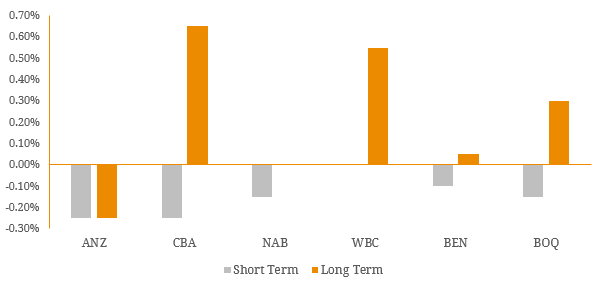

Last month, the Reserve Bank of Australia (RBA) cut the official cash rate by 0.25% to 1.50% with many Australian banks deciding not to pass on the full rate cut to mortgage holders and instead partially maintaining (and in some cases improving) some term deposit rates. In response to media criticism the banks cited regulatory reasons for these actions but what does this actually mean? During the Global Financial Crisis (GFC), several global banks suffered a liquidity crisis due to their over reliance on short-term wholesale funding and interbank lending markets. As confidence evaporated during this period, banks were unwilling to lend to each other and these credit markets effectively dried up forcing some financial institutions to collapse. As part of the banking regulation overhaul (known as Basel III), two primary liquidity measures were proposed, the Liquidity Coverage Ratio (LCR) which has been implemented (January 2016) and the Net Stable Funding Ratio (NSFR) which is yet to be implemented. The NSFR calculates the proportion of long-term assets which are funded by “stable funding”. This type of funding includes customer deposits, long term wholesale funding and equity and excludes short-term wholesale funding. As a result, the ratio allows regulators to measure individual banks reliance of short term interbank funding markets to prevent a similar liquidity crisis experienced during the GFC. The Australian Prudential Regulation Authority (APRA) has a planned implementation date of the 1st of January 2018 in which 15 of Australia’s largest banks will have to have a NSFR greater than 100%. As a result, many banks are beginning to work towards this regulatory hurdle and are maintaining/improving term deposit rates to remain attractive to investors in an already highly competitive market. However, this has mainly been applied to longer term deposits (i.e. 1 year and beyond) to ensure a greater degree of stability in deposit funding. As Figure 1 depicts below, the majority of Australian banks passed on most of rate cut to short term deposits rate (~3 months) but actually increased longer term rates (~12 months). Figure 1. Change in Term Deposit Rates After August’s Cash Rate Cut