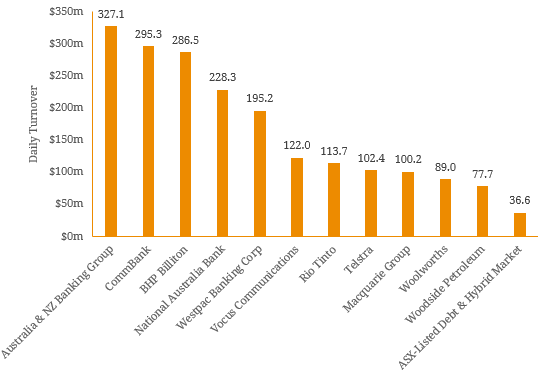

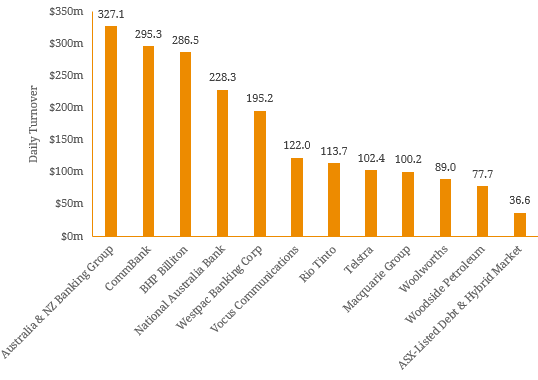

When investing in the ASX-Listed Debt & Hybrid market, an important consideration is liquidity. Given the market’s size of ~$60 billion, liquidity can be limited and if a major announcement occurs it may be difficult to get in or out of positions. For this reason, investors may have to accept a lower price to sell or pay a higher price to buy to entice a counterparty to transact. On the other hand, the domestic equity market boasts a market capitalisation of ~$1.6 trillion and an average daily turnover of ~$4.7 billion and naturally liquidity is much stronger. To put this in perspective, Figure 1 shows the top 20 traded shares by value on the 3rd of May 2017 in comparison total turnover in the ASX-Listed Debt & Hybrid market. Figure 1. Top 20 Shares Traded by Value vs Total Turnover in the ASX-Listed Debt & Hybrid Market (3 May 2017)  Source: ASX, BondAdviser Figure 2. ASX-Listed Debt & Hybrid Market Daily Turnover (Value)

Source: ASX, BondAdviser Figure 2. ASX-Listed Debt & Hybrid Market Daily Turnover (Value)  Source: BondAdviser as at 3 May 2017 This significant divergence in liquidity profiles is a function of many things but ultimately it is a retail market where most investors buy and hold until maturity. The significant growth issuance in the ASX-listed Debt & Hybrid market in recent years, particularly for banks given the regulatory landscape, does not seem to have had a material effect. There are other reasons for this such as cost of active strategies and the overall composition of Australian wealth (~50% allocation to equities) but there are also regulatory implications for market makers which make it difficult. Figure 3. Major Bank Equity Market Capitalisation vs Listed Debt & Hybrid Securities (Tier 1 & Tier 2)

Source: BondAdviser as at 3 May 2017 This significant divergence in liquidity profiles is a function of many things but ultimately it is a retail market where most investors buy and hold until maturity. The significant growth issuance in the ASX-listed Debt & Hybrid market in recent years, particularly for banks given the regulatory landscape, does not seem to have had a material effect. There are other reasons for this such as cost of active strategies and the overall composition of Australian wealth (~50% allocation to equities) but there are also regulatory implications for market makers which make it difficult. Figure 3. Major Bank Equity Market Capitalisation vs Listed Debt & Hybrid Securities (Tier 1 & Tier 2)  Source: BondAdviser Figure 4. Major Bank Tier 1 Capital Ratios

Source: BondAdviser Figure 4. Major Bank Tier 1 Capital Ratios  Source: Company Reports Unsurprisingly, the most heavily traded ASX-listed income security is a Additional Tier 1 bank hybrid, PERLS VI (ASX: CBAPC). On a daily basis trading value has not exceeded $26 million and on average daily turnover is around $1.3 million highlighting the difficulty in moving large parcels of securities. As a result, we advise investors to be structured in their approach to liquidity. Executing on more than 50% of average daily trading value can have implications for valuations and subsequently the bid-offer spread (i.e. the trade size would be ‘market moving’). Figure 5. CBAPC Maximum Daily Trade Size as a function of total Parcel Size

Source: Company Reports Unsurprisingly, the most heavily traded ASX-listed income security is a Additional Tier 1 bank hybrid, PERLS VI (ASX: CBAPC). On a daily basis trading value has not exceeded $26 million and on average daily turnover is around $1.3 million highlighting the difficulty in moving large parcels of securities. As a result, we advise investors to be structured in their approach to liquidity. Executing on more than 50% of average daily trading value can have implications for valuations and subsequently the bid-offer spread (i.e. the trade size would be ‘market moving’). Figure 5. CBAPC Maximum Daily Trade Size as a function of total Parcel Size  Source: BondAdviser, For this reason, we believe positions in excess for $1 million should be transacted through specialist brokers. These institutions have access to liquidity pools not available to the public eye and utilise a ‘special crossing’ execution mechanism to get these relatively large trades (in respect to the market) in a timely manner. Note that for less liquid securities (i.e. non-financial income securities or smaller financial institutions), proposed transactions of under $1 million may require a specialist broker. Overall, liquidity is a notable hurdle when investing in the ASX-listed Debt & Hybrid market that can impact yield and subsequently portfolio return. Investors should be aware of this and take note of execution risk when constructing a portfolio. For more information or to get a list of specialist brokers please email us at info@bondadviser.com.au.

Source: BondAdviser, For this reason, we believe positions in excess for $1 million should be transacted through specialist brokers. These institutions have access to liquidity pools not available to the public eye and utilise a ‘special crossing’ execution mechanism to get these relatively large trades (in respect to the market) in a timely manner. Note that for less liquid securities (i.e. non-financial income securities or smaller financial institutions), proposed transactions of under $1 million may require a specialist broker. Overall, liquidity is a notable hurdle when investing in the ASX-listed Debt & Hybrid market that can impact yield and subsequently portfolio return. Investors should be aware of this and take note of execution risk when constructing a portfolio. For more information or to get a list of specialist brokers please email us at info@bondadviser.com.au.