On the 6th of July 2016 ratings agency S&P issued a request for comment relating to proposed amendments to Australian Prudential Regulation Authority’s (APRA) evaluation criteria regarding the capital adequacy of banks. Ultimately, the agency’s intention is to begin capturing recent Basel III enhancements that were introduced after the Global Financial Crisis in Pillar 3 bank disclosure statement reports. Some of the proposals are outlined below:

- In line with APRA’s newly established (but deferred) conglomerate regulation, S&P propose to deduct investments in insurance subsidiaries and significant minority investments held by the banks from capital (the current approach is to apply a risk weight of 1.25%).

- The treatment of deferred tax assets (DTA) will also be fine-tuned in light of enhanced regulatory disclosures to be more closely aligned to Basel III requirements. This will be done by deducting DTA’s related to tax-loss carry forwards net of deferred tax liabilities (DTL), rather than gross (when regulators permit such netting). In these instances, if there is a net DTL, S&P will make neither a deduction nor an addition to arrive at total adjusted capital.

- The risk weights on sovereign exposures will also be amended, with loss given default assumptions revised to 45% from 40% to reflect findings from experience and recent academic studies. Risk weighted assets (RWA) for mortgages will be adjusted based upon financial institutions loss experience as well as from information provided by regulatory stress tests conducted over the past few years. APRA’s current instituted mortgage RWA of at least 25% (up from 16%) effective from 1 July 2016 is seen as an interim measure until changes arising from the Basel Committee’s broader review of this framework are finalized (expected to be by the end of 2016). As an aside, the Financial System Inquiry (FSI) recommended a mortgage RWA of 25-30%.

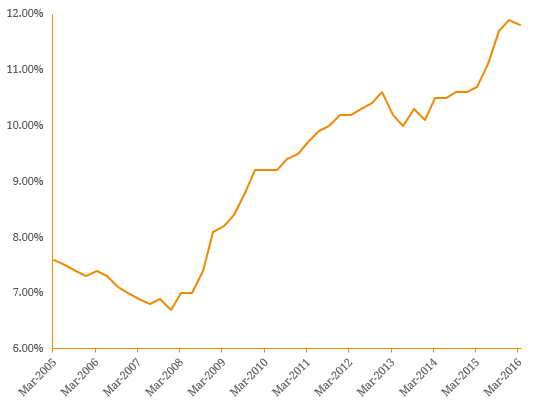

All other things being equal, this change in methodology could see the senior credit ratings of the four major Australian banks lowered by one notch as it was a similar occurrence in December 2011 (when S&P last overhauled their bank credit rating methodology). This led to a cut in the senior credit ratings of the major banks to their current senior credit rating. S&P’s placing of Australia’s sovereign credit rating on negative outlook on the 7th of July 2016 will only add to this pressure. However, potentially countering this could be the improving capital position of the banks, where (on average) major bank Tier 1 capital ratios have improved from a December 2007 low of 6.7% to 11.8% at the end of March 2016 (Figure 1). Accordingly, an upgrade to Capital and Earnings from ‘Adequate’ to ‘Strong’ could see an upgrade to the Stand-Alone Credit Profile (SACP). With the proposed amendments, the capital adequacy requirement may only moderately change with only a slight prospect of a capital adequacy driving an upgrade. Ironically, this may lead to an upwards revision in the rating of additional tier 1 hybrids and tier 2 subordinated debt as the rating for these securities are based upon the SACP credit rating rather than from the senior credit rating. Figure 1. Average Major Bank Tier 1 Capital Ratio