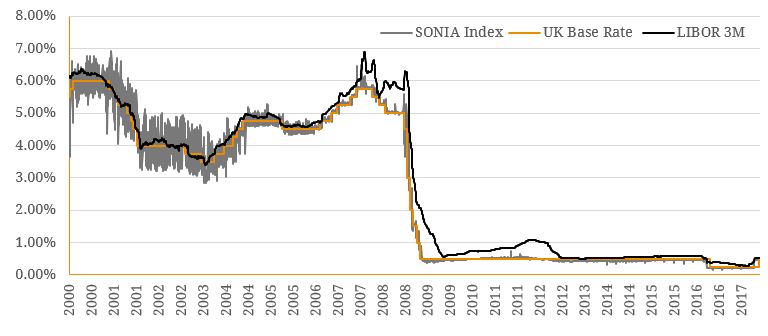

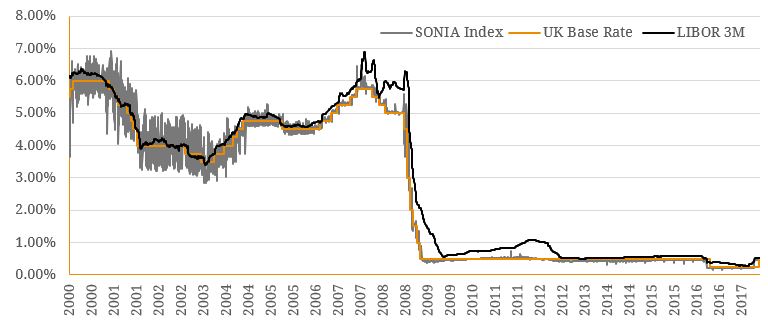

ANZ’s (ASX: ANZ) issuance of £740 million (~A$1.35 billion) on 11 January 2018 represented the first non-UK bank to launch a SONIA-linked covered bond. The competitive and sizeable issue signifies the emergence of the Sterling Overnight Index Average (SONIA) as an appropriate replacement of the London Interbank Offered Rate (LIBOR) for all issuers. Following the decline in unsecured inter-bank lending after the 2008 GFC, the volume-weighted calculation of LIBOR became an unreliable benchmark rate. LIBOR, previously seen as a key short-term lending rate around the globe and the anchor of ~US$350 trillion (A$489 trillion) of financial products, could no longer rely on high trade volumes and was therefore based off “best estimates” put forward by “experts” each day. Whilst 2008 saw markets and regulators lose some confidence in LIBOR, it was the revelations released over 2012 rate-rigging scandal, in which major banks were accused of manipulating LIBOR to profit from significant short-term trades, that really put the nail in the LIBOR coffin. Subsequently, in 2017, the UK Financial Conduct Authority (FCA), the body responsible for the administration of the Index, announced that from 2021 onwards, the panel banks would not be required to submit the mandatory rate expectations with which the LIBOR is calculated. The recent ANZ issue, which follows those of the European Investment Bank and Lloyds Banking Group, gives an indication of how banks will look to transition to the post-LIBOR environment. SONIA was created in 1997 as JP Morgan’s short-term interest rate and strategy team searched for a way to hedge short-term floating rate risk against European currencies. In April 2016, the Bank of England became the benchmark’s administrator before introducing reforms to its structure and calculation methodology in April 2018 as it pushed to replace the flawed LIBOR measurement. SONIA is a measure of the rate at which interest is paid on Sterling short-term wholesale funds where credit, liquidity and other risks are minimal. SONIA is calculated each London trading day as the “trimmed mean”1 of interest rates paid on eligible Sterling-denominated deposit transactions. A more robust measure of the short-term interest rate, SONIA is anchored to active liquid underlying markets (the average daily transaction value in the underlying market since April 2018 is approximately £45 billion or ~A$82 billion per day). This is in contrast with LIBOR, which is calculated using limited transaction data and which really relied upon a panel of banks submitting estimates of their own borrowing costs. Also hampering LIBOR’s usefulness is the lack of a liquid underlying market underpinning it with 2017 average volumes of only £183 million (A$335 million) of 3-month deposits per day. Additionally, SONIA does not include a measure of bank credit risk and therefore gives a better measure of the general level of interest rates as seen in Figure 1 below. Figure 1. Historical Benchmark Rates (2000 – Present)