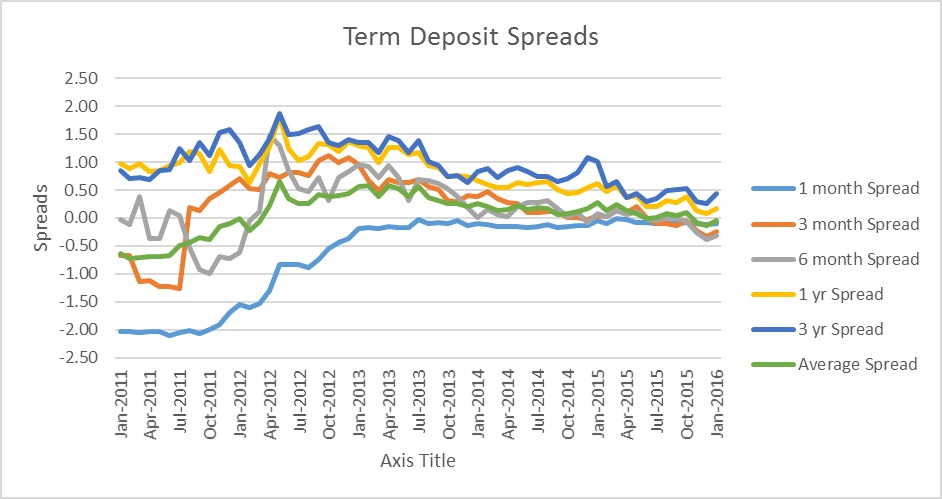

- Both margins and outright term deposit rates have fallen over the past two years;

- While the Bank Bill Swap Rate (BBSW) is expected to continue the declining trend following the Reserve Bank of Australia (RBA) official cash rate, any further lowering of outright rates on term deposits during 2016 may be offset by the banks potentially increasing the margin offered to depositors if competition for capital increases;

- Finally, it is important to remember that the Australian government guarantee only covers the first $250,000 per entity per Authorised Deposit-taking Institution (ADI). Investors should seek out the highest rate available irrespective of the ADI for any amount that is covered by the government guarantee.

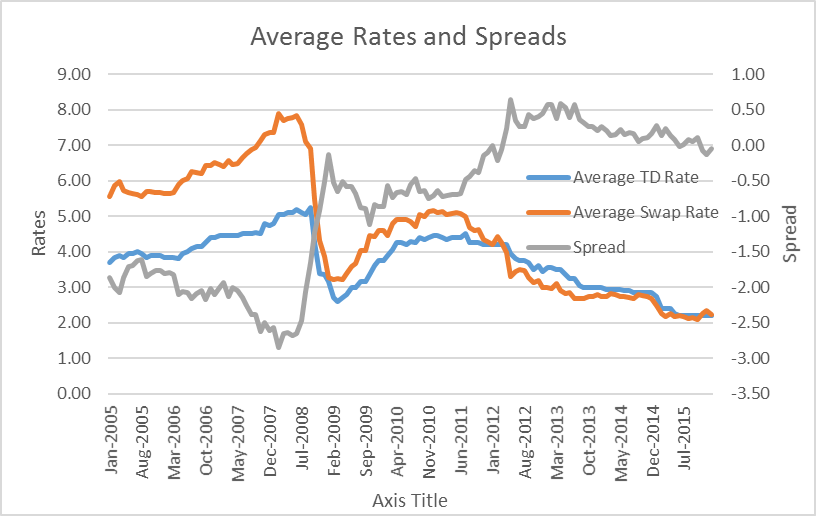

Deposits offer investors a range of benefits over other types of investments. The diverse offering in Australia allows for flexibility. Depositors are able to choose their investment term and deposit type. This allows the investors to effectively express a view on interest rates. Additionally, deposits offer certainty of returns. The type of deposit and level of base rate on the transaction date remains unchanged during the duration of the investment. This allows the investor avoid market volatility. The fixed margin or spread (the difference between the advertised deposit rate and benchmark swap rate) of the deposit will depend on prevailing market conditions on the transaction date. On the negative side, term deposits can only be liquidated early with the issuing institution (i.e. there is no open market). Although deposits offer a certain return, there is no capital upside as there is in bonds if interest rates fall. The Australian banking industry has been subject to substantial regulatory pressures over the last few years including the introduction of the liquidity coverage ratio in January 2015. During this phase, term deposit markets saw extreme competition and as a result, yields were very attractive. This golden age is slowly coming to an end as term deposit rates (and accompanying spreads) trend downwards as banks begin to satisfy their regulatory requirements. However, over the past 6 months overall debt funding costs have risen making deposits an increasingly attractive funding option for banks. If this trend continues we could see an increase in deposit rates over the coming year (subject to the RBA cash rate remaining stable).  Prior to the Global Financial Crisis, banks were unwilling to pay a premium for money held in deposits resulting in subdued negative spreads. As these catastrophic events unfolded, global credit markets dried up forcing Australian banks to improve their deposit offering to investors. As a result, spreads began to increase as many financial institutions fought over funding and this trend continued up to 2012. Over the past few years, capital markets have increased in flexibility as participants have regained confidence in the financial system. Consequently, deposit rate and spreads have trended downwards as the cost of funding for banks has declined due to alternatives funding options. This has been evident in the major bank fund transfer pricing. Funding transfer pricing is how financial institutions attribute profitability to difference sources of funding and data suggests downward pressure on deposit rates can be linked to greater profitability from wholesale funding options.

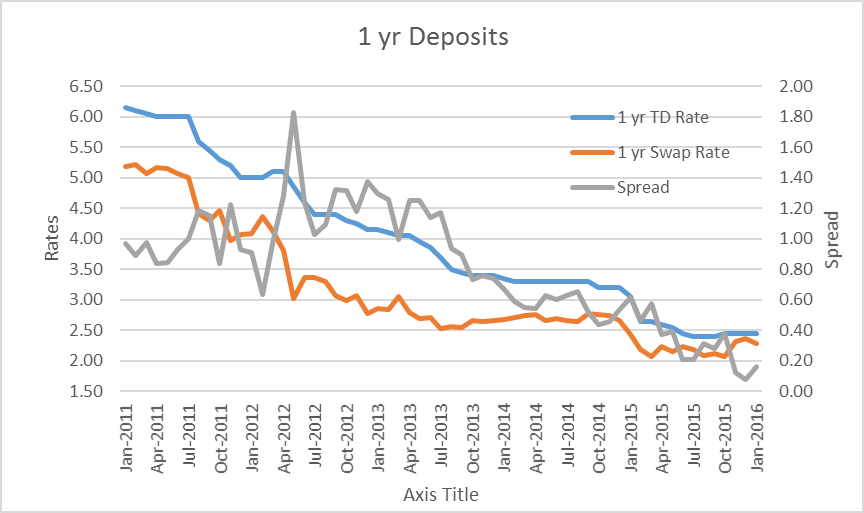

Prior to the Global Financial Crisis, banks were unwilling to pay a premium for money held in deposits resulting in subdued negative spreads. As these catastrophic events unfolded, global credit markets dried up forcing Australian banks to improve their deposit offering to investors. As a result, spreads began to increase as many financial institutions fought over funding and this trend continued up to 2012. Over the past few years, capital markets have increased in flexibility as participants have regained confidence in the financial system. Consequently, deposit rate and spreads have trended downwards as the cost of funding for banks has declined due to alternatives funding options. This has been evident in the major bank fund transfer pricing. Funding transfer pricing is how financial institutions attribute profitability to difference sources of funding and data suggests downward pressure on deposit rates can be linked to greater profitability from wholesale funding options.  On the 1-year term deposit rate, the margin was 62 basis points above the benchmark swap rate at the start of 2015. This bottomed out to 8 basis points, but has since risen to 16 basis points in February. Other rates have displayed the same trend.

On the 1-year term deposit rate, the margin was 62 basis points above the benchmark swap rate at the start of 2015. This bottomed out to 8 basis points, but has since risen to 16 basis points in February. Other rates have displayed the same trend.  Major banks are currently offering 6 month rates in a range of 2.2% – 2.4% p.a. and 1 year rates between 2.3% – 2.45% p.a. The two major regionals term deposit rates are running at a premium to this (2.60% – 2.90% p.a.) while smaller regionals and credit unions are edging towards the 3% mark. This difference should not be mistaken for premiums associated with credit risk. All deposits in Australia up to $250,000 are guaranteed by the government, which implies that the default risk of all deposits are identical. Instead, the rate differential is a product of funding accessibility. Many smaller institutions do not have access to capital markets or other alternative sources of funding. As a result, the cost of funding is higher and the primary source of capital is through deposit growth. Therefore, the higher term deposit rate allows these institutions to attract a larger pool of investors. In terms of total deposit market share, the second half of last year saw a slight reduction in market concentration. Total market share in terms of the major banks and minors (Macquarie, Suncorp, Bendigo Bank & Bank of Queensland) dropped from 87.8% to 87.1%. Currently, combined market share sits at 87.3%. In our view, other financial institutions are offering more attractive rates and as investors become more aware this could create further competitive pressure in the coming years.

Major banks are currently offering 6 month rates in a range of 2.2% – 2.4% p.a. and 1 year rates between 2.3% – 2.45% p.a. The two major regionals term deposit rates are running at a premium to this (2.60% – 2.90% p.a.) while smaller regionals and credit unions are edging towards the 3% mark. This difference should not be mistaken for premiums associated with credit risk. All deposits in Australia up to $250,000 are guaranteed by the government, which implies that the default risk of all deposits are identical. Instead, the rate differential is a product of funding accessibility. Many smaller institutions do not have access to capital markets or other alternative sources of funding. As a result, the cost of funding is higher and the primary source of capital is through deposit growth. Therefore, the higher term deposit rate allows these institutions to attract a larger pool of investors. In terms of total deposit market share, the second half of last year saw a slight reduction in market concentration. Total market share in terms of the major banks and minors (Macquarie, Suncorp, Bendigo Bank & Bank of Queensland) dropped from 87.8% to 87.1%. Currently, combined market share sits at 87.3%. In our view, other financial institutions are offering more attractive rates and as investors become more aware this could create further competitive pressure in the coming years.  Given the economic landscape, we believe that margin widening is possible. As other sources of funding become more expensive, banks will need to increase their offerings to become more competitive with smaller participants. We note that future regulation may also play a role in the widening as further balance sheet capitalisation will be a priority. As a result, there is possibility that rates will return to levels seen at the beginning of 2012 and investors should be cautious in locking funds in a long term deposits. We do caution that this improvement may be partially mitigated as economic conditions may persuade the Reserve Bank of Australia to cut the cash rate (which is a component of term deposit rates) by 0.25% to 1.75%. Currently, the futures market is predicting two rate cuts in 2016. As to when this will occur depends on multiple factors including market volatility, commodity prices, emerging market growth and funding costs. However, this expected cut in the cash rate may be a positive for investors as the lower rates (and effectively lower funding costs for the banks) could result in higher competition, pushing term deposit rates up as financial institutions fight for investor market share.

Given the economic landscape, we believe that margin widening is possible. As other sources of funding become more expensive, banks will need to increase their offerings to become more competitive with smaller participants. We note that future regulation may also play a role in the widening as further balance sheet capitalisation will be a priority. As a result, there is possibility that rates will return to levels seen at the beginning of 2012 and investors should be cautious in locking funds in a long term deposits. We do caution that this improvement may be partially mitigated as economic conditions may persuade the Reserve Bank of Australia to cut the cash rate (which is a component of term deposit rates) by 0.25% to 1.75%. Currently, the futures market is predicting two rate cuts in 2016. As to when this will occur depends on multiple factors including market volatility, commodity prices, emerging market growth and funding costs. However, this expected cut in the cash rate may be a positive for investors as the lower rates (and effectively lower funding costs for the banks) could result in higher competition, pushing term deposit rates up as financial institutions fight for investor market share.