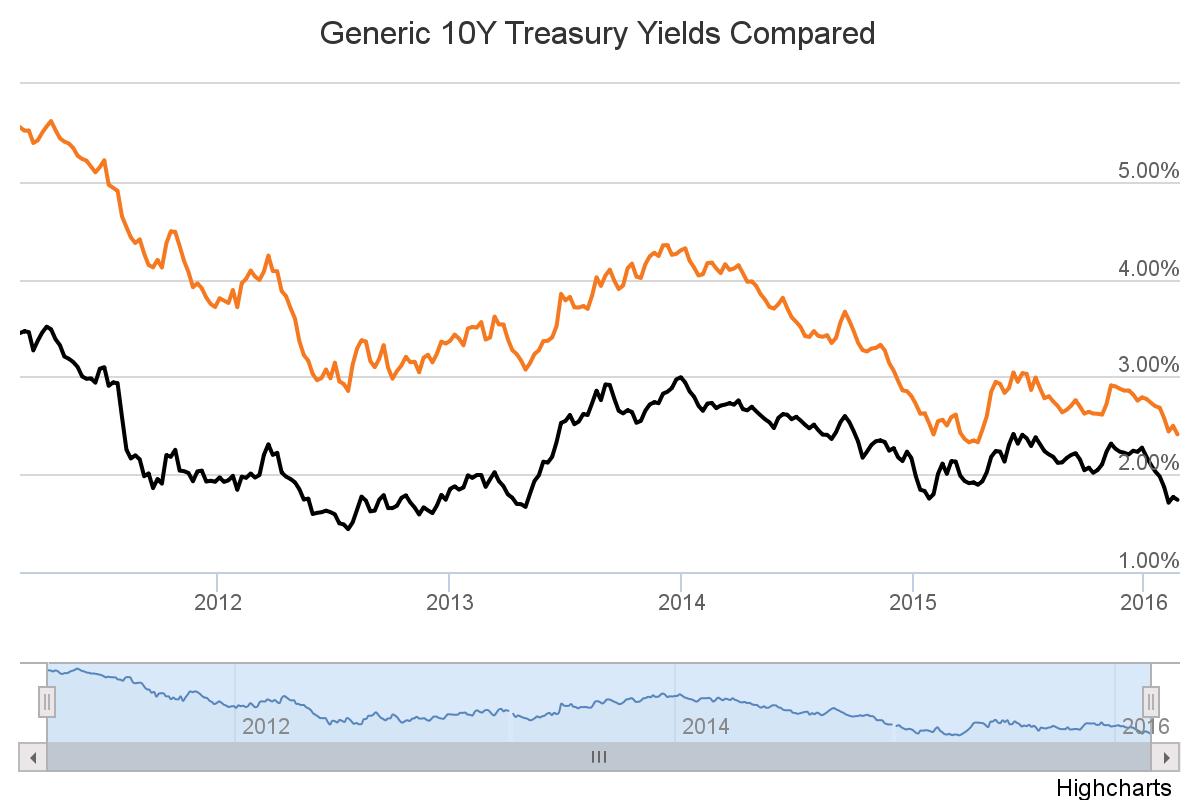

Bond markets outperformed equity last week as the Banks and BHP weighed heavily on the ASX200 while the yield curve continued its trajectory lower in anticipation of further monetary policy action. Regulated bank capital continues to be an active market with Westpac announcing the completion of a $525 million wholesale offering of Basel III compliant Tier 2 notes priced at 3 month BBSW + 3.10%. This compares to a similar offering from ANZ which priced its Tier 2 notes at 3 month BBSW +2.70% on 17th February 2016. The Westpac deal appears to have been issued at a slight premium to secondary market pricing. For retail investors the closest comparable security is Westpac’s ASX listed Tier 2 notes (ASX Code: WBCHB) which closed on Friday with a trading margin of 2.75% per annum. In the Tier 1 hybrid market the Commonwealth Bank of Australia (CBA) set the PERLS VIII margin at 5.20% per annum (low end of the 5.20% – 5.35% range) giving an initial yield of ~7.50%. The CBA allocated $910 million of PERLS VIII on a firm basis under the Broker Firm Offer with the final issue size now dependent upon applications received under the Reinvestment (for eligible PERLS III Holders) and Security Holder Offers. It is still unclear on the take-up rate by PERLS III holders ($1.166 billion on issue) which means the final issue size for PERLS VIII is still uncertain. Since the deal was announced the PERLS VII margin initially narrowed from a margin of 5.80% over swap to 5.20% before ending last week at 5.45%. In terms of senior debt the past 3 months have proven the resilience of short duration investments from the four major banks. Trading margins have widened by ~0.15 – 0.25% (3-7 year maturities) despite negative equity returns of between -11% and -17% over the same period. However, over the past week the price of senior debt seems to have stabilised despite the negative press regarding the mortgage books. Click below for Interactive Charts Chart 1: Bloomberg AUSBond Composite Index (Monthly) Chart 2: Bonds vs Equities 2014/15 (Monthly) Chart 3: Average Cost of New Bank Debt (US vs Australia) Interest Rates