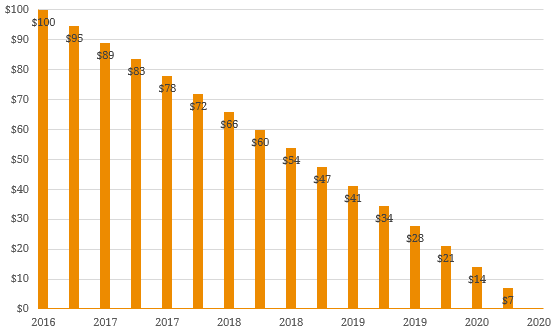

In the Australian fixed income market, the vast majority of debt instruments pay interest periodically and repay principal upon maturity (or an optional call date), providing flexibility in managing cash flow and asset/liability matching risks. In comparison to the “interest only” payment structure, is another type of bond structure known as “amortising”, which distributes principal and interest (P&I) distributions periodically, similar to that of a typical residential mortgage. As a result, the face value of the investment declines over the lifetime of the instrument as principal is repaid. Depending on the terms of the security, this will leave either a portion of face value at maturity or the bond will amortise completely until all principal is repaid meaning there will be no large principal repayment at maturity. Given the repayment structure of the underlying assets, amortising structures are most commonly used in residential mortgage backed securities (RMBSs). Occasionally though, the structure is used by corporate issuers. A recent example in Australia was the NRW Holdings Limited (ASX: NWH) 7.50% Senior Secured Fully Amortising Bonds. These were issued on 19th of December 2016, and the company raised $70 million (upsized from initial $60 million due to oversubscription) with level repayments quarterly in arrears. In line with the terms of the issue, principal is fully amortised over the 4-year tenor. Given its unique P&I payment structure, the risk profile of the instrument differs somewhat from the more traditional and common interest-only security structure. Figure 1. NRW Fully Amortising Notes Principal Profile ($100 Face Value)  Source: BondAdviser The security offers a quarterly payment of $7.29 per par amount, which commenced at 19th of March 2017 and continues up until the maturity date. However, due to its amortising structure, the outstanding principal amount will gradually decrease as each periodic distribution is made. As shown in Figure 1, the principal amount was par value ($100) before the first payment was made. Given the increasing return of capital to the investor as the security progresses, credit risk (specifically loss given default) declines over the tenor of the security. Figure 2. NRW Amortising Bond Principal and Interest Payment Structure

Source: BondAdviser The security offers a quarterly payment of $7.29 per par amount, which commenced at 19th of March 2017 and continues up until the maturity date. However, due to its amortising structure, the outstanding principal amount will gradually decrease as each periodic distribution is made. As shown in Figure 1, the principal amount was par value ($100) before the first payment was made. Given the increasing return of capital to the investor as the security progresses, credit risk (specifically loss given default) declines over the tenor of the security. Figure 2. NRW Amortising Bond Principal and Interest Payment Structure  Source: BondAdviser As each payment reduces the outstanding principal, the interest payment (outstanding principle mutiplied by the coupon rate) declines concurrently, resulting in a greater proportion of the (level) payment attributable to principal amortisation. This can be demonstrated in Figure 2. For example, the NRW Fully Amortising securities a $7.29 payment on the 19th of March 2017, comprised $1.82 (25%) of interest and $5.47 (75% of payment) of principal. As maturity approaches, the interest component gradually declines to zero whereas the repayment of outstanding principal continues to increase. From a ‘time value of money’ perspective, receiving a stream of capital repayments during the investment horizon always generates more return than receiving a larger lump sum at maturity as cash flows are less impacted by discounting. As a result, the payment structure of 7.50% NRW amortising bonds results in a yield of 7.71% p.a. whereas for non-amortising fixed rate bonds, the coupon rate (7.50%) will be the identical to the yield in the absence of a redemption premium. Compared to traditional interest-only securities, amortisation helps investors realise capital returned earlier (on a time weighted average basis) than maturity. Risk of capital loss is lower as principal is progressively repaid to investors. However, this also means less interest is paid because the principal is lower. For issuers, amortising bonds are of particular use in project finance where a high-value asset is required to be purchased or constructed over time. As this is done, cashflows increase substantially and can be used for earlier bond repayment. For investors, when new investment opportunites become available, earlier repayment of capital allows for redeployment into new instruments as opposed to having to wait until final maturity. As a result, the amortising structure presents an attractive alternative to traditional fixed income instruments if understood properly and cash flows are modelled correctly.

Source: BondAdviser As each payment reduces the outstanding principal, the interest payment (outstanding principle mutiplied by the coupon rate) declines concurrently, resulting in a greater proportion of the (level) payment attributable to principal amortisation. This can be demonstrated in Figure 2. For example, the NRW Fully Amortising securities a $7.29 payment on the 19th of March 2017, comprised $1.82 (25%) of interest and $5.47 (75% of payment) of principal. As maturity approaches, the interest component gradually declines to zero whereas the repayment of outstanding principal continues to increase. From a ‘time value of money’ perspective, receiving a stream of capital repayments during the investment horizon always generates more return than receiving a larger lump sum at maturity as cash flows are less impacted by discounting. As a result, the payment structure of 7.50% NRW amortising bonds results in a yield of 7.71% p.a. whereas for non-amortising fixed rate bonds, the coupon rate (7.50%) will be the identical to the yield in the absence of a redemption premium. Compared to traditional interest-only securities, amortisation helps investors realise capital returned earlier (on a time weighted average basis) than maturity. Risk of capital loss is lower as principal is progressively repaid to investors. However, this also means less interest is paid because the principal is lower. For issuers, amortising bonds are of particular use in project finance where a high-value asset is required to be purchased or constructed over time. As this is done, cashflows increase substantially and can be used for earlier bond repayment. For investors, when new investment opportunites become available, earlier repayment of capital allows for redeployment into new instruments as opposed to having to wait until final maturity. As a result, the amortising structure presents an attractive alternative to traditional fixed income instruments if understood properly and cash flows are modelled correctly.