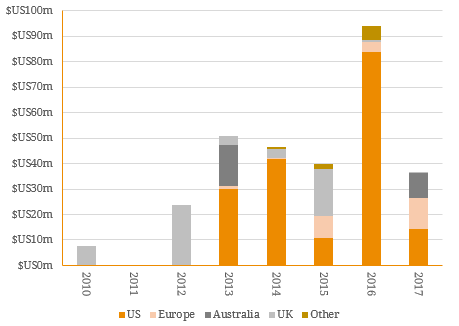

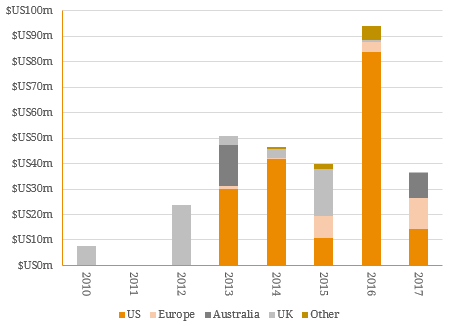

In an earlier article, we explored Ethical Fixed Income in Australia. In relation to this, an ethical product which is grabbing the interest of global investors are Social Benefit Bonds (SBBs). A social benefit bond (SBB) is an innovative way to match investors and outcomes which aims to better the wider society that we all live in via a targeted programme. An outcome payer (generally a government or semi-government) would contract a service provider, which receives up-front funding from the private sector (via the SBB). Over a set timeframe, the service provider delivers its programme as designed and agreed. Through this time investors receive tiered coupons based on outcome success rates – instilling an upside feature into the SBB. Most structures incorporate some degree of principal risk should the final measured outcome be below a set baseline. Figure 1. General SBB The Flow-Chart  Source: BondAdviser There are many underlying issues which social bonds can be designed to target such as health, unemployment and eductation. Previous Australian issues have attempted to improve foster care and mental health outcomes and to lower homelessness and reoffending rates. According to the Social Finance Network, there have been 89 bonds issued worldwide with 6 so far in Australia. If past issuance growth is repeated, there could be many more in the near future which ultimately expands the opportunity set for Australia investors. Figure 2. Annual Social Impact Bond Issuance

Source: BondAdviser There are many underlying issues which social bonds can be designed to target such as health, unemployment and eductation. Previous Australian issues have attempted to improve foster care and mental health outcomes and to lower homelessness and reoffending rates. According to the Social Finance Network, there have been 89 bonds issued worldwide with 6 so far in Australia. If past issuance growth is repeated, there could be many more in the near future which ultimately expands the opportunity set for Australia investors. Figure 2. Annual Social Impact Bond Issuance  Source: Social Finance Network Figure 3. Australian Social Benefit Bonds

Source: Social Finance Network Figure 3. Australian Social Benefit Bonds  Source: Social Finance Network As way of example, the Benevolent Society Bond was Australia’s first Social Impact Bond and the product the product of a joint-venture between the Benevolent Society, Westpac and the Commonwealth Bank. The $10 million in proceeds funded the ‘Resilient Families Service” which aimed to support up to 400 families and children in NSW. The bond was launched in response to the growing number of NSW children in foster care. Returns are calculated when the 5-year bond expires and is dependent on whether the investor holds “Class P” or ‘Class E” bonds. The former is the senior, capital protected class while the latter is the subordinated, capital exposed class. The return band is driven by the ‘Performance Percentage’ which accounts for various other factors but is largely driven by the reduction in out-of-home care entries. Using the formula to be applied at maturity, investors would theoretically receive 10.5% for “Class E” bonds and 6% for “Class P” bonds as at 30 June 2016 (the ‘Good 1’ return band). Figure 4. Theoretical Investor Returns for Maturity for the Benevolent Society Bond

Source: Social Finance Network As way of example, the Benevolent Society Bond was Australia’s first Social Impact Bond and the product the product of a joint-venture between the Benevolent Society, Westpac and the Commonwealth Bank. The $10 million in proceeds funded the ‘Resilient Families Service” which aimed to support up to 400 families and children in NSW. The bond was launched in response to the growing number of NSW children in foster care. Returns are calculated when the 5-year bond expires and is dependent on whether the investor holds “Class P” or ‘Class E” bonds. The former is the senior, capital protected class while the latter is the subordinated, capital exposed class. The return band is driven by the ‘Performance Percentage’ which accounts for various other factors but is largely driven by the reduction in out-of-home care entries. Using the formula to be applied at maturity, investors would theoretically receive 10.5% for “Class E” bonds and 6% for “Class P” bonds as at 30 June 2016 (the ‘Good 1’ return band). Figure 4. Theoretical Investor Returns for Maturity for the Benevolent Society Bond  Source: The Benevolent Society In summary the broad benefits of Social Benefit Bonds include:

Source: The Benevolent Society In summary the broad benefits of Social Benefit Bonds include:

- Investors and servicers have an incentive to be an effective and efficient as possible to the performance-based nature of the contract.

- Taxpayer money is prevented from being spent on services which could be potentially ineffective. This essentially improves the efficiency of government funding.

- New social models can be tested at a faster rate enabling the expansion of services that might explored.

- Helps bridge the gap between private investment markets and social enterprise.

As the educational bridge between investors, government entities and program providers continues to advance, we expect issuance of SBBs to increase and become a solidified pillar of Ethical Income Investing in Australia.