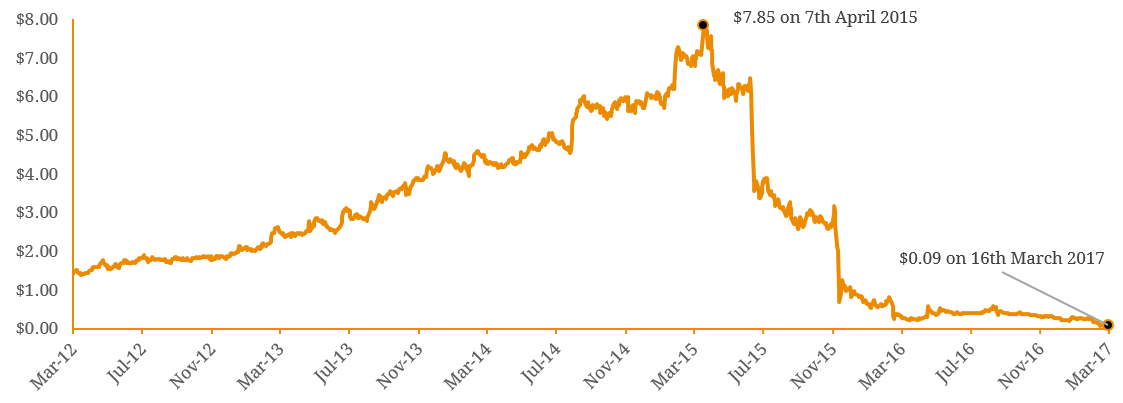

In early 2015, legal firm Slater and Gordon (ASX: SGH) acquired the professional services division of the controversial UK group Quindell Plc for $1.2 billion. The debt-funded acquisition, which management hoped to be transformational, has since resulted in large losses and been completely written down, weighing significantly on the firm’s earnings and balance sheet. The weak performance of the group continued in the first half of 2017, with SGH posting a 33.8% decline in revenue to $322.7 million and net loss of $425.1 million. In addition to the vulnerable UK business (39.9% drop in fees and services revenue), the Australian division was also impacted by the negative sentiment, with a 17.5% fall in fees and services revenue. Cash flow remained negative at -$11.4 million, an improvement from -$20.9 million in the prior corresponding period. Moreover, in December 2016, the firm’s accounting policies were scrutinised by the Australian Securities and Investment Commission (ASIC), in addition to a $250 million shareholder class action suit led by rival class action firm Maurice Blackburn. Overall, this resulted in negative equity (liabilities exceeding assets) of $126 million and the company’s shares plummeted 98.9% from a peak of $7.85 in April 2015. Figure 1. Slater & Gordon Share Price  Source: Bloomberg This has prompted the management to embark on a recapitalisation plan with lenders to keep the troubled firm afloat. This capital restructure plan involves a structured Debt-for-Equity swap with the lenders of the firm. Through this, the lenders cancel part or all of their debt position in exchange for shares in the restructured SGH firm. While the value of the swap is generally determined at market rates, management could incentivise stakeholders to participate in this by offering a premium. The terms of the SGH swap are still being negotiated. If an agreement is reached, this will relieve stress and inject liquidity into the financially distressed company, allowing it to remain solvent. This will also give the opportunity to the new owners (lenders) to stabilise the business, providing confidence to the group’s staff and clients. However, this will also completely wipe out (dilute) the stake of the current equity holders. SGH’s current market capitalisation is $42.3 million and debt obligations stand at $760 million (18x debt-to-equity ratio). Major lenders including Westpac, National Australia Bank, Barclays and Royal Bank of Scotland, which were together owed ~$700 million have sold their debt to distressed debt-buyers (like Anchorage) at a fraction of their face value, paving the way for restructure. This also threatens the position of senior management at the group, who have been severely criticized for the doomed Quindell acquisition. Over the past few years debt-for-equity swaps have been on the uptake, with a large number of debt-ridden Chinese companies opting for this form of capital restructure. While mining company Emeco displayed a turnaround, others like Italian Bank Monte dei Paschi di Siena and miner Atlas Iron have not been able to bounce back. With substantial negative sentiment weighing on SGH’s top line revenue, it will be interesting to see if this restructure is enough to ensure the group’s viability.

Source: Bloomberg This has prompted the management to embark on a recapitalisation plan with lenders to keep the troubled firm afloat. This capital restructure plan involves a structured Debt-for-Equity swap with the lenders of the firm. Through this, the lenders cancel part or all of their debt position in exchange for shares in the restructured SGH firm. While the value of the swap is generally determined at market rates, management could incentivise stakeholders to participate in this by offering a premium. The terms of the SGH swap are still being negotiated. If an agreement is reached, this will relieve stress and inject liquidity into the financially distressed company, allowing it to remain solvent. This will also give the opportunity to the new owners (lenders) to stabilise the business, providing confidence to the group’s staff and clients. However, this will also completely wipe out (dilute) the stake of the current equity holders. SGH’s current market capitalisation is $42.3 million and debt obligations stand at $760 million (18x debt-to-equity ratio). Major lenders including Westpac, National Australia Bank, Barclays and Royal Bank of Scotland, which were together owed ~$700 million have sold their debt to distressed debt-buyers (like Anchorage) at a fraction of their face value, paving the way for restructure. This also threatens the position of senior management at the group, who have been severely criticized for the doomed Quindell acquisition. Over the past few years debt-for-equity swaps have been on the uptake, with a large number of debt-ridden Chinese companies opting for this form of capital restructure. While mining company Emeco displayed a turnaround, others like Italian Bank Monte dei Paschi di Siena and miner Atlas Iron have not been able to bounce back. With substantial negative sentiment weighing on SGH’s top line revenue, it will be interesting to see if this restructure is enough to ensure the group’s viability.