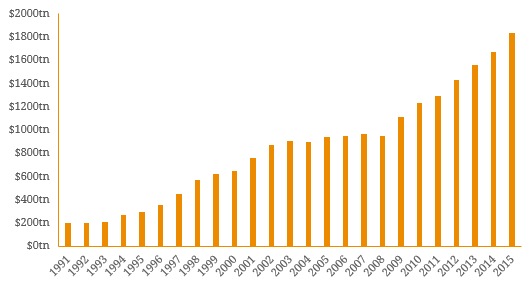

While hybrid securities are generally Australian investors’ primary choice for high income products, high-yield bond markets constitute a growing alternative. A high-yield bond is typically non-investment grade (i.e. low credit rating or unrated) and compensates investors by paying a relatively higher coupon for this additional credit risk. In the US and Europe, the high-yield bond market is large (US$1.4 trillion in the US and ~$420 billion in Europe) and closely watched by many analysts and market commentators as a gauge for corporate default rates and broader economic health. Figure 1. Global US dollar-denominated high-yield bond market size  Source: JP Morgan While bank debt is typically the funding norm for Australian companies, the growing regulatory burden bestowed upon the domestic banking system has ensued some limitations on risk-based lending exposures. As a result, a number of unrated companies have bypassed the banks and engaged capital markets by issuing high-yielding fixed income instruments. This includes listed transactions such as Peet Bonds (ASX: PPCHA), IMF Bentham Bonds (ASX: IMFHA) and URF Notes I, II and III (ASX: URFHA, URFHB, URFHC) and unlisted (over-the-counter/wholesale) transactions from issuers such as Capitol Health (ASX: CAJ), NextDC (ASX: NXT), G8 Education (ASX: GEM) and Cash Converters (ASX: CCV). We note that the Alumina 7.25% 2019 XTB (ASX: YTMAWC) has also became a high-yielding instrument following a double notch credit downgrade which triggered coupon step-up clause. In a global context, these securities would constitute high-yield bonds. Figure 2. High Yield Bond Issuance in Australia

Source: JP Morgan While bank debt is typically the funding norm for Australian companies, the growing regulatory burden bestowed upon the domestic banking system has ensued some limitations on risk-based lending exposures. As a result, a number of unrated companies have bypassed the banks and engaged capital markets by issuing high-yielding fixed income instruments. This includes listed transactions such as Peet Bonds (ASX: PPCHA), IMF Bentham Bonds (ASX: IMFHA) and URF Notes I, II and III (ASX: URFHA, URFHB, URFHC) and unlisted (over-the-counter/wholesale) transactions from issuers such as Capitol Health (ASX: CAJ), NextDC (ASX: NXT), G8 Education (ASX: GEM) and Cash Converters (ASX: CCV). We note that the Alumina 7.25% 2019 XTB (ASX: YTMAWC) has also became a high-yielding instrument following a double notch credit downgrade which triggered coupon step-up clause. In a global context, these securities would constitute high-yield bonds. Figure 2. High Yield Bond Issuance in Australia  Source: BondAdviser For investors wanting to take a more diversified approach, an alternate option for high yield exposure could be the iShares Global High Yield Bond (AUD Hedged) ETF (ASX: IHHY). The fund tracks the performance of the Markit iBoxx Global Developed Markets Liquid High Yield Capped Index which measures the performance of global high-yield bond markets, primarily in the US (~64% weighting) and Europe (~27% weighting). Following a strong year for the sub asset-class, the fund has returned ~15% in 2016. Figure 3. iShares Global High Yield Bond (AUD Hedged) ETF Performance Index

Source: BondAdviser For investors wanting to take a more diversified approach, an alternate option for high yield exposure could be the iShares Global High Yield Bond (AUD Hedged) ETF (ASX: IHHY). The fund tracks the performance of the Markit iBoxx Global Developed Markets Liquid High Yield Capped Index which measures the performance of global high-yield bond markets, primarily in the US (~64% weighting) and Europe (~27% weighting). Following a strong year for the sub asset-class, the fund has returned ~15% in 2016. Figure 3. iShares Global High Yield Bond (AUD Hedged) ETF Performance Index  Source: Blackrock While the Australian fixed income market remains underdeveloped relative to its global counterparts, the growing trend of high-yield issuance is a positive step forwards and we are expecting further high-yield bond issuance in 2017. These types of high-income instruments fit in the realm of traditional fixed income and are typically less structurally complex than hybrids. This makes credit risk the standout when analysing high-yield bonds and highlights the importance of independent credit analysis.

Source: Blackrock While the Australian fixed income market remains underdeveloped relative to its global counterparts, the growing trend of high-yield issuance is a positive step forwards and we are expecting further high-yield bond issuance in 2017. These types of high-income instruments fit in the realm of traditional fixed income and are typically less structurally complex than hybrids. This makes credit risk the standout when analysing high-yield bonds and highlights the importance of independent credit analysis.