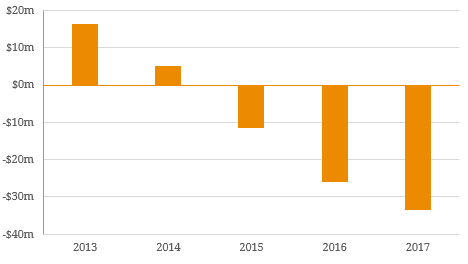

In recent years, unlisted Queensland sugar milling company Mackay Sugar has come under intense financial pressure. This has been largely attributable to the significant debt pile the company has accumulated over the past decade, which has left management no choice but to explore recapitalisation options. As we would expect with any agricultural company, Mackay Sugar is heavily capital intensive and its assets require significant ongoing maintenance. The group’s mills were originally built prior to 1900 and which has led to a large deterioration in the group’s asset base. Given the weak balance sheet, management are currently unable to fund maintenance projects. Poor corporate decisions have also been a factor in the group’s financial woes evidenced by the commitment to the construction of a $120 million co-generation plant which has never reached full capacity and purchasing Mossman mill for $25 million. The latter is arguably a legacy asset and which is ironically being sold by the company. Consequently, core milling performance has suffered, leaving unharvested crop for farmers and which has adversely impacted company earnings. Figure 1. 5-Year Historical Net Profit  Source: Company Reports Another key factor to the group’s financial status has been the competitiveness of the global sugar industry. This has led to worldwide oversupply at a time where sugar consumption has declined against an increasing focus on health standards (17 countries have imposed a ‘sugar tax’). As a result, the price of raw sugar has fallen by ~30% this year and with some reports stating market prices have fallen below the cost of production, resulting in negative profit margins. This has hurt the group’s strategic stake in Sugar Australia and is reflective of an impairment of ~$35 million booked in FY17. We would also note that only a few years ago, the accepted expert wisdom was that sugar consumption would increase as emerging markets evolve and incomes rise. Figure 2. 1-Year Historical Sugar Price

Source: Company Reports Another key factor to the group’s financial status has been the competitiveness of the global sugar industry. This has led to worldwide oversupply at a time where sugar consumption has declined against an increasing focus on health standards (17 countries have imposed a ‘sugar tax’). As a result, the price of raw sugar has fallen by ~30% this year and with some reports stating market prices have fallen below the cost of production, resulting in negative profit margins. This has hurt the group’s strategic stake in Sugar Australia and is reflective of an impairment of ~$35 million booked in FY17. We would also note that only a few years ago, the accepted expert wisdom was that sugar consumption would increase as emerging markets evolve and incomes rise. Figure 2. 1-Year Historical Sugar Price  Source: Bloomberg As the company is unlisted and has diversified ownership of ~1000 sugar cane growers, there are limited equity raising options. As a result, the group’s debt has grown to $200 million which includes its $50 million high-yield (7.25%) bond issued in 2013. To avoid incurring further debt, the company has proposed the divestment of its co-generation plant for ~$90 million and a $2 per tonne deferred cane levy on its farmers. The latter has resulted in a widespread backlash from the Queensland sugar community and subsequent legal action has been taken. The opposing argument from management is that growers own the company and hence, need to invest in the mills. Nonetheless, the court granted that a subset of growers are not legally required to pay the levy as their bargaining agents had not agreed to the deal casting significant doubt over the success of the recapitalisation. Holders of the group’s high-yield bond have experienced a significant loss of capital with the securities currently trading at ~$78. Given the bonds are set to mature in April 2018, there are quite valid concerns that the company will be unable to repay investors in full and the company will be in default. As at 30 June 2017, balance sheet cash stood at $18.2 million. A proportion of this cash would have to be utilised for working capital meaning the bulk of the maturing bonds will likely need refinancing or met with asset sales. With regards to the former, a brief look at the above figures should plainly show how difficult this option would be. Regarding the latter point, the potential sale of the group’s co-generation plant could relieve this liquidity issue. The latest update given by management on the sale stated six parties had given non-binding indicative offers under both straight acquisition or lease back arrangements. However, Mackay Sugar has indicated that in the event that bids do not meet expectations, the company will have no choice but to seek a cornerstone investor or sell the business entirely to avoid default. Also to the detriment of investors is the company’s $105 million of secured banking facilities which rank ahead of the bondholders in the capital structure. While negotiations between Mackay and the banks could see this extended, it is perhaps unlikely given the dire circumstances putting further pressure on liquidity. Figure 3. Mackay Sugar 10-Year Historical Debt and Gearing

Source: Bloomberg As the company is unlisted and has diversified ownership of ~1000 sugar cane growers, there are limited equity raising options. As a result, the group’s debt has grown to $200 million which includes its $50 million high-yield (7.25%) bond issued in 2013. To avoid incurring further debt, the company has proposed the divestment of its co-generation plant for ~$90 million and a $2 per tonne deferred cane levy on its farmers. The latter has resulted in a widespread backlash from the Queensland sugar community and subsequent legal action has been taken. The opposing argument from management is that growers own the company and hence, need to invest in the mills. Nonetheless, the court granted that a subset of growers are not legally required to pay the levy as their bargaining agents had not agreed to the deal casting significant doubt over the success of the recapitalisation. Holders of the group’s high-yield bond have experienced a significant loss of capital with the securities currently trading at ~$78. Given the bonds are set to mature in April 2018, there are quite valid concerns that the company will be unable to repay investors in full and the company will be in default. As at 30 June 2017, balance sheet cash stood at $18.2 million. A proportion of this cash would have to be utilised for working capital meaning the bulk of the maturing bonds will likely need refinancing or met with asset sales. With regards to the former, a brief look at the above figures should plainly show how difficult this option would be. Regarding the latter point, the potential sale of the group’s co-generation plant could relieve this liquidity issue. The latest update given by management on the sale stated six parties had given non-binding indicative offers under both straight acquisition or lease back arrangements. However, Mackay Sugar has indicated that in the event that bids do not meet expectations, the company will have no choice but to seek a cornerstone investor or sell the business entirely to avoid default. Also to the detriment of investors is the company’s $105 million of secured banking facilities which rank ahead of the bondholders in the capital structure. While negotiations between Mackay and the banks could see this extended, it is perhaps unlikely given the dire circumstances putting further pressure on liquidity. Figure 3. Mackay Sugar 10-Year Historical Debt and Gearing  Source: BondAdviser, Company Reports Although outcomes are still highly uncertain, Mackay Sugar demonstrates the complexities of corporate high-yield fixed income investment. While the outright yield returns can appear attractive, robust credit analysis is required to venture into this segment of the fixed income market. Bondholders of Mackay Sugar are currently finding themselves on the wrong side of this paradigm. After four years of 7.25% coupon returns, they are now facing a potentially large discount to capital returned, especially so with over twice the amount of secured debt ranking ahead of bond investors in the capital structure. For this reason, high-yield credit must be continuously monitored, assumptions re-tested and the overall investment decision and justification re-evaluated.

Source: BondAdviser, Company Reports Although outcomes are still highly uncertain, Mackay Sugar demonstrates the complexities of corporate high-yield fixed income investment. While the outright yield returns can appear attractive, robust credit analysis is required to venture into this segment of the fixed income market. Bondholders of Mackay Sugar are currently finding themselves on the wrong side of this paradigm. After four years of 7.25% coupon returns, they are now facing a potentially large discount to capital returned, especially so with over twice the amount of secured debt ranking ahead of bond investors in the capital structure. For this reason, high-yield credit must be continuously monitored, assumptions re-tested and the overall investment decision and justification re-evaluated.