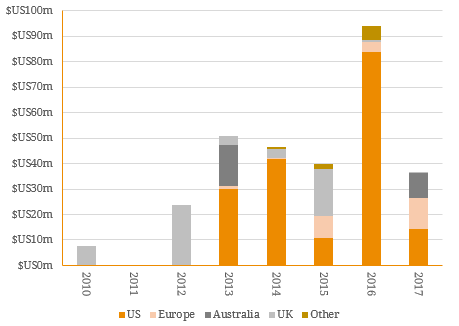

As a rule of thumb, we consider Major Bank Tier 2 securities as one of the best risk-adjusted capital investment for investors due to their superior capital structure ranking, non-discretionary interest payments and event of default terminology. Historically, while the retail (listed) Tier 2 market increased post-GFC, there was uncertainty among investors in the wholesale (over-the-counter) market regarding the premium associated with the Non-Viability Trigger clause introduced by APRA (Sep 2011). Consequently, the wholesale market saw limited issuance between 2011-13. More recently however, there has been a turn in the tide and many banks have elected the wholesale market as their primary Tier 2 capital funding channel with only one listed Major Bank Tier 2 issuance (NAB Subordinates Notes 2 – ASX: NABPE) since 2014. Figure 1. Historical Cumulative Major Bank Tier 2 Issuance (AUD-Denominated)  Source: BondAdviser We do not expect this trend to change in the near term and with a majority of listed bank Tier 2 instruments maturing from June to August, we expect this sub-set of the listed market to contract further. While only one of these securities has been partially refinanced in the listed market (NABHB into NABPE), there are few like-for-like replacements for other maturities, of which the majority will mature in the next 18 months. Moving up the risk curve One alternative for investors would be to move up the risk curve and invest in Tier 1 instruments which provide an additional premium as well as significant risk uptake. Figure 3. Credit Curves Across the Bank Capital Structure

Source: BondAdviser We do not expect this trend to change in the near term and with a majority of listed bank Tier 2 instruments maturing from June to August, we expect this sub-set of the listed market to contract further. While only one of these securities has been partially refinanced in the listed market (NABHB into NABPE), there are few like-for-like replacements for other maturities, of which the majority will mature in the next 18 months. Moving up the risk curve One alternative for investors would be to move up the risk curve and invest in Tier 1 instruments which provide an additional premium as well as significant risk uptake. Figure 3. Credit Curves Across the Bank Capital Structure  Source: BondAdviser as at 28th of June *Due to limited datapoints, Tier 2 curve includes wholesale instruments Under the Basel III reforms, Additional Tier 1 (AT1) hybrid holders would be the second line of loss absorption (behind shareholders) in a bank failure, as seen in the case of Spanish bank Banco Popular earlier this month. Hence, they should theoretically trade at a risk premium to Tier 2 securities. The market is currently pricing these risks at a ~1.95% premium for a 5 year AT1 hybrid priced to the first optional call date. In the current low growth, low yield environment, these valuations may appear attractive but it is important to acknowledge that for the most part of 2017 technicals (demand outpacing supply) has dictated market direction rather than fundamentals (i.e. relative risk across the capital structure). Figure 4. Key points of difference between Tier 1 and Tier 2 Instrument

Source: BondAdviser as at 28th of June *Due to limited datapoints, Tier 2 curve includes wholesale instruments Under the Basel III reforms, Additional Tier 1 (AT1) hybrid holders would be the second line of loss absorption (behind shareholders) in a bank failure, as seen in the case of Spanish bank Banco Popular earlier this month. Hence, they should theoretically trade at a risk premium to Tier 2 securities. The market is currently pricing these risks at a ~1.95% premium for a 5 year AT1 hybrid priced to the first optional call date. In the current low growth, low yield environment, these valuations may appear attractive but it is important to acknowledge that for the most part of 2017 technicals (demand outpacing supply) has dictated market direction rather than fundamentals (i.e. relative risk across the capital structure). Figure 4. Key points of difference between Tier 1 and Tier 2 Instrument  Source: BondAdviser As the Australian banking system is underpinned by a strong regulatory framework and resilient economy, investors may be comfortable with current market valuations. However, investors should acknowledge that tail risk (bank failure) is still present which is captured by the non-viability and capital triggers embedded in these securities. Diversification through Separately Managed Accounts (SMAs) Clients looking to diversify their portfolio also have the option to invest in the BondAdviser SMAs available on the HUB24 platform. Our model portfolios – Income Opportunities and Income Plus, remain biased to higher quality exposures that have lower default risk and have recently completed a full year of performance. Figure 5. BA Model Portfolio Performance (Excess over Benchmark)

Source: BondAdviser As the Australian banking system is underpinned by a strong regulatory framework and resilient economy, investors may be comfortable with current market valuations. However, investors should acknowledge that tail risk (bank failure) is still present which is captured by the non-viability and capital triggers embedded in these securities. Diversification through Separately Managed Accounts (SMAs) Clients looking to diversify their portfolio also have the option to invest in the BondAdviser SMAs available on the HUB24 platform. Our model portfolios – Income Opportunities and Income Plus, remain biased to higher quality exposures that have lower default risk and have recently completed a full year of performance. Figure 5. BA Model Portfolio Performance (Excess over Benchmark)  Source: HUB24 as at 29th June The above performance demonstrates the value of active security selection from in-depth issuer analysis overlayed with investment strategy focused on risk management. We advocate this approach to credit investing which lays the foundation of our investment process.

Source: HUB24 as at 29th June The above performance demonstrates the value of active security selection from in-depth issuer analysis overlayed with investment strategy focused on risk management. We advocate this approach to credit investing which lays the foundation of our investment process.