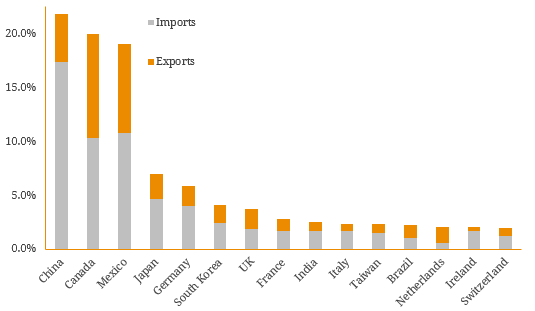

Over recent weeks, we have seen U.S. President Donald Trump introduce his latest protectionist policy by placing import tariffs on steel and aluminium on various countries, most notably, China. The imposition of a 10% tariff on aluminium and 25% on steel led to global outcry from numerous trade partners and forced the Trump administration to grant exemptions for certain countries which currently includes Mexico, Canada, the European Union and Australia. In total, the tariffs will affect at least US$50 billion of Chinese imports as President Trump attempts to redress the country’s US$375 billion trade deficit with China. In response to these actions, Beijing has hit back with US$3 billion of tariffs on U.S. imports, including a 25% tariff on pork and recycled aluminium, and a 15% tariff on other goods such as U.S. steel pipes, dried fruit and wine. Figure 1. Top 15 Trading Partners of the U.S.  Source: US Government Census, BondAdviser This increasing tension between the two world superpowers has fuelled concerns of an escalating and expanding trade war contributing to increased volatility in global equity markets. Given the current political environment, fixed income investors must ask themselves: how would a US-China trade war impact the credit market? Whilst many believe that a full-blown trade war is unlikely, with the U.S. and China commencing behind-the-scenes negotiations, one of the key concerns is that a trade war could drag on global economic growth. Given the close correlation of economic fundamentals and the credit cycle, a slowdown in the global economy would have a far-reaching and profound impact on credit spreads across the world should it result in a cycle inflection point. Figure 2. U.S. Trade Deficit with China

Source: US Government Census, BondAdviser This increasing tension between the two world superpowers has fuelled concerns of an escalating and expanding trade war contributing to increased volatility in global equity markets. Given the current political environment, fixed income investors must ask themselves: how would a US-China trade war impact the credit market? Whilst many believe that a full-blown trade war is unlikely, with the U.S. and China commencing behind-the-scenes negotiations, one of the key concerns is that a trade war could drag on global economic growth. Given the close correlation of economic fundamentals and the credit cycle, a slowdown in the global economy would have a far-reaching and profound impact on credit spreads across the world should it result in a cycle inflection point. Figure 2. U.S. Trade Deficit with China  Source: US Government Census, BondAdviser The tariffs could drive up the cost of goods for global consumers and businesses alike, which could ultimately lead to a decrease in consumption and investment in the economy. This would consequently drag on economic growth. With economy-wide tariffs likely to be imposed as part of retaliatory measures, a sluggish global economic backdrop could be a likely outcome. With inflation expectations already rising from cycle lows, the U.S. Federal Reserve is already in a strong tightening cycle and may not be considering these rising global risks. Figure 3. The Economic Cycle of a Trade War

Source: US Government Census, BondAdviser The tariffs could drive up the cost of goods for global consumers and businesses alike, which could ultimately lead to a decrease in consumption and investment in the economy. This would consequently drag on economic growth. With economy-wide tariffs likely to be imposed as part of retaliatory measures, a sluggish global economic backdrop could be a likely outcome. With inflation expectations already rising from cycle lows, the U.S. Federal Reserve is already in a strong tightening cycle and may not be considering these rising global risks. Figure 3. The Economic Cycle of a Trade War  Source: BondAdviser Such a scenario would have serious economic impact, with the cost of borrowing inevitably rising under such pressure. If these events play out into extremely adverse conditions, the unknown would rest with the Fed, likely stuck between a potential depressed economic outlook on the one hand, and rising inflation on the other. For this reason, it is evident that a US-China trade war would create mayhem in global markets for all risk assets including credit. It is worth noting that such a protectionist move may be in fact counter-intuitive to narrowing the country’s trade gap, as the higher dollar (lower demand for foreign currencies) would ultimately make U.S. exports relatively more expensive to substitute supplier The combination of a lethargic global economy, rising interest rates and inflation would almost certainly create a recipe for disaster in equity and credit markets across the globe. In this sense, one could say that the imposition of widespread tariffs would create a butterfly effect on economic factors well outside of the U.S. government’s control. This may be just one of the many reasons the Chinese and American governments have commenced negotiations to resolve the issues of intellectual property and trade deficits in a less economically-destructive manner.

Source: BondAdviser Such a scenario would have serious economic impact, with the cost of borrowing inevitably rising under such pressure. If these events play out into extremely adverse conditions, the unknown would rest with the Fed, likely stuck between a potential depressed economic outlook on the one hand, and rising inflation on the other. For this reason, it is evident that a US-China trade war would create mayhem in global markets for all risk assets including credit. It is worth noting that such a protectionist move may be in fact counter-intuitive to narrowing the country’s trade gap, as the higher dollar (lower demand for foreign currencies) would ultimately make U.S. exports relatively more expensive to substitute supplier The combination of a lethargic global economy, rising interest rates and inflation would almost certainly create a recipe for disaster in equity and credit markets across the globe. In this sense, one could say that the imposition of widespread tariffs would create a butterfly effect on economic factors well outside of the U.S. government’s control. This may be just one of the many reasons the Chinese and American governments have commenced negotiations to resolve the issues of intellectual property and trade deficits in a less economically-destructive manner.