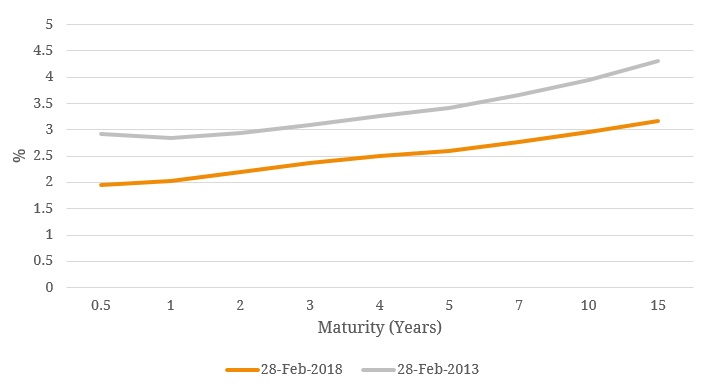

The term structure of interest rates is the relationship between interest rates or bond yields and different terms or maturities, which is also commonly known as the yield curve (Figure 1). The term structure of interest rates is the single most important benchmark in the fixed income world, central to all debt securities and plays a vital role in the economy. In essence, the term structure reflects market participants’ collective expectations about future changes in interest rates, inflation and their assessment of monetary policy conditions. In other words, it has been argued that long-term interest rates are determined, at least in part, by current and future expected short-term rates (known as forward rates), in such a way that investors are indifferent between investing in long term bonds and investing in a sequence of short-term bonds, since the options return the same for the investor. Figure 1: Australian Term Structure

- While expectations for future short-term nominal, real and inflation rates vary over time, changes in risk premia tend to have a greater influence than changes in expectations on movements in observed yields, at least over short time horizons. This emphasises the importance of not taking changes in observed yields at face value when trying to infer market expectations.

- Medium- to -long-term expectations for real interest rates, have declined in recent years.

- Long-term inflation expectations have fallen over the 1990s as the RBA’s inflation-targeting framework gained credibility, and have remained reasonably stable within the RBA’s 2% – 3% target band.

- A large portion of the decline in yields on Australian government securities (AGS) (Figure 1) since the global financial crisis has reflected lower real term premia, rather than declines in inflation expectations. The decline may reflect overseas factors such as the US quantitative easing programs and associated portfolio rebalancing flows, given it has coincided with declines in US term premia.

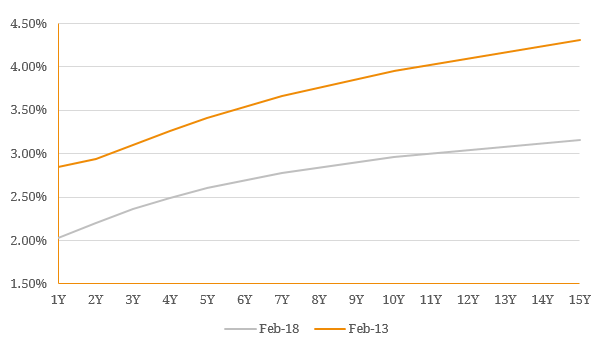

Figure 2. US, Australian Term Structures