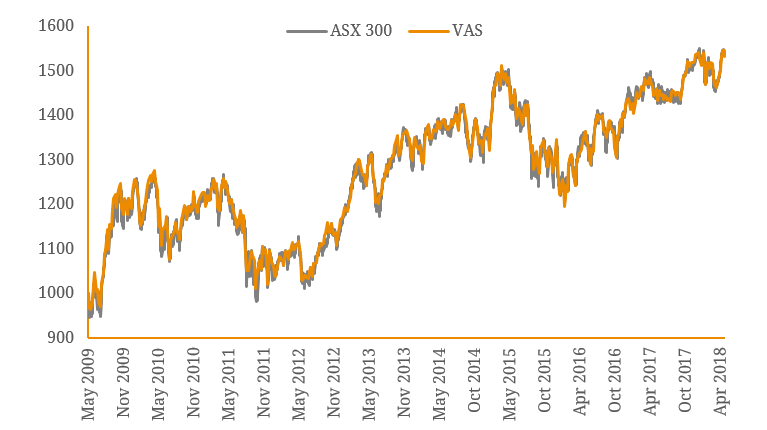

The official cash rate, mostly because of low wages and poor economic growth, has been standing at 1.5% for 17 months in a row. This does provide organisations with incentives to raise capital at conducive borrowing costs but also depresses investors’ interest income and principle upside risks. However, with the domestic economy beginning to firmly strengthen recently, the cash rate is widely expected to experience its first increase for many years in the near future. This obviously indicates investors will earn higher interests moving forward but also raises another concern which is less widely talked about – potential capital losses for fixed income investors. More specifically, when fundamental borrowing costs increase, so do the yields of bonds and prices usually moves inversely to this. Investors in a rising interest rate environment while holding some fixed-income securities will likely suffer from some degree of capital losses. This article provides some options to help investors better manage the increasing downside risks and begins to explore potential profits in such an environment. The most straightforward way to reduce risks and increase returns (minimise capital losses) for investors is to rebalance their portfolios by increasing cash products holdings and decreasing bond holdings. In theory, cash products can benefit directly from a higher interest rates as returns on these investments are mostly attributed to interest payments derived from the higher base rates. Similarly, switching long-term bonds to short-term bonds can somewhat mitigate downside risks as well given shorter term bonds’ prices are less sensitive to interest rate movements from their lower durations. However, these approaches could be conservative plays as money markets are subject to little upside gain and should interest rates fail to increase in time, higher returns generated by longer-term bonds might be capped with portfolios actually holding less bonds. Instead of trimming bonds holdings, investors could also reconstruct their portfolios by replacing fixed-rate bonds with floating rate securities. Floating rate notes offer coupons which comprise of a variable base rate and a fixed spread. As the base rate is reset periodically to reflect the fundamental interest rate background, it serves to mostly protect capital moving downwards when interest rates go up. A good example is the fixed rate note IAGPA (issued by Insurance Australia Group Limited), which experienced larger volatility than the floating rate note SBKPA (issued by Suncorp-Metway Limited) when the cash rate increased from 3.00% to 4.75% during September 2009 and December 2010 (figure 1). It is worth noting that fixed rate notes usually offer more attractive interest returns upon issuance than floating rate notes, which is mostly attributable to the uncertainty of interest movements over the investment horizon. Figure 1. Capital Prices of IAGPA and SBKPA from September 2009 to December 2010