Given the persistently low interest rate environment, the search for yield is becoming an increasingly difficult task. Central banks’ ‘lower of longer’ stance of interest rates has led to exacerbated returns and the timing of a global economic turnaround is uncertain to say the least. The world is in a state of transition. High-growth emerging markets and cutting edge technology are the new source of returns in today’s society as global platform connectivity is giving competitive access to smaller participants in traditionally large corporate industries. As a result, it is no surprise that many companies who rode the golden era of returns over the last 30 years driven by high consumer demand from emerging markets, increasing productivity gains and falling interest rates are not producing similar growth and returns in the current economic landscape. Figure 1. Generic 10-Year Treasury Bond Yields Compared Source: Bloomberg Fixed rate bonds were a major beneficiary of these favourable past market conditions as sharp declines in nominal interest rates from extraordinarily high levels prior to 1990 drove bond returns (through capital appreciation). Assuming that nominal increase rates comprise the real interest rate and an inflation premium, the increase in returns was driven by two primary factors:

- As inflation was brought under control, central banks began to reduce real interest rates from historically high levels.

- Due to the substantial reduction in inflation, investors shifted their inflation expectations downward and therefore, a smaller inflation premium was required. This also drove down nominal yields.

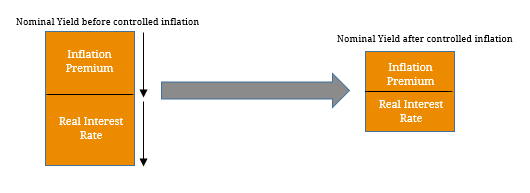

Figure 2. Relationship between nominal interest rate, real interest rate and inflation premium

- We expect global interest rates will remain low (especially in Australia) for an extended period. As a result, to achieve the same amount of income that investors have become accustomed to they will in variably need venture into the high-yield bond market (increasing default risk) or the hybrid market (increasing volatility). This increase in asymmetric risk will need to be managed through greater due diligence and credit research is needed.

- As economies around the world recover (some faster than others), this will be a positive for bondholders as spreads increase and greater income (through increased interest payments) can be achieved on a per unit of risk basis.

- However, depending the speed of the shift from low to high interest rates, bondholders may experience significant capital losses as inflation expectations adjust quickly. If inflation and inflation expectations rise gradually as the real interest rate is lifted by central banks, capital losses may not be as severe.

Ultimately, this is the reality facing fixed income investors today and as a result, return expectations should be revised downwards in the present interest rate environment.