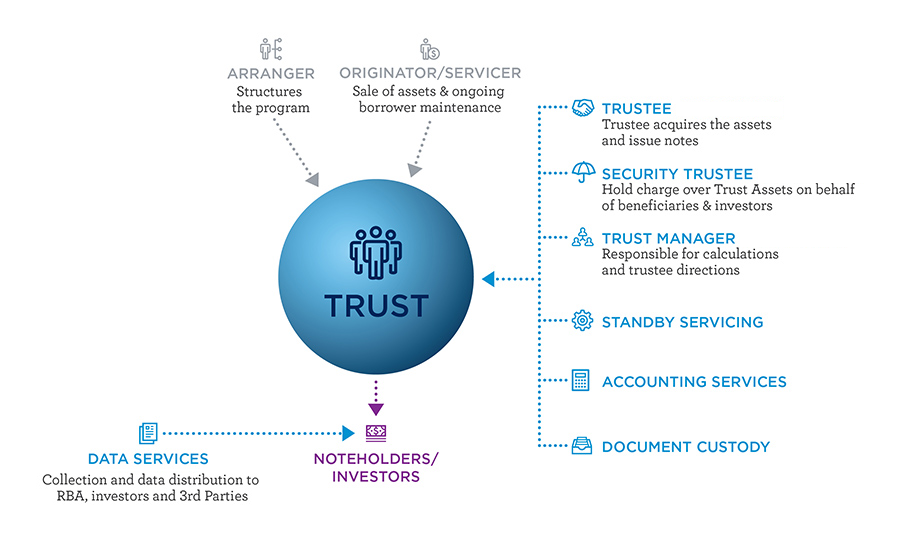

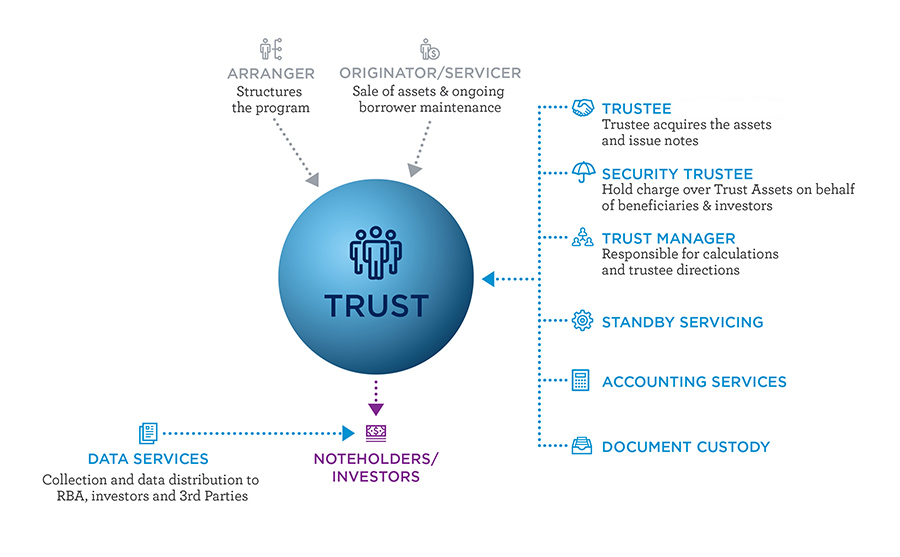

In the low-interest rate environment, domestic markets have displayed a growing appetite for high-yield bond issuance in recent years. Aside from the increased risk compensation (higher coupons), investor interests are also protected by intermediaries, namely bond trustees. A bond trustee is a company designated by the issuer as the custodian of funds and official representative of bondholders. The trustee plays a vital role in investor protection with the aim of operating in the best interest of the investors rather than the issuer (although the trustee’s expenses are paid by the issuer). The Trustee is generally indemnified against all liabilities of the issuer and all actions and proceedings undertaken, except in the case of a breach of the deed or a fraud. The bondholders who subscribe for the issue at the outset (or by subsequently purchasing the bonds in the secondary market) will have accepted that the trustee will act on their behalf (Figure 1). Figure 1. Typical Trust Structure

- holding the issuer’s obligation to pay principal and interest (and holding any security if the bond is secured) on trust for the bondholders,

- monitoring the issuer to ensure the issuer is not in breach of its obligations under the terms and conditions of the bond,

- acting on behalf of the bondholders in certain situations,

- enforcing the covenants of the trust deed on behalf of each bondholder, and

- coordinating and disseminating information.

Why? For most senior unsecured bond issuance there is no obligation to have a trustee. So, in effect, the issuer is free to choose whether to use a fiscal agent or trustee. However, the presence of trustees is increasing for the following reasons:

- Certain types of issuance, such as asset-backed debt, nearly always requires the use of a trustee, and this market has grown exponentially over the past decade;

- There is a growing trend towards the use of trustees in sovereign issues; and

- As access to the capital markets widens, new issuers are coming forth and are utilising trustees as a vote of confidence for investors.

Trustees are predominantly used for bonds in the wholesale market. In comparison, once a secondary market trading commences in the listed retail market, tranches or segments often trade in dark pools making it tough for the trustee to identify holders. As a result, issuers sometimes choose to issue Deed Polls (e.g. NAB Subordinated Notes 2), which replaces the Trust Deed but still gives a legal overlay to the issuer’s obligation. This is also because trustees often will not want to get deeply involved with this issue. The Market The market for bond trustees is fairly niche, and generally bundled with other ancillary financial services under an institution’s fund/investment management arm. While institutions like Westpac, AMP and Challenger Limited provide internal trustee services through their funds management arm, other participants in the domestic bond market include: