The concept of liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without having a material impact on price. Similarly, bond market liquidity refers to the extent to which the bond market allows assets to be bought and sold at stable prices. Cash or cash equivalent securities are the most liquid asset while sub-investment grade fixed income securities are less liquid. Whilst the retail bond market is generally more transparent (ASX is a public market place), the wholesale or institutional bond market (although electronic platforms such as Yield Broker & Bloomberg exist to help facilitate price discovery) is less so. Most secondary bond market transactions (especially when dealing in large volume or in less liquid securities) tend to be transacted via voice or private chat rooms to avoid having a negative price impact in the bond market. Institutional bond market liquidity also varies from security to security for a number of reasons, the main ones being:

- Market breadth. The sheer number and diversity of bonds potentially affects liquidity. The market includes corporates, state government and Australian government bonds to name a few, each with different characteristics and risk factors. Different bonds issued by the same company can also have different characteristics (i.e. senior bonds (more liquid) versus hybrids/junior debt (less liquid)) Assigning value and quickly matching buyers and sellers in a market with so many bonds and so little uniformity is not an easy task.

- Dealer inventory. Since the global financial crisis, many dealers have reduced risk appetite and are not buying or holding as many bonds as in the past. This phenomenon is also due to increased regulatory scrutiny aimed at preventing financial institutions from carrying too much illiquid and/or low grade bonds. This can cause large losses and cause an institution failure during times of financial stress. With fewer buyers and sellers in the market, it may be harder for investors, brokers and authorised dealers to find a buyer willing to purchase a particular security, during periods of market volatility.

- Selling pressure. Any time multiple owners of a security collectively seek to sell at the same time, liquidity may be reduced. Market corrections, domestic or global economic shocks, or sharp movements in could trigger a major demand-supply liquidity imbalance in bond markets.

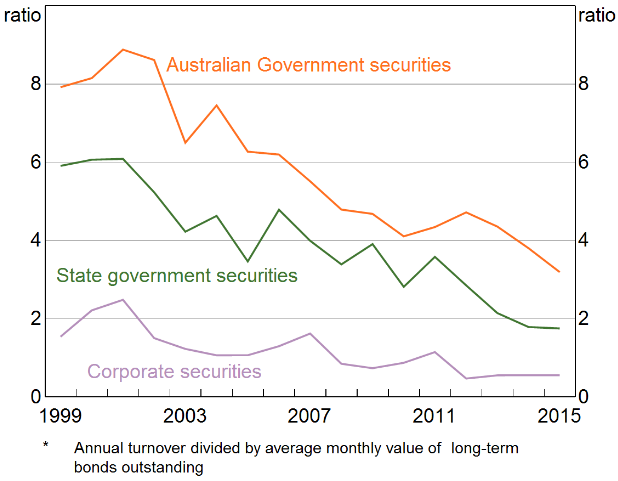

Measuring bond market liquidity is also not an easy exercise in Australia. Most of institutional bond transactions traded in the secondary market are executed over the phone or via chat rooms rather than through an electronic platform, meaning trade data is less readily available. Whilst it would be good to see more trade data on transactions in the market, transparency can make it difficult to move a large parcel. Large parcels can result in bonds’ bid/offer spread widening (reduced liquidity) even if market conditions are benign. Guy Debelle (RBA Assistant Governor – Financial Markets) commented upon the state of “Liquidity in Australian Fixed Income Markets’ on 21 June 2016 in an address to the 4th Australian Regulatory Summit. Assistant Governor Debelle showed that a smaller proportion of bonds are being being transacted relative to the past (Figure 1). Figure 1 – Annual Bond Turnover Ratios*

- “the share of the government bond market that used to turnover in an average month now takes a bit over six weeks”

- “the average share of the corporate securities market that used to turnover in one month now takes closer to two months”

- “We also hear from market participants that it is, in general, a bit more difficult to transact in size.”

That being said, Australia has been fortunate that the withdrawal of dealers from the local bond market has not had as sizeable an impact as seen elsewhere. Whilst regulatory change has contributed to the reduced capacity in the local market (e.g. some overseas investment banks operating within Australia no longer hold as much corporate bond inventory as they did prior to the GFC), it has so far not been to the detriment of overall market functionality. The decline in the presence of foreign banks reflects both a change of business strategy and also a response to regulations. Certain foreign banks are now subject to increased capital requirements and the leverage ratio in their home markets which has led to a lower level (or greater rationing) of principal-based market-making. This is a direct result of decreased appetite for warehouse risk particularly for securities that are not very liquid. Another reason why Australian fixed income markets continue to function smoothly is that the derivative market have been operating effectively. Figure 2 shows that market depth (the size of a trade that can be executed for a given trade size) in the Australian government 10 year futures market. It appears to be at a similar prevailing level to that prior to the Global Financial Crisis. Figure 2 – Market Depth*