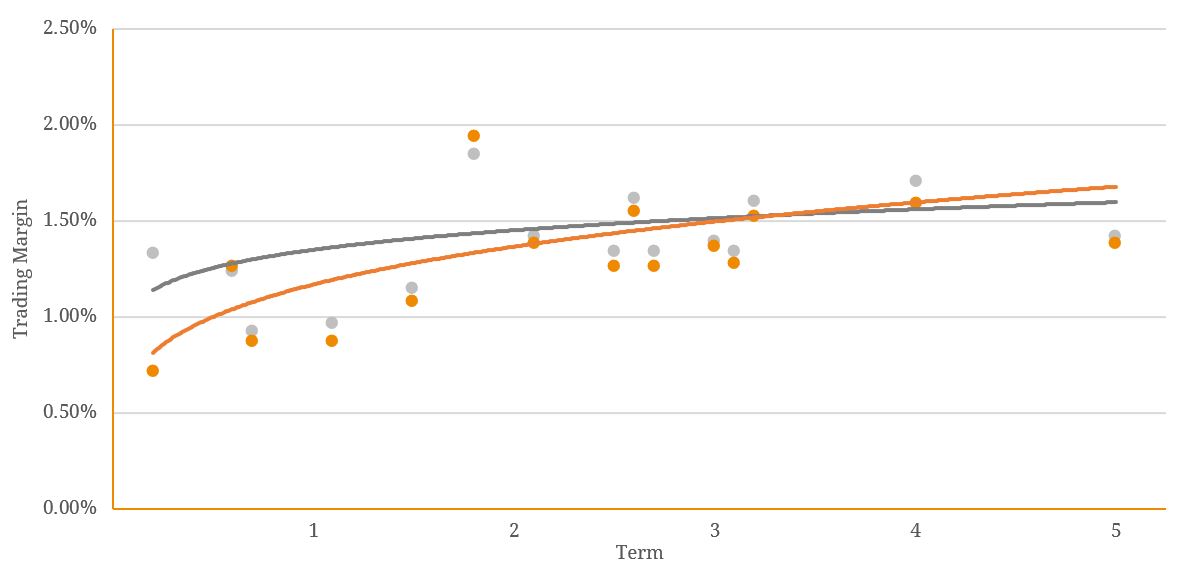

Throughout 2018, we have observed the listed Tier 2 financial hybrid industry continue to shrink as names such as Suncorp and Westpac redeem their respective instruments. However, what may not have been as obvious is the flattening of the Tier 2 curve that has occurred throughout the year. To fully understand the catalysts of this, as well as the changing global yield environment, it is best to go back to basics and fully understand why Tier 2 capital exists in the first place. Making up part of the more junior level of authorised deposit-taking institutions (ADIs) funding, Tier 2 capital is supplementary capital held by banks in excess of their Common Equity Tier 1 (CET1) capital requirements outlined by APRA following Basel III reforms in 2015. Whilst the assets making up Tier 2 also include reserves, for our purposes, the primary focus is on subordinated debt. It is also worth noting that as this is largely a bank requirement for funding and liquidity, corporates do not generally issue Tier 2 capital instruments and their subordinated debt is not included within our Tier 2 universe. Figure 1 below shows the flattening that we’ve seen since January as supply has mostly dried up and the domestic interest rate environment remains well and truly subdued. Figure 1. The Tier 2 Curve has compressed significantly since the start of the year…  Source: BondAdviser, Bloomberg Investors may be wondering why the supply tap has slowed to a trickle, as one would naturally assume that banks would make the most of the record-low interest rate environment to issue as much debt as possible before rates inevitably rise over the next few years. One of the main reasons is that throughout 2018, domestic banks have remained very well-capitalised and are on-track to meet APRA’s 2020 “unquestionably strong” minimum capital requirements (figure 2). Whilst being a credit positive for investors in the banks, this balance sheet strength has ultimately been a leading cause behind the scene, with the likes of AMP (AMPHA), Suncorp (SUNPD) and Westpac (WBCHB) redeeming or planning to redeem their listed instruments before the end of the year. Figure 2. The Major Banks Remain Well-Capitalised and On-Track to Meet APRA’s Requirements…

Source: BondAdviser, Bloomberg Investors may be wondering why the supply tap has slowed to a trickle, as one would naturally assume that banks would make the most of the record-low interest rate environment to issue as much debt as possible before rates inevitably rise over the next few years. One of the main reasons is that throughout 2018, domestic banks have remained very well-capitalised and are on-track to meet APRA’s 2020 “unquestionably strong” minimum capital requirements (figure 2). Whilst being a credit positive for investors in the banks, this balance sheet strength has ultimately been a leading cause behind the scene, with the likes of AMP (AMPHA), Suncorp (SUNPD) and Westpac (WBCHB) redeeming or planning to redeem their listed instruments before the end of the year. Figure 2. The Major Banks Remain Well-Capitalised and On-Track to Meet APRA’s Requirements…  Source: BondAdviser, Company Reports Also contributing to this issue has been a gradual move towards offshore issuance by the banks in recent years due largely to the deeper and more developed bond markets abroad. Banks have traditionally issued in a range of currencies in a variety of markets, and the strong balance sheets of the Australian domestic banks has meant that they have enjoyed strong demand for their debt when they tap the markets abroad. This has in-part been due to the record-low interest rate environment seen around the globe which is a residual from the GFC, as central banks slashed rates in an attempt to salvage their economic strength and viability. This interest rate environment has largely been the reason why banks are able to issue cheap debt and see the sustained demand as investors have little in the way of alternatives. With the US yield curve continuing to rise as a result of monetary policy divergence, with the Fed raising rates amidst other laissez-faire central banks, the conditions for Tier 2 issuance appear set to remain sub-optimal. Figure 3 demonstrates the resurgence of this trend in recent years following negative net issuance in the post-GFC credit environment. Figure 3. Net Bond Issuance by the Australian Banks has seen Offshore Issuance Rising…

Source: BondAdviser, Company Reports Also contributing to this issue has been a gradual move towards offshore issuance by the banks in recent years due largely to the deeper and more developed bond markets abroad. Banks have traditionally issued in a range of currencies in a variety of markets, and the strong balance sheets of the Australian domestic banks has meant that they have enjoyed strong demand for their debt when they tap the markets abroad. This has in-part been due to the record-low interest rate environment seen around the globe which is a residual from the GFC, as central banks slashed rates in an attempt to salvage their economic strength and viability. This interest rate environment has largely been the reason why banks are able to issue cheap debt and see the sustained demand as investors have little in the way of alternatives. With the US yield curve continuing to rise as a result of monetary policy divergence, with the Fed raising rates amidst other laissez-faire central banks, the conditions for Tier 2 issuance appear set to remain sub-optimal. Figure 3 demonstrates the resurgence of this trend in recent years following negative net issuance in the post-GFC credit environment. Figure 3. Net Bond Issuance by the Australian Banks has seen Offshore Issuance Rising…  Source: BondAdviser, ABS Ultimately, the flattening of the local Tier 2 curve is driven by limited supply and the strong demand for Australian bond overseas. Whilst there may re-emerge greater yield opportunities as the Australian Royal Commission concludes next year and the impact Commissioner Kenneth Hayne’s findings or recommendations for the banks remain unknown, the Tier 2 universe is arguably lacking in both yield and opportunities for credit investors in the current environment. Ultimately, it is our expectation that whilst an ever-changing regulatory environment may result in Tier 2 debt continuing to be a staple of bank balance sheets, based on the above, we expect supply will remain low and the Tier 2 curve to remain broadly flat in the short to medium term.

Source: BondAdviser, ABS Ultimately, the flattening of the local Tier 2 curve is driven by limited supply and the strong demand for Australian bond overseas. Whilst there may re-emerge greater yield opportunities as the Australian Royal Commission concludes next year and the impact Commissioner Kenneth Hayne’s findings or recommendations for the banks remain unknown, the Tier 2 universe is arguably lacking in both yield and opportunities for credit investors in the current environment. Ultimately, it is our expectation that whilst an ever-changing regulatory environment may result in Tier 2 debt continuing to be a staple of bank balance sheets, based on the above, we expect supply will remain low and the Tier 2 curve to remain broadly flat in the short to medium term.