The financial world has been littered with pieces discussing, generally in a distinctively disapproving tone, the true motivations behind the Evans Dixon Group and its New York-focused US Masters Residential Property Fund (URF). Although we will not completely dissect the strategy’s positives and negatives since inception, there are some very obvious lessons to be understood.

In isolation, the initial premise of the Fund was solid enough – capitalise on a very high Australian dollar price (2010-2011) and the aftermath (to the US) of the credit crisis to acquire knock-down real estate in New York, refurbish properties and sell for a profit or let at much-increased rents. However, a brief look into the history of the URF will turn up many choices made which were not wise or overall favourable for investors. At the heart of the problem are the vertical integration and fee structures of both the URF and its parent, the Evans Dixon Group.

It has been widely reported that Dixon Advisory clients, prior to its merger with Evans & Partners in 2017, were recommended to invest in the URF ordinary units, as well as the listed debt securities issued by the property fund. It subsequently emerged that Dixon Advisory collected $56 million in fees (FY17) from investors in the URF, which accounted for a large portion of the advisory group’s total revenues.

There are multiple fee mechanisms contributing to the (now) Evans Dixon Group and we are also not enthusiastic about of the opacity surrounding intra-group entities. The above total is even after a lauded reduction of fees by the manager.

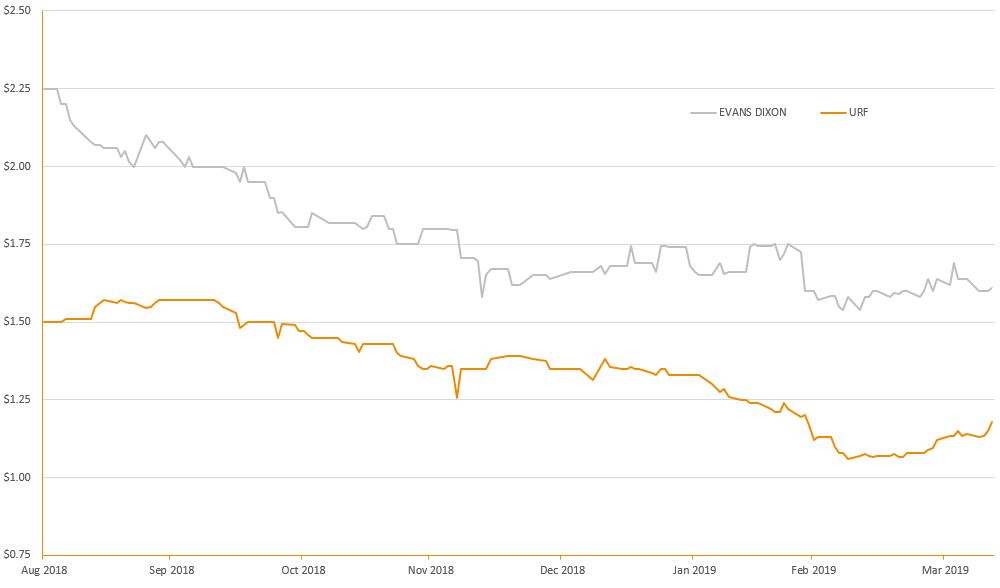

It is clear that this conflict has had a reputational impact on both the Evans Dixon Group and the URF entity (ASX: URF) itself with the main fund currently trading at $1.17, up from its all time low of $1.06 last month, but still 28% lower than its price one year ago. Shares in the Evans Dixon Group (ASX: ED1) have also suffered heavily since floating.

Figure 1. URF and ED1 Share Prices

A further cause for concern to investors in the Fund is its price in relation to net tangible assets, estimated by the URF at an unaudited value of $1.55 per unit, before withholding tax on unpaid distributions (as at March 31, with post-tax NTA of $1.35). This implies a current unit price discount to net tangible assets of approximately 25% and is an area that the Fund managers have stated they wish to address via ‘strategic alternatives’, whatever these might be (most likely precluding an equity raise).

From a credit perspective, the reputational issues and current net tangible assets discount have noticeable ramifications. While note holders of issues closer to redemption (ASX: URFHB and URFHC) have seen only a small drop in market value, note holders of the December 2017 issued Convertible Step-Up Preference Unitshave seen a very dramatic decline (ASX: URFPA), most likely equity correlated.

Figure 1. URF Debt Securities

There are further implications from the current predicament – the damage to reputation will likely adversely affect the pricing of any potential new issues, requiring an exorbitant premium to attract investors. As mentioned, the Fund’s ability to raise new equity capital is also greatly hindered, given the discount to NTA would greatly dilute existing shareholders. The URFHB Notes mature in December 2020 having missed their call date of December 2018. The URFHC Notes have a call date this December, which we do not believe will be met, and mature two years later (2021).

So, URF has $90 million to repay in 1.75 years and $175 million to repay in 2.75 years. The Convertible Notes issued $200 million and are potentially perpetual if not converted by URF (but step up to a higher interest). Assuming URF cannot refinance the Notes, asset sales could be a likely solution but would erode future equity value as clearly seen in the above charts. This may also narrow the gap to NAV in a not-positive way if properties are sold below book value.

Who knows what the future will bring, but we can say confidently that vertical integration presents an inherently riskier scenario to investors than alternatives, particularly in relation to conflicts of management interests. Whether or not the URF was merely a vehicle to repeatedly and variously overcharge clients, it clearly faces some testing times in the short-to-medium term.

As always, thorough research on such instruments can reveal a great deal about any potential conflicts or uncertainty. We ceased coverage of all URF securities some years ago for this very reason, coupled with a concern over the actual fees charged.

We are somewhat surprised the main bonds are holding up as well as they are, but they are high-interest (popular), which is appealing and appear to have a significant net asset buffer at the URF fund level. We will watch with interest both the price movements and evolving story behind the URF, but the key mixed-metaphorical lesson is that one cannot forever milk the golden goose without spilling blood.