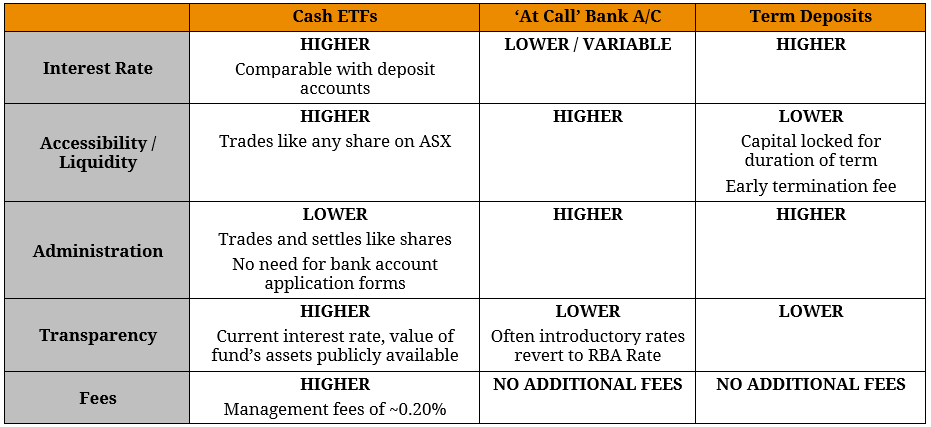

In the current low-growth, low-yield environment, there is no question investors are finding it difficult to generate short-term returns with an acceptable level of risk. For this reason, there has been a push for new products that represent an alternative to traditional cash investments (i.e. term deposits). For this reason, ‘Cash’ Exchange Traded Funds (Cash ETFs) have gained traction among Australian investors. A Cash ETF invests primarily in deposit products and attempts to track cash market indices such as the RBA Cash Rate Index and the AusBond Bank Bill Index. As it trades like a normal ordinary share, holdings in the ETF can be bought or sold on the ASX without the need for opening bank accounts or rolling over deposits. In other words, these products offer investor convenience. Investors normally use bank Term Deposits (TDs) to hold cash where interest income is guaranteed (up to $250,000) over a certain period. Funds are typically locked in over the investment period and physical roll over is required when maturity is reached. TDs can also incur potential break fees or forfeiting of interest if investors withdraw funds before the TD matures. In comparison, a cash ETF provides investors with a flexible alternative. Where cash ETFs differ from a normal TD is the opportunity to generate a higher return while providing ample liquidity (can sell and buy at any time on the ASX). However, investors should be aware that ETFs are subject brokerage and management fees while there is no such fee for normal TDs. Figure 1. General Comparison between Cash ETFs and other alternatives

- UBS IQ Cash ETF (ASX: MONY) aims to provide excess returns over the RBA Cash Rate.

- iShares Core Cash ETF (ASX: BILL) aims to track the S&P/ASX200 Bank Bill Index.

- iShares Enhanced Cash ETF (ASX: ISEC) aims to provide excess returns over the S&P/ASX200 Bank Bill Index.

- BetaShares Australian Bank Senior Floating Rate Bond ETF (ASX: QPON) aims to track the Solactive Australian Bank Senior Floating Rate Bond Index.

Figure 2. Cash Alternative ETFs in the domestic market

- Convenience: Comparable risk and return to deposit products without need for bank account opening or periodic manual roll-over periods.

- Regular distributions: Providing regular low-risk income streams.

- Capital stability: Unlike other fixed-rate income investments, the value of a Cash ETF will not decline (and will, in fact, increase) in a rising interest rate environment (like a TD).

- Transparency: Interest rate information, value of Fund’s assets and other disclosures publicly available via the ASX.

- Liquidity: Holdings in the ETF can be bought or sold at any time during market trading hours with a short settlement period.

However, investors considering the alternative must also be aware of a few key downside risks:

- Fees: Most funds charge management fees (typically ~0.20%) which could be expensive in the context of the total yield of (~2% – 2.50%).

- Price Volatility: Unlike traditional TDs, cash ETFs are subject to price volatility on the ASX.