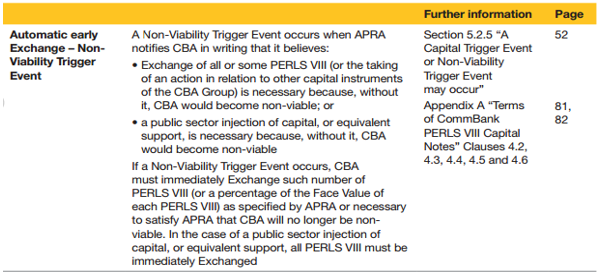

Since 1 January 2013 all Australian Banks regulated by the Australian Prudential Regulation Authority (APRA) have issued hybrid securities (also known as Additional Tier 1 (AT1) capital securities) that include terminology called a non- viability trigger event which is designed to absorb losses in a time of stress while the bank is still a going concern. These loss-absorption triggers allow the principal of the security to be written down or converted to common equity when APRA deems the bank to be non-viable. This has the effect of strengthening the banks’ capital position at a time when raising additional equity would otherwise be difficult. Allowing the issuer to miss coupon payments can also reduce pressure on liquidity. The problem is trying to understand what APRA (at their sole discretion) deems as the point of non-viability (PNV). While this is described in the prospectus (see example in Figure 1) it is very difficult to understand how this sort of event could occur. Figure 1. An example of a “Non-Viability Trigger Event” clause.  Source: Commbank PERLS VIII Capital Notes Prospectus, 16 February 2016 The intensity of APRA’s supervisory attention on a particular bank increases as its capital level falls and it approaches the PNV. This process is summarised in Figure 2. It is clear that the regulators want to pre-empt any situation whereby a bank potentially reaches a PNV long before they get there. While this has always been the case, recent regulatory changes have arguably made this process a lot more transparent. Figure 2: How APRA would respond to declining CET1 ratios

Source: Commbank PERLS VIII Capital Notes Prospectus, 16 February 2016 The intensity of APRA’s supervisory attention on a particular bank increases as its capital level falls and it approaches the PNV. This process is summarised in Figure 2. It is clear that the regulators want to pre-empt any situation whereby a bank potentially reaches a PNV long before they get there. While this has always been the case, recent regulatory changes have arguably made this process a lot more transparent. Figure 2: How APRA would respond to declining CET1 ratios  Source: APRA Prudential Practice Guide A lot of Australian Regulatory experience can be drawn from the banking sector problems of the mid-1980s and early 1990s. Deregulation during the mid-1980s had intensified competition and led to the desire of institutions to grow their balance sheets rapidly as a result. This took place in an environment in which asset prices, particularly commercial property prices, were increasing quickly, and credit assessment procedures at many financial institutions had not adjusted to the new liberalised environment. The result was extremely strong credit growth secured against increasingly overvalued commercial property. In 1989, the combination of high interest rates and a softening of the commercial property market exposed the poor credit quality of some of the most risky loans. Then, as the economy went into recession and the decline in property prices accelerated, more broadly based credit quality problems became evident. By mid-1992, the ratio of non-performing loans to total loans had increased to 6%. Whilst the brunt of losses during this period were borne by State government owned banks such as the State Bank of Victoria & the State Bank of South Australia, they were not alone as three of the four major Australian banks also found themselves in difficulties during this time. Westpac (WBC) struggled with its bad and doubtful debt provisions. A profit of $476 million in 1991 was earned after making provisions of $1.12 billion, and in 1992 the situation worsened, with a bad and doubtful debt provision of $2.8 billion, resulting in a loss of $1.56 billion. The 1992 expense included new specific provisions relating to “diminutions in value of property development projects”, brought about by changing valuation policy to current market value because of a disastrous fall in the property market. Similarly Australia & New Zealand Banking Corporation Ltd (ANZ) reported a loss of $579 million in 1992 due to bad and doubtful debt provisions of $1.6 billion resulting from property devaluations in Victoria in particular. Even the Commonwealth Bank of Australia (CBA) reported a provision of $1.03 billion for bad and doubtful debts in 1991 but were able to still declare a profit of $883 million. During 1992 the CBA reported an even lower profit of $409 million with provisions still high at $843 million. Where the State banks’ pre-tax losses exceeded the 1989 level of shareholders’ funds by three times, the major Australian banks were able to absorb the losses through their balance sheets with some help. If these banks had issued today’s generation of AT1 hybrids it is possible that a non-viability event may have been triggered and hybrid investors would have been ‘bailed-in’. The National Australia Bank (NAB) would follow suite a decade later when during 2001 they reflected the collapse of their United States subsidiary, HomeSide. The NAB’s net profit (after tax) was $2.083 billion, but could have been more but for the $3.617 billion of write-downs of mortgage servicing rights and goodwill. Similarly during the Global Financial Crisis (GFC) period of 2007-09 the major Australian banks, Suncorp & Bankwest all had their own issues to deal with to varying degrees. The four major Australian banks endured the GFC period relatively unscathed, in part as they were beneficiaries of the Australian Government’s Guarantee Scheme for Large Deposits & Wholesale Funding that shored up bank liquidity at a time when global bond market liquidity was almost non-existent. In 2009 Suncorp was able to set up a ‘non-core’ or ‘bad bank’ to run off $18 billion of loans consisting of mainly commercial property and corporate loans that soured after the GFC due to “inappropriate risk settings”. When these loans were ‘carved out’ of the group’s more stable regional banking franchise, the ‘‘non-core’’ loan book equalled about 20% of group assets, which was dangerously high. Whilst not all of the loans were bad, Suncorp’s funding base had been severely impacted by the collapse of the wholesale funding markets during the crisis, and as commercial property prices slid, problem loans in the portfolio grew. It is under this type of scenario that it is quite possible that APRA could indeed decide to call a non-viability event and decide to ‘bail-in’ AT1 hybrid investors. In the case of Bankwest, their business lending book was called into question following the CBA’s purchase of the business from UK bank HBOS plc. Under the ownership of HBOS, Bankwest was very dependent on funding secured by its UK-based parent. Bankwest representatives advised that at this time 65% of Bankwest’s funding was self-funded from Australian deposits, with the remainder ($17 billion) funded through wholesale funding secured by HBOS. HBOS themselves however were particularly exposed to the GFC and in 2008 found itself with a vulnerable funding position and experiencing a run on its shares. In June 2008 a number of upbeat statements attributed to Bankwest executives regarding the safety of Bankwest were reported in the media, however, the situation in the UK became dire. In September 2008, at a time when the crisis had taken a dramatic turn and HBOS’s position had substantially worsened, a deal for Lloyds TSB to acquire HBOS was negotiated. The UK government subsequently announced it would make a capital investment into the merged firm, acquiring a stake of approximately 43.4%. At the subsequent Parliamentary joint committee on Corporations & Financial Services inquiry into the impairment of customer loans, one of the Bankwest executives to whom the positive statements reported in the media in June 2008 were attributed acknowledged the pressures that HBOS were under during that time, but maintained that ‘the reason HBOS had to sell Bankwest was more about its difficulties in the UK than its position in Australia’. Overall, it is clear there were serious issues at Bankwest. A previous managing director of the bank (appointed following the acquisition by the CBA) stated during his evidence to a 2009 inquiry that ‘the previous owners had to stop writing business; they could not continue to write business given the funding pressures they were under’. Once again, had the current regulatory regime been in place and Bankwest had issued current generation AT1 hybrid securities, it is possible that they would have been ‘bailed-in’ by APRA. Today’s environment bears some similarities to those experienced during the 1990s and the GFC, except that it is the Australian housing market (rather than the commercial property market) that is the main area of concern. APRA in their Insight Issue One 2016 documented the findings resulting from their increased scrutiny of mortgage lending practices and risk profiles of Australian ADI’s (See The Housing Squeeze is On). This has led to the banks being far more vigilant when approving loans over the last 6-9 months in particular as lending standards continue to be tightened as evidenced by the banks scrutinising both internal and external mortgage broker loan applications and whether the underlying borrower has a domestic or overseas income as well as determining whether they are an owner occupier or investor. Conclusions: Hopefully sufficient remedial action by the Australian regulators will be enough to head off these potential issues before we experience either increasing interest rates (both globally and domestically) and/or a higher unemployment rate. If an economic slowdown is unable to be avoided despite historically low interest rates both domestically and overseas that are clearly being held down in an attempt to stimulate economic growth, banks mortgage loan books could come under stress. Although these new measures are yet to be tested, history shows how events that can cause a non-viability event trigger can accelerate and spiral out of control if not dealt with before they become too large to remain in control. During the early 1990s and in the lead up years to the GFC it was the apparent lack of ability by both the regulators and the ADI’s themselves to self-diagnose issues within ADI balance sheets that contributed to rapid and substantial loss of capital. Prudent lending practices were not being adhered to. In this regard, positive steps have been taken by the regulators to provide more robust and transparent mechanisms to reduce, but not completely eliminate the risk of another banking sector crisis from occurring. Whether we see another banking crisis within Australia is largely the responsibility of the senior management teams of all Australian banks and their respective Boards to ensure that all employees, both direct and indirect (external mortgage brokers), are not repeating the same lending mistakes that were highlighted during the 1980s, 1990s and the GFC. Controls and checks & balances are in place to help all Australian banks understand the risks of the loans that they are writing. However, acting prudently will come at a cost with the most obvious one being that ADI profitability and dividend payout ratios may decline over time. This will not happen overnight because to careful and gradual deleveraging period is needed to avoid a credit crunch. It also remains to be seen whether APRA would trigger a non-viability event even if one was warranted for fear of causing even higher levels of uncertainty and therefore market volatility. In summary, the above case studies touch upon a number of the most common reasons listed below as to how a bank can have serious financial problems and eventually fail:

Source: APRA Prudential Practice Guide A lot of Australian Regulatory experience can be drawn from the banking sector problems of the mid-1980s and early 1990s. Deregulation during the mid-1980s had intensified competition and led to the desire of institutions to grow their balance sheets rapidly as a result. This took place in an environment in which asset prices, particularly commercial property prices, were increasing quickly, and credit assessment procedures at many financial institutions had not adjusted to the new liberalised environment. The result was extremely strong credit growth secured against increasingly overvalued commercial property. In 1989, the combination of high interest rates and a softening of the commercial property market exposed the poor credit quality of some of the most risky loans. Then, as the economy went into recession and the decline in property prices accelerated, more broadly based credit quality problems became evident. By mid-1992, the ratio of non-performing loans to total loans had increased to 6%. Whilst the brunt of losses during this period were borne by State government owned banks such as the State Bank of Victoria & the State Bank of South Australia, they were not alone as three of the four major Australian banks also found themselves in difficulties during this time. Westpac (WBC) struggled with its bad and doubtful debt provisions. A profit of $476 million in 1991 was earned after making provisions of $1.12 billion, and in 1992 the situation worsened, with a bad and doubtful debt provision of $2.8 billion, resulting in a loss of $1.56 billion. The 1992 expense included new specific provisions relating to “diminutions in value of property development projects”, brought about by changing valuation policy to current market value because of a disastrous fall in the property market. Similarly Australia & New Zealand Banking Corporation Ltd (ANZ) reported a loss of $579 million in 1992 due to bad and doubtful debt provisions of $1.6 billion resulting from property devaluations in Victoria in particular. Even the Commonwealth Bank of Australia (CBA) reported a provision of $1.03 billion for bad and doubtful debts in 1991 but were able to still declare a profit of $883 million. During 1992 the CBA reported an even lower profit of $409 million with provisions still high at $843 million. Where the State banks’ pre-tax losses exceeded the 1989 level of shareholders’ funds by three times, the major Australian banks were able to absorb the losses through their balance sheets with some help. If these banks had issued today’s generation of AT1 hybrids it is possible that a non-viability event may have been triggered and hybrid investors would have been ‘bailed-in’. The National Australia Bank (NAB) would follow suite a decade later when during 2001 they reflected the collapse of their United States subsidiary, HomeSide. The NAB’s net profit (after tax) was $2.083 billion, but could have been more but for the $3.617 billion of write-downs of mortgage servicing rights and goodwill. Similarly during the Global Financial Crisis (GFC) period of 2007-09 the major Australian banks, Suncorp & Bankwest all had their own issues to deal with to varying degrees. The four major Australian banks endured the GFC period relatively unscathed, in part as they were beneficiaries of the Australian Government’s Guarantee Scheme for Large Deposits & Wholesale Funding that shored up bank liquidity at a time when global bond market liquidity was almost non-existent. In 2009 Suncorp was able to set up a ‘non-core’ or ‘bad bank’ to run off $18 billion of loans consisting of mainly commercial property and corporate loans that soured after the GFC due to “inappropriate risk settings”. When these loans were ‘carved out’ of the group’s more stable regional banking franchise, the ‘‘non-core’’ loan book equalled about 20% of group assets, which was dangerously high. Whilst not all of the loans were bad, Suncorp’s funding base had been severely impacted by the collapse of the wholesale funding markets during the crisis, and as commercial property prices slid, problem loans in the portfolio grew. It is under this type of scenario that it is quite possible that APRA could indeed decide to call a non-viability event and decide to ‘bail-in’ AT1 hybrid investors. In the case of Bankwest, their business lending book was called into question following the CBA’s purchase of the business from UK bank HBOS plc. Under the ownership of HBOS, Bankwest was very dependent on funding secured by its UK-based parent. Bankwest representatives advised that at this time 65% of Bankwest’s funding was self-funded from Australian deposits, with the remainder ($17 billion) funded through wholesale funding secured by HBOS. HBOS themselves however were particularly exposed to the GFC and in 2008 found itself with a vulnerable funding position and experiencing a run on its shares. In June 2008 a number of upbeat statements attributed to Bankwest executives regarding the safety of Bankwest were reported in the media, however, the situation in the UK became dire. In September 2008, at a time when the crisis had taken a dramatic turn and HBOS’s position had substantially worsened, a deal for Lloyds TSB to acquire HBOS was negotiated. The UK government subsequently announced it would make a capital investment into the merged firm, acquiring a stake of approximately 43.4%. At the subsequent Parliamentary joint committee on Corporations & Financial Services inquiry into the impairment of customer loans, one of the Bankwest executives to whom the positive statements reported in the media in June 2008 were attributed acknowledged the pressures that HBOS were under during that time, but maintained that ‘the reason HBOS had to sell Bankwest was more about its difficulties in the UK than its position in Australia’. Overall, it is clear there were serious issues at Bankwest. A previous managing director of the bank (appointed following the acquisition by the CBA) stated during his evidence to a 2009 inquiry that ‘the previous owners had to stop writing business; they could not continue to write business given the funding pressures they were under’. Once again, had the current regulatory regime been in place and Bankwest had issued current generation AT1 hybrid securities, it is possible that they would have been ‘bailed-in’ by APRA. Today’s environment bears some similarities to those experienced during the 1990s and the GFC, except that it is the Australian housing market (rather than the commercial property market) that is the main area of concern. APRA in their Insight Issue One 2016 documented the findings resulting from their increased scrutiny of mortgage lending practices and risk profiles of Australian ADI’s (See The Housing Squeeze is On). This has led to the banks being far more vigilant when approving loans over the last 6-9 months in particular as lending standards continue to be tightened as evidenced by the banks scrutinising both internal and external mortgage broker loan applications and whether the underlying borrower has a domestic or overseas income as well as determining whether they are an owner occupier or investor. Conclusions: Hopefully sufficient remedial action by the Australian regulators will be enough to head off these potential issues before we experience either increasing interest rates (both globally and domestically) and/or a higher unemployment rate. If an economic slowdown is unable to be avoided despite historically low interest rates both domestically and overseas that are clearly being held down in an attempt to stimulate economic growth, banks mortgage loan books could come under stress. Although these new measures are yet to be tested, history shows how events that can cause a non-viability event trigger can accelerate and spiral out of control if not dealt with before they become too large to remain in control. During the early 1990s and in the lead up years to the GFC it was the apparent lack of ability by both the regulators and the ADI’s themselves to self-diagnose issues within ADI balance sheets that contributed to rapid and substantial loss of capital. Prudent lending practices were not being adhered to. In this regard, positive steps have been taken by the regulators to provide more robust and transparent mechanisms to reduce, but not completely eliminate the risk of another banking sector crisis from occurring. Whether we see another banking crisis within Australia is largely the responsibility of the senior management teams of all Australian banks and their respective Boards to ensure that all employees, both direct and indirect (external mortgage brokers), are not repeating the same lending mistakes that were highlighted during the 1980s, 1990s and the GFC. Controls and checks & balances are in place to help all Australian banks understand the risks of the loans that they are writing. However, acting prudently will come at a cost with the most obvious one being that ADI profitability and dividend payout ratios may decline over time. This will not happen overnight because to careful and gradual deleveraging period is needed to avoid a credit crunch. It also remains to be seen whether APRA would trigger a non-viability event even if one was warranted for fear of causing even higher levels of uncertainty and therefore market volatility. In summary, the above case studies touch upon a number of the most common reasons listed below as to how a bank can have serious financial problems and eventually fail:

- Bad loans

- Funding issues

- Regulatory issues

- Proprietary trading

- Non-bank activities

- Risk management decisions

- Runs on banks

- Inappropriate loans to bank insiders

- Rogue employees

- Asset/liability mismatch