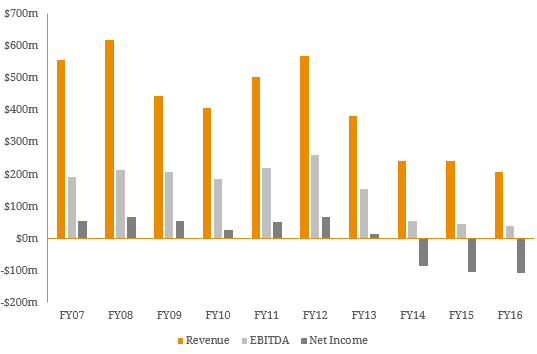

Over the past few years, Emeco Holdings Limited (ASX: EHL) has been in financial distress. Post Australia’s mining boom (~2012), the mining equipment solutions provider was left with a large debt pile on its balance sheet and as a result, experienced a credit rating downgrades trifecta at the end of 2015. Subdued commodity prices persisted into 2016 and Emeco’s client base looked to cut costs rapidly, especially in mining rentals – the company’s core market. As a result, Emeco’s earnings profile has been severely damaged (Figure 1) which has filtered through to poor cashflow. Figure 1. Emeco Historical Earnings  Source: Bloomberg Given the company’s ~$400 million of debt outstanding, serviceability became a growing concern among Emeco bond investors (Figure 2). It was clear the Emeco was in need in urgent recapitalisation and in September 2016, the company finally reached a three-way restructuring support agreement (RSA) with Orionstone and Andy’s Earthmovers. Under the agreement, noteholders would emerge with 34% ownership in the new entity in a debt-for-equity swap arrangement. All three credit rating agencies were critical of the transaction, describing it as a ‘distressed exchange’. Figure 2. Historical Price History of USD-Denominated Emeco 9.875% 2019 Bonds

Source: Bloomberg Given the company’s ~$400 million of debt outstanding, serviceability became a growing concern among Emeco bond investors (Figure 2). It was clear the Emeco was in need in urgent recapitalisation and in September 2016, the company finally reached a three-way restructuring support agreement (RSA) with Orionstone and Andy’s Earthmovers. Under the agreement, noteholders would emerge with 34% ownership in the new entity in a debt-for-equity swap arrangement. All three credit rating agencies were critical of the transaction, describing it as a ‘distressed exchange’. Figure 2. Historical Price History of USD-Denominated Emeco 9.875% 2019 Bonds  Source: Bloomberg As part of the scheme of arrangement, the deal required more than 50% of noteholders by number and 75% of noteholders by face value of notes outstanding. While 89.6% of Emeco noteholders supported the transaction, only 65.2% backed the deal by value. This was primarily blocked by US-based asset management firm Black Diamond Capital Management which controls 25% of Emeco bonds outstanding. Given the recent uptick in the commodity prices since the deal was first announced, the primary concern was that noteholders weren’t being adequately compensated through the size of ownership stake. However, Black Diamond quickly reversed its stance after being given the opportunity to acquire more equity in the group. But where would this equity come from? The additional equity was split between Emeco equity investors and the other Emeco noteholders who originally backed the deal. Under the revised RSA, Emeco shareholders will lose 1% ownership while other Emeco noteholders will lose 3% ownership of the merged entity. The transaction is subject to further shareholder and creditor approval expected to take place in March 2017. Emeco demonstrates the importance of understanding and identifying credit risk. The Australian mining sector has left trail of destruction over the past few years with companies such as Arrium (ASX: ARI), McAleese (ASX: MCS) and Atlas Iron (ASX: AGO) all experiencing similar issues with significant restructuring required. While it is important to recognise company specific issues (bottom-up), this case highlights risk originated from an industry/sector based level (top-down). As a result, it is imperative to consider macroeconomic and industry level risks with conducting credit analysis to avoid other issuer portfolio exposures to experience systemic capital losses.

Source: Bloomberg As part of the scheme of arrangement, the deal required more than 50% of noteholders by number and 75% of noteholders by face value of notes outstanding. While 89.6% of Emeco noteholders supported the transaction, only 65.2% backed the deal by value. This was primarily blocked by US-based asset management firm Black Diamond Capital Management which controls 25% of Emeco bonds outstanding. Given the recent uptick in the commodity prices since the deal was first announced, the primary concern was that noteholders weren’t being adequately compensated through the size of ownership stake. However, Black Diamond quickly reversed its stance after being given the opportunity to acquire more equity in the group. But where would this equity come from? The additional equity was split between Emeco equity investors and the other Emeco noteholders who originally backed the deal. Under the revised RSA, Emeco shareholders will lose 1% ownership while other Emeco noteholders will lose 3% ownership of the merged entity. The transaction is subject to further shareholder and creditor approval expected to take place in March 2017. Emeco demonstrates the importance of understanding and identifying credit risk. The Australian mining sector has left trail of destruction over the past few years with companies such as Arrium (ASX: ARI), McAleese (ASX: MCS) and Atlas Iron (ASX: AGO) all experiencing similar issues with significant restructuring required. While it is important to recognise company specific issues (bottom-up), this case highlights risk originated from an industry/sector based level (top-down). As a result, it is imperative to consider macroeconomic and industry level risks with conducting credit analysis to avoid other issuer portfolio exposures to experience systemic capital losses.