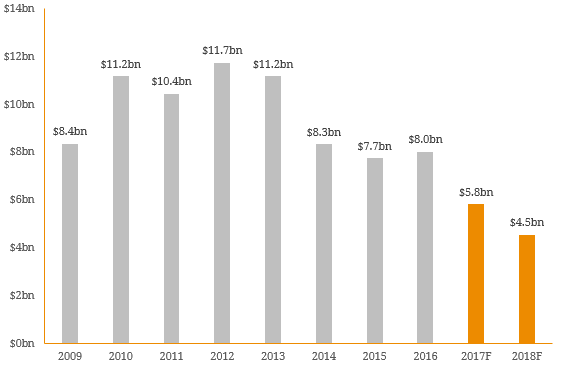

In recent years, non-financial corporate security issuance into the ASX-Listed Debt & Hybrid market has dwindled. There has been a number of factors but a standout contributor has been the change to credit rating methodology known as ‘equity-credit’ where hybrid securities are classified as equity (instead of debt) from a credit rating perspective. This maintains the underlying issuer’s credit metrics when assessed by the credit rating agencies. In 2012, Standard & Poor’s (S&P) adjusted its equity credit methodology and consequently a number of ASX-Listed income securities were reclassified from ‘High’ (100%) to ‘Intermediate’ (50%) equity credit content. This has made it less atrractive for corporates to issue into the listed market (particularly for hybrids) and therefore the volume of issuance has declined (Figure 1). Figure 1. ASX-Listed Corporate Security Issuance  Source: BondAdviser The current low cost of bank debt and relative expensiveness of ASX-listed debt issuance has also reduced the incentive for corporate issuers to tap the retail market for funds. As a result, many issuers are choosing not to roll-over existing securities but rather refinance through a combination of bank debt, cash and equity. Also, given the domestic low-growth economy, corporate balance sheets are generally healthier with stable leverage and high liquidity and thus, credit metrics are typically well within credit rating comfort zones. For this reason, the existing 50% equity credit treatment is not as useful as it once was when balance sheets were more stretched to pursue growth opportunities. This was evident at the end of 2016 when Origin Energy and Woolworths chose not to roll-over their ASX-listed subordinated notes (ORGHA, WOWHC) which left $1.6 billion of funds without reinvestment. Following these redemptions, the corporate listed market is now at its smallest outstanding issuance since 2010 and will further shrink as Tabcorp Subordinated Notes (TAHHB) and Elders Hybrid (ELDPA) are redeemed later this month. Additionally, Crown Resorts has announced the early buy-back of Crown Subordinated Notes I (CWNHA) and if completed, this will see a further $880 million of corporate redemption in 2017. There has been no managerial communication from Caltex, APA Group and Goodman Group but given the underlying business environment, it is reasonable to assume these securities will also be redeemed in favour of alternative funding sources. Figure 2. ASX-Listed Corporate Maturity Profile

Source: BondAdviser The current low cost of bank debt and relative expensiveness of ASX-listed debt issuance has also reduced the incentive for corporate issuers to tap the retail market for funds. As a result, many issuers are choosing not to roll-over existing securities but rather refinance through a combination of bank debt, cash and equity. Also, given the domestic low-growth economy, corporate balance sheets are generally healthier with stable leverage and high liquidity and thus, credit metrics are typically well within credit rating comfort zones. For this reason, the existing 50% equity credit treatment is not as useful as it once was when balance sheets were more stretched to pursue growth opportunities. This was evident at the end of 2016 when Origin Energy and Woolworths chose not to roll-over their ASX-listed subordinated notes (ORGHA, WOWHC) which left $1.6 billion of funds without reinvestment. Following these redemptions, the corporate listed market is now at its smallest outstanding issuance since 2010 and will further shrink as Tabcorp Subordinated Notes (TAHHB) and Elders Hybrid (ELDPA) are redeemed later this month. Additionally, Crown Resorts has announced the early buy-back of Crown Subordinated Notes I (CWNHA) and if completed, this will see a further $880 million of corporate redemption in 2017. There has been no managerial communication from Caltex, APA Group and Goodman Group but given the underlying business environment, it is reasonable to assume these securities will also be redeemed in favour of alternative funding sources. Figure 2. ASX-Listed Corporate Maturity Profile  Source: BondAdviser Figure 3. Non-Financial Corporate Hybrid Market Size

Source: BondAdviser Figure 3. Non-Financial Corporate Hybrid Market Size  Source: BondAdviser As a result, listed investment options outside the Australian banking sector are limited. In November 2016 we stated a large proportion of redemptions would be reinvested in existing corporate issues to achieve some degree of sectoral diversification away from the banks. Since then, the demand/supply imbalance has squeezed trading margins on corporate hybrids to the point where some security valuations are being stretched from a trading margin risk perspective. Figure 4. Average Hybrid Trading Margins

Source: BondAdviser As a result, listed investment options outside the Australian banking sector are limited. In November 2016 we stated a large proportion of redemptions would be reinvested in existing corporate issues to achieve some degree of sectoral diversification away from the banks. Since then, the demand/supply imbalance has squeezed trading margins on corporate hybrids to the point where some security valuations are being stretched from a trading margin risk perspective. Figure 4. Average Hybrid Trading Margins  Source: BondAdviser Given the priority of payments implied by a company’s capital structure, securities that rank lower should typically trade at a premium to senior fixed income instruments such as bonds. However, lack of issuance against the persistently low interest rate environment has discouraged selling and forced investors to drive up valuations. So whilst fundamental and technical factors are currently supportive of credit markets, excess market demand is resulting in margins that are not fully reflective of underlying risk. For instance, AGL Energy’s ASX-Listed Subordinated Notes are currently trading close to the group’s Australian dollar denominated senior bond which is higher up on the capital structure. Figure 5. AGL 5.00% 2021 Senior Bond vs AGL Subordinated Notes (AGLHA)

Source: BondAdviser Given the priority of payments implied by a company’s capital structure, securities that rank lower should typically trade at a premium to senior fixed income instruments such as bonds. However, lack of issuance against the persistently low interest rate environment has discouraged selling and forced investors to drive up valuations. So whilst fundamental and technical factors are currently supportive of credit markets, excess market demand is resulting in margins that are not fully reflective of underlying risk. For instance, AGL Energy’s ASX-Listed Subordinated Notes are currently trading close to the group’s Australian dollar denominated senior bond which is higher up on the capital structure. Figure 5. AGL 5.00% 2021 Senior Bond vs AGL Subordinated Notes (AGLHA)  Source: BondAdviser Although we expect tight supply dynamics to continue and support expensive valuations, particularly for corporate listed securities, new investors should be aware of the inherent risk. For investors already holding these securities there is probably no reason to sell as scheduled corporate redemptions will continue to intensify demand in a relatively small market. We believe this situation of demand over supply will persist. However, given valuations are not reflective of risk profiles, we will be reviewing our recommendations if corporate hybrid margins continue to tighten.

Source: BondAdviser Although we expect tight supply dynamics to continue and support expensive valuations, particularly for corporate listed securities, new investors should be aware of the inherent risk. For investors already holding these securities there is probably no reason to sell as scheduled corporate redemptions will continue to intensify demand in a relatively small market. We believe this situation of demand over supply will persist. However, given valuations are not reflective of risk profiles, we will be reviewing our recommendations if corporate hybrid margins continue to tighten.