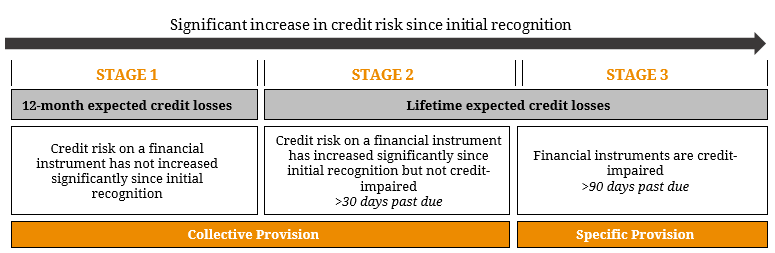

2017 has been marked by both growing global geopolitical risk and uncertainty surrounding the ‘overheating’ domestic property market. Earlier this month, the Reserve Bank of Australia (RBA) released its Financial Stability Review (click here) focusing primarily on potential economic instability as a result of the high level of household debt. While this is not new, the review highlighted riskier types of borrowing, such as interest-only loans as a primary threat. Although profitability for Australian banks has moderated in recent years, capital ratios have risen substantially and are expected to increase further once the Australian Prudential Regulatory Authority (APRA) finalises its framework to ensure that banks are ‘unquestionably strong.’ With the growing importance of credit quality, APRA has introduced a new provisioning standard for Authorised Deposit-Taking Institutions (ADIs) – AASB 9 Financial Instruments. AASB 9 changes the financial reporting landscape for how entities report financial instruments. Below is a summary of impact of the AASB 9: Table 1. AASB 9

- Collating historical and using forward-looking data for determining expected losses, particularly in respect of intercompany loans and loans to associates;

- Documenting hedge relationships;

- Even though the effectiveness of testing requirements are less onerous, entities wishing to apply hedge accounting will need to set up processes and systems to meet the documentation requirements for hedge accounting. The new hedging rules also mean entities may start to issue more exotic hedging products such as swaptions, zero cost collars, etc. This in turn will lead to increased complexity.

Since AASB 9 does not preclude the use of a compliant regulatory provisioning based approach, APRA has permitted ADIs currently using this method to continue to do so, subject to appropriate adjustments. The mandatory effective implementation date for incorporating this standard is for reporting periods beginning on 1st January 2018, but major banks have chosen early adoption and are already publishing reports using AASB 9.