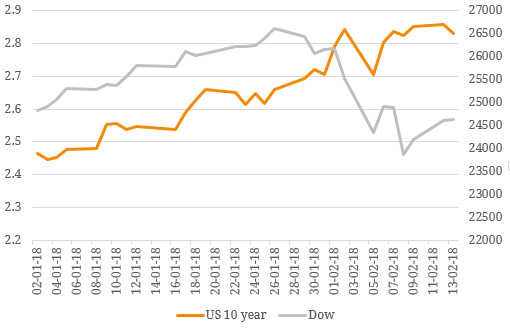

One of the fundamental functions of capital markets is to determine an appropriate pricing of risk – the process of finding that magical equilibrium where the capital surplus suppliers and the capital deficit demand side are mutually agreeable, representing the fair cost of capital, given all the available information. That is the theory anyway. In practice, determining an appropriate price for a new security (credit spread in the case of fixed income securities) is an exercise in both art and science. Arguably, the price discovery process to establish the credit spread for a new fixed income issuance is derived by: • Secondary market analysis – market information from the secondary market trading levels for existing bonds should form a baseline for the credit spread of the new issue. • Recent transaction analysis – similarly-structured recent issues from the issuer or other comparable issuers imply the approximate market demand for a prospective new issue. • Comparable analysis – the credit spreads of comparable issuers in the issuer industry can be referenced for the price discovery process. This analysis reflects the perceived risk in the issuer’s industry by investors, a strong starting point for determining credit spreads. • Investor sentiment – ultimately, investors provide the feedback necessary to adjust the credit spread of the issue through marketing and informal pre-launch ‘soundings’. Westpac’s recent AT1 hybrid issuance (WBCPH), which priced at 3.20% – the low end of its guidance range of 3.20% – 3.40%, offers some working evidence of the theories. On the day Westpac announced the deal, the fair value spread for a major bank hybrid with the same 7.5-year call date was about 340 basis points. Instead of paying a traditional “new issue premium” to induce reluctant investors to participate, the deal implied a discount which, to some, appeared to reward Westpac for being the first major bank issuer to put an AT1 hybrid note to the local Australia market this year. We noted in our analysis of the issue that supply is expected to be very limited in the near term and Westpac itself may not need to return to the AT1 market until after 2019. Indeed, in total, there is only around $20 million of major bank hybrids traded on the ASX each day. Given such trading volumes, it would take a while indeed to place large amounts of capital into the market whilst also acting to tighten spreads. The issue drew confidence from Westpac’s US$1.25 billion deal in 2017, which was heavily oversubscribed and which has had significant spread compression post launch. There is also a strong case that the major banks’ ASX hybrids are still attractive relative to their US$ equivalents and also to US and UK peer banks. An examination of 10 comparable BB+ rated hybrid securities in the US market found that the average spread above the US bank bill equivalent rate for a 7.5-year security was 248 basis points, or 70 basis points lower than what WBCPH pays. Even adding the cost of swapping the USD back into AUD, the US issuances could still be 50 bps tighter than the WBCPH. Conventional wisdom holds that bonds represent a defensive asset class for portfolios and if properly constructed, they provide diversification from equities. Historically, investors counted on bonds rising in value (and dropping in yield) when shares fell, as people move funds from riskier equity investments into safer bonds. But the market correction that began two weeks ago caused bonds and equities to sell off sometimes in tandem (Figure 1, 2). Figure 1. US 10 Year Yield vs Dow