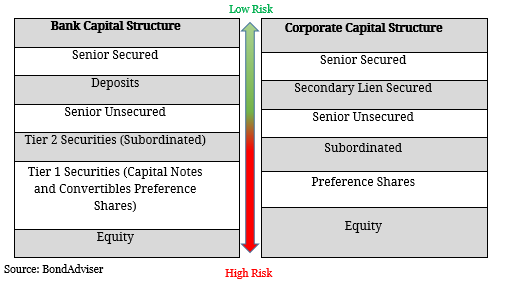

In Australia, financial institutions continually use debt capital markets as source of funding. But what about other companies? The majority of ASX200 non-financial groups tend to issue overseas in larger markets such as the UK, the Eurozone, Singapore and the US. From our findings, we discovered on average 44% of borrowings for ASX200 companies that have marketable debt in Australia is domiciled outside Australia (i.e. in the form of Foreign Bonds, US Private Placements and Euro-dollar debt). This is primarily of function of funding diversification, allowing these companies to tap different funding sources when needed. In Australian debt markets, most of these companies issue in the over-the-counter (OTC) market which is generally out of reach to retail investors. However, how analysis has uncovered 146 different securities that meet special eligibility requirements to be transmuted into listed Chess Depository Interests (CDIs). This enables the holder to receive coupon payments and principal repayment at maturity from the security over which the CDI has been issued without holding the security directly (similar to Australian Government Bonds trading on the ASX currently). This would significantly improve retail access into the fixed income asset class and allow investors to lower the risk of their portfolios by allocating funds further up the capital structure.

| Group | Ticker | Rated | Debt ($Am) | Bank Debt% | ASX Listed Debt% | Aus OTC Debt% | Overseas Debt% |

| AGL Energy | AGL | Yes | $3,129 | 46% | 21% | 19% | 14% |

| Alumina | AWC | Yes | $152 | 18% | 0% | 82% | 0% |

| APA Group | APA | Yes | $9,366 | 11% | 5% | 3% | 80% |

| Asciano | AIO | Yes | $3,839 | 16% | 0% | 9% | 75% |

| Ausnet Services | AST | Yes | $6,898 | 0% | 0% | 22% | 78% |

| BHP Billiton | BHP | Yes | $50,153 | 6% | 0% | 5% | 89% |

| BWP Trust | BWP | Yes | $480 | 58% | 0% | 42% | 0% |

| Caltex Australia | CTX | Yes | $694 | 0% | 78% | 22% | 0% |

| Coca Cola Limited | CCL | Yes | $2,536 | 8% | 0% | 6% | 86% |

| Crown Resorts | CWN | Yes | $3,064 | 25% | 37% | 24% | 14% |

| Dexus Property | DXS | Yes | $3,286 | 37% | 0% | 18% | 45% |

| Downer Edi | DOW | No | $646 | 6% | 0% | 72% | 23% |

| Duet Group | DUE | No | $6,201 | 56% | 0% | 31% | 13% |

| G8 Education | GEM | No | $535 | 0% | 0% | 22% | 78% |

| Goodman Group | GMG | Yes | $2,873 | 13% | 0% | 0% | 87% |

| GPT Group | GPT | Yes | $2,958 | 59% | 0% | 21% | 20% |

| Incitec Pivot | IPL | Yes | $2,252 | 45% | 0% | 9% | 46% |

| Investa Office Fund | IOF | Yes | $1,098 | 48% | 0% | 11% | 41% |

| Lendlease | LLC | Yes | $2,593 | 47% | 0% | 18% | 35% |

| Mirvac Group | MGR | Yes | $3,243 | 39% | 0% | 19% | 42% |

| Nufarm | NUF | Yes | $1,204 | 62% | 0% | 0% | 38% |

| Origin Energy | ORG | Yes | $9,488 | 7% | 9% | 0% | 84% |

| Qantas Airways | QAN | Yes | $5,244 | 77% | 0% | 18% | 5% |

| Ramsay Health Care | RHC | No | $3,367 | 92% | 8% | 0% | 0% |

| Scentre Group | SCG | Yes | $11,103 | 13% | 0% | 21% | 67% |

| Seven Group Holdings | SVW | No | $2,210 | 43% | 22% | 0% | 34% |

| Shopping Centres Australasia | SCP | No | $762 | 44% | 0% | 23% | 34% |

| Stockland | SGP | Yes | $3,677 | 4% | 0% | 19% | 77% |

| Sydney Airport | SYD | Yes | $8,181 | 18% | 0% | 35% | 47% |

| Tabcorp Holdings | TAH | Yes | $1,411 | 67% | 18% | 0% | 15% |

| Tatts Group | TTS | No | $933 | 45% | 21% | 0% | 34% |

| Telstra | TLS | Yes | $14,434 | 6% | 0% | 19% | 75% |

| Transurban | TCL | No | $12,194 | 27% | 0% | 10% | 63% |

| Vicinity | VCX | No | $4,717 | 56% | 0% | 22% | 23% |

| Wesfarmers | WES | Yes | $6,282 | 11% | 0% | 29% | 60% |

| Woolworths | WOW | Yes | $4,715 | 1% | 15% | 21% | 64% |

Source: Company Reports (last reporting date), BondAdviser Estimates