Much has been said in recent months about the wider stability (or lack of) within Italian Banking. Likewise, the apparent unpredictability of US markets has also been well publicised. BondAdviser has provided various comments on both topics in previous additions of Up the Curve, available here.

Late last month, following a systemic selloff in risk assets, the 10-year government bond yields for these two nations were trading at an identical rate of 2.46%.

It is important to highlight what this represents. The concept of a risk free-rate, or the yield of government-issued securities, is widely appreciated and a bedrock of capitalism and pricing calculations. It is an idea so intuitive that the general investing public throughout the developed world is happy to equate government yields with a hypothetical risk-free investment. So, what should be deciphered from the recent parity of Italian and US 10-year government bond yields?

Italian 10-year government bond yields had followed a steep upward trend to conclude 2018. This sharp rise over a period of months was attributed to a range of factors, including the recently elected populist coalition government’s attempts to defy the European Central Bank’s common rules in controlling national debt. Recent yield spikes have also brought into specific relief the serious flaws in the Italian financial system, exposing the underlying risks present to both rating agencies and investors alike.

But an important downward shift followed the 10-year yield peak of 3.69% in October last year – its highest mark since 2014. Though the Italian national debt has remained above €2 trillion, positive macro data in the first quarter of 2019 and the expectations of a coalition break-up have contributed to generally positive market performance. Earlier this week 10-year government bond yields in Italy declined to an 11-month low of 2.45%.

Figure 1. Italian 10-year Government Bond Yields vs US 10-year Government Bond Yields

A sharp contrast to this rising trend of stability, if that is what is being reflected within the movements of Italian yields, is the movement of US yields. Early last week, US 10-year yields hit a low of 2.37% – the lowest mark since 2017, before slightly rebounding. This is noteworthy because 3-month bond yields had risen above this rate, causing a much-analysed inversion of the yield curve.

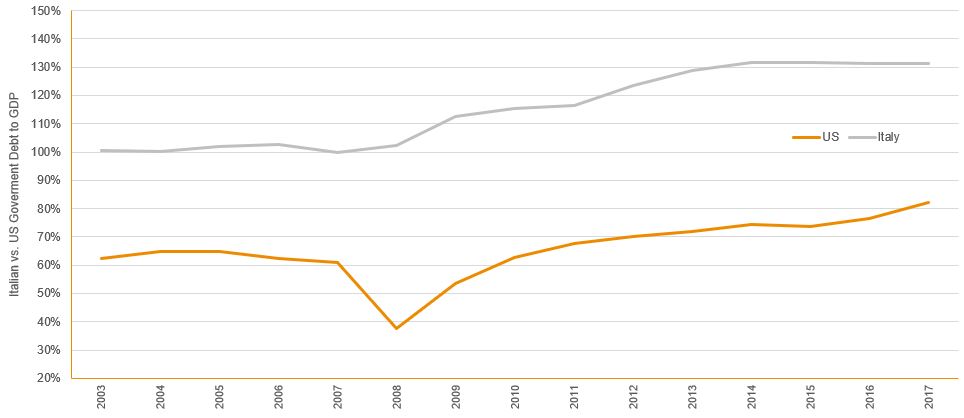

Much has been made of the “recession predictability” this phenomenon possesses. Yet it is the apparent lack of distinction or preference for investment between these two nations which may be most puzzling and, on the surface, counterintuitive. What the convergence of these two yield curves would appear to indicate is that, FX and cross-currency basis rates aside, the two present equal propositions of risk. Cognitively, this appears well removed from any sound logic. A more objective picture of this can be taken when comparing GDP/debt figures from both countries.

Figure 1. Italian vs US GDP as Percentage of Debt

Although positive signs are evident in the movement of the Italian 10-year government bond yields, one should not mistake these two economies as being equally risk-free. We would avoid penning a hardline theory as to why the market has converged – social, political and economic developments across both nations wield vast influence. Yet we would avoid equating the two economies in terms of risk, regardless of these recent market movements.

To turn a domestic eye toward this conversation, the Australian 10-year government bond yields have followed this wider global trend of falling bond yields, losing over 30 basis points in March and dropping to a low of 1.73%. Last week, just as in the US, the Australian 3-month vs. 10-year curves crossed paths, battling concerns of weaker global growth and reduced talk of interest rate rises.

Figure 3. Australian 3-month vs 10-year Government Bond Yields

Source: BondAdviser, Bloomberg

We would again be loath to pen a thesis on the apparently less risky risk-free pricing of the Australian 10-year government bond yields, when compared to both Italy and the US. However, and not surprisingly, the Australian financial market has unquestionably followed more textbook behaviours, including a risk-free rate which has been truly risk free.

Whilst the fluctuations in Italy and the US can be viewed within a wider global trend, they highlight the importance of both central bank independence and political stability in economic health. They also highlight the individuality of each economy’s risk-free rate, and its limitations as a comparison tool between nations.